Macro Letter – No 33 – 10-04-2015

Technology Indices and Creative Destruction – When Might the Bubble Burst?

- Publically traded technology stocks trade on modest multiples compared to 2000

- Private sector overinvestment may, however, be cause for concern

- European technology companies have outperformed US this year – it may not last

- Technology and growth stocks remain highly correlated to the major indices

I adhere to the belief that technology and other such improvements in manufacturing are the key to delivering productivity growth, which thereby improves the quality of life for the greatest number. Of course, as Joseph Schumpeter so incisively illustrated, the process is often cathartic. For the technology investor this increases both the risk and potential reward.

Technology is affects all industries. In an attempt to be more specific, here is a table taken from a February 2015 report by Brookings – America’s Advanced Industries:-

Source: Brookings

The report goes on to describe the scale and importance of these industries to the US economy:-

As of 2013, the nation’s 50 advanced industries employed 12.3 million U.S. workers. That amounts to about 9 percent of total U.S. employment. And yet, even with this modest employment base, U.S. advanced industries produce $2.7 trillion in value added annually—17 percent of all U.S. gross domestic product (GDP). That is more than any other sector, including healthcare, finance, or real estate.

At the same time, the sector employs 80 percent of the nation’s engineers; performs 90 percent of private-sector R&D; generates approximately 85 percent of all U.S. patents; and accounts for 60 percent of U.S. exports. Advanced industries also support unusually extensive supply chains and other forms of ancillary economic activity. On a per worker basis, advanced industries purchase $236,000 in goods and services from other businesses annually, compared with $67,000 in purchasing by other industries. This spending sustains and creates more jobs. In fact, 2.2 jobs are created domestically for every new advanced industry job—0.8 locally and 1.4 outside of the region. This means that in addition to the 12.3 million workers employed by advanced industries, another 27.1 million U.S. workers owe their jobs to economic activity supported by advanced industries. Directly and indirectly, then, the sector supports almost 39 million jobs—nearly one-fourth of all U.S. employment.

…From 1980 to 2013 advanced industries expanded at a rate of 5.4 percent annually—30 percent faster than the economy as a whole.

…Workers in advanced industries are extraordinarily productive and generate some $210,000 in annual value added per worker compared with $101,000, on average, outside advanced industries. Because of this, advanced industries compensate their workers handsomely and, in contrast to the rest of the economy, wages are rising sharply. In 2013, the average advanced industries worker earned $90,000 in total compensation, nearly twice as much as the average worker outside of the sector. Over time, absolute earnings in advanced industries grew by 63 percent from 1975 to 2013, after adjusting for inflation. This compares with 17 percent gains outside the sector. Even workers with lower levels of education can earn salaries in advanced industries that far exceed their peers in other industries. In this regard, the sector is in fact accessible: More than half of the sector’s workers possess less than a bachelor’s degree.

The report is not an unalloyed paean of praise, however, they go on to emphasise the need for better education and training in order to maintain momentum.

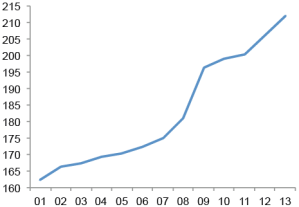

The last great technology stock collapse was seen in the aftermath of the “Dotcom” bubble which burst in 2001:-

Source: Kampas Research

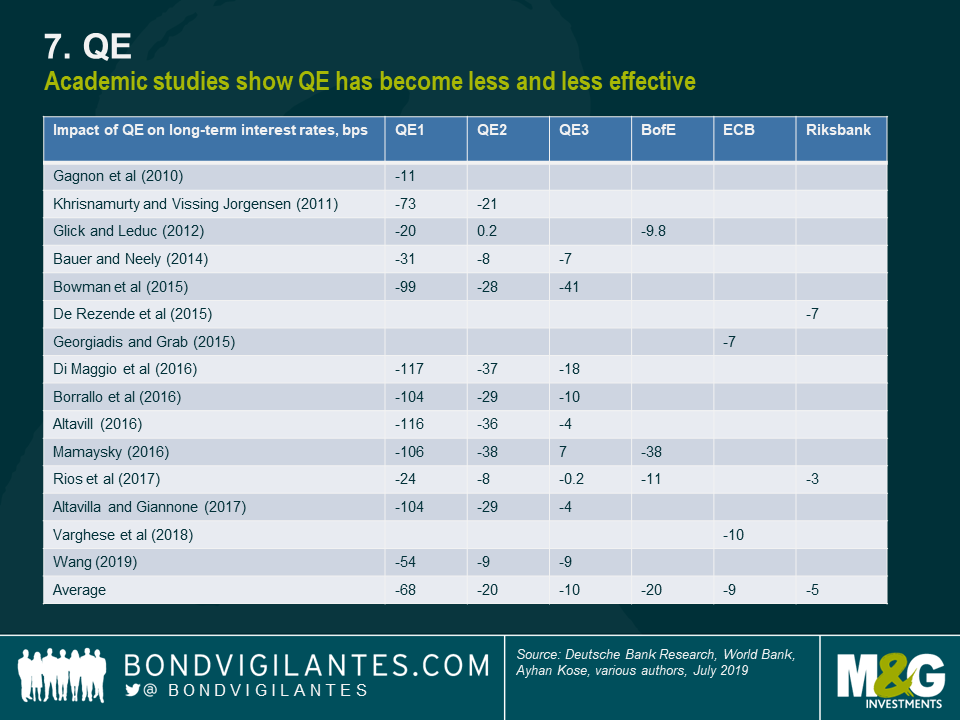

During the early part of the last decade the growth in valuation of the technology sector returned to its long-term trend. Since 2008, however, central bank policies have changed the valuation paradigm for all stocks by reducing interest rates towards the zero-bound. Their quantitative easing policies (QE) have flattening government bond yield curves to unprecedented levels, especially given the absolute level of rates. Nonetheless, many of the signs of a bubble have begun to emerge as this December 2014 article from the Economist – Frothy.com – explains:-

In December 15 years ago the dotcom crash was a few weeks away. Veterans of that fiasco may notice some familiar warning signs this festive season. Bankers and lawyers are being priced out of office space in downtown San Francisco; all of the space in eight tower blocks being built has been taken by technology firms. In 2013 around a fifth of graduates from America’s leading MBA schools joined tech firms, almost double the share that struck Faustian pacts with investment banks. Janet Yellen, the head of the Federal Reserve, has warned that social-media firms are overvalued—and has been largely ignored, just as her predecessor Alan Greenspan was when he urged caution in 1999.

Good corporate governance is, once again, for wimps. Shares in Alibaba, a Chinese internet giant that listed in New York in September using a Byzantine legal structure, have risen by 58%. Executives at startups, such as Uber, a taxi-hailing service, exhibit a mighty hubris.

…Instead, today’s financial excess is hidden partly out of sight in two areas: inside big tech firms such as Amazon and Google, which are spending epic sums on warehouses, offices, people, machinery and buying other firms; and on the booming private markets where venture capital (VC) outfits and others trade stakes in young technology firms.

Take the spending boom by the big, listed tech firms first. It is exemplified by Facebook, which said in October that its operating costs would rise in 2015 by 55-75%, far ahead of its expected sales growth. Forget lean outfits run by skinny entrepreneurs: Silicon Valley’s icons are now among the world’s biggest, flabbiest investors. Together, Apple, Amazon, Facebook, Google and Twitter invested $66 billion in the past 12 months. This figure includes capital spending, research and development, fixed assets acquired with leases and cash used for acquisitions (see chart 1).

Source: The Economist, Bloomberg

That is eight times what they invested in 2009. It is double the amount invested by the VC industry. If you exclude Apple, investments ate up most of the cashflow the firms generated. Together these five tech firms now invest more than any single company in the world: more than such energy Leviathans as Gazprom, PetroChina and Exxon, which each invest about $40 billion-50 billion a year. The five firms together own $60 billion of property and equipment, almost as much as General Electric. They employ just over 300,000 people. Google says it is determined to keep “investing ahead of the curve”.

…The second area of technology froth is in private markets. Their exuberance was demonstrated on December 4th when Uber closed a $1.2 billion private funding round that valued the five-year old firm at $40 billion. Baidu, China’s biggest search engine, is set to buy a stake, too (see page 101). There are 48 American VC-backed firms worth $1 billion or more, compared with ten at the height of the dotcom bubble, according to VentureSource, a research outfit. In October a software firm called Slack was valued at $1.1 billion, a year after being founded. 2014 looks set to be the biggest year for VC investments since 2000 (see chart 2).

Source: The Economist

Whilst this investment boom has centred around the giants of the technology industry and venture capitalists in the private sector, few large scale scientific research facilities have been developed without government grants or subsidies as this December 2014 FRBSF Economic Letter – Innovation and Incentives: Evidence from Biotech – makes abundantly clear:-

The adoption of biotech subsidies raises the number of star scientists in a state by 15% relative to that state’s pre-adoption number of stars. We find a similar effect from the adoption of R&D credits. These findings are important because of the role star scientists play on the local development and survival of U.S. biotech clusters. In addition, we find that most of the increase in the number of stars is due to their relocation to states that adopt incentives. Meanwhile, subsidies have only a limited effect on the productivity, measured by patenting, of incumbent scientists already in the state. We also find that the increase in star scientists happening after a state adopts a biotech incentive is entirely due to an increase in private/for-profit sector scientists, with no detectable increase in academic scientists.

The authors’ conclusions, however, are qualified:-

We found that, after states adopted incentives, they experienced significant increases in the number of star scientists, the total number of biotech workers, and the number of establishments, but limited effects on salaries and patents. We also uncovered significant spillover effects from biotech incentives to employment in other sectors that provide services in the local economy such as retail and construction.

In terms of policy implications, it is important to keep in mind that our finding that biotech subsidies are successful at attracting star scientists and at raising local biotech employment do not necessarily imply that the subsidies are economically justified. The economic benefits to a state of providing these incentives must be weighed against their fiscal costs—for instance, the loss of tax revenues and resulting loss of public services. Our research suggests that state incentives are successful at increasing the number of jobs inside the state. Nevertheless, our results do not suggest that the social benefit—either for that state or for the nation as a whole—is larger than the cost to taxpayers, nor that incentives for innovation are the most effective way to increase jobs in a state.

Government incentives may appear benign, but, as Michael Dell put it, in a November 2014 Op Ed for the Wall Street Journal – Going Private Is Paying Off for Dell:-

Yet we find ourselves in a world increasingly afflicted with myopia-governments that can’t see beyond the next election, an education system that can’t see beyond the next round of standardized tests, and public financial markets that can’t see beyond the next trade. This was what Dell faced as a public company. Shareholders increasingly demanded short-term results to drive returns; innovation and investment too often suffered as a result. Shareholder and customer interests decoupled.

My personal preference is for a free-market approach, despite the risk of underinvestment in the most capital intensive areas of research.

Valuation?

The valuation of growth stocks has always been fraught with uncertainty, especially when future cashflows are often deferred by several years and earnings forecasts, subject to significant variance. An even greater difficulty, as the chart above makes clear, is to assess, and hopefully anticipate, the herd behaviour of technology investors.

The chart below shows the differential performance of the STOXX Europe 600 Technology Index (FX8.Z) the global IXN Technology ETF and the Nasdaq Composite:-

Source: Yahoo Finance

The European dalliance with technology investment was shorter lived than in the US. So was the violence of the subsequent bust. The market had still not cleared by 2008 and achieved new lows for the decade. The subsequent recovery has been muted. The IXN appears to be roughly halfway between the two extremes. US investor perception of technology seems to be substantially rosier than that of the European investor.

The six month chart reveals a rather different picture. Since the equity market correction last November, European technology has out-performed both the US and other technology stocks globally:-

Source: Yahoo Finance

Looks can be deceptive. This move has been broader based than simply the European technology sector. Led by Germany, most Eurozone stock markets have traded higher. This has largely coincided with the QE actions of the ECB and the steady weakening in the value of the Euro that this policy has abetted. The Euro Effective Exchange Rate has fallen from 100 to 90 over the same period.

Research carried out by LinkedIn sheds a unique perspective on global trends in technology industries. Their analysis focussed on migrating workers, identifying which countries and cities were net beneficiaries. This July 2014 article from Bruegal – Fact of the week: Not one European city in the top 10 for tech talent – takes up the story:-

In terms of skills uniquely identified in movers, Math, Science, Technology and Engineering seem to play a particularly important role. In terms of industries, movers are found to work mostly in media and entertainment; professional services; oil and energy; government, education and non-profit but most importantly, technology-software.

…Five out of ten cities attracting people with tech skills (especially IT infrastructure and system managements; Java development and web programming) are located in India, including the first four of the list. San Francisco only comes fifth, followed by two other US cities and two Australian.

No European city at all makes it to the list. For the 52 cities looked at in the study, the median percentage of new residents with tech skills was 16%, or just under 1 in 6; in many of the Indian cities, its more than double that figure. European cities are the real laggards: the percentage of new residents with tech skills was 18% in Berlin, 15% in Paris, 13% in Madrid and 11% in Paris.

The trend obviously mirror the Indian ongoing technology boom, in a still rather “virgin” environment. Kunal Bahl – founder of Snapdeal, a wannabe Indian Amazon – told USA Today in 2011 that India offers huge opportunity “because there are no mature companies, like Google and Microsoft, over there. The feeling is like in the U.S. in 1999.”

But there may be more to that.. Research by Vivek Wadhwa (Stanford) revealed that half of Silicon Valley start-ups were launched by immigrants, many of them educated in US top universities. But he also noticed that “for the first time, immigrants have better opportunities outside the U.S.” because, among other things, of rather strict immigration laws and California’s steep cost of living. Bahl himself, who studied in the US and spent some time working at Microsoft, reportedly wanted to initiate his company in the US but eventually went back to India because of visa problems.

And this is also why the tech industry – at the (by now almost) desperate search for engineers – is supporting the introduction of specific “start-up visa” for high-skilled workers in the US. The insights provided by this data is particularly important in the context of the recent discussions on the US immigration reform, but it is not without implications for Europe, which is at the bottom of the ranking as far as attracting tech talent is concerned.

This research suggests that the recent outperformance of the European technology sector may be short lived, yet, another article from November of last year by Bruegal – Brain drain, gain, or circulation? – indicates a somewhat more optimistic outcome for parts of Europe, specifically the UK and Spain:-

Source: Bruegal, OECD

This chart benchmarks the median quality of scientists leaving or moving (for the first time) to a country between 1996-2011. The size of the bubble corresponds to total flows (inflows plus outflows). Countries in red are net contributors to the international market for scientists, those in blue net recipients.

Ideally, a country should want to be below or on the 45-degree line, indicating that the quality of the newcomers is just as high (or higher) as that of the leavers. Conditional on this, a country should also prefer a larger rather than smaller bubble, representing a sizeable flow of scientists and indicating a full exploitation of synergies gained from international cooperation. Finally, countries should aim to land in the top-right quadrant, indicating higher quality of both incoming and outgoing researchers.

Over the long-term (pre-crisis) period analysed, Spain and the UK seemed the best placed at attracting high-quality scientists. France and Germany were broadly breaking even in terms of quality, although we note that they were facing significant net outflows of scientists, as was the UK.

All in all, in the sample here presented, while the US (unsurprisingly) comes out as the top performer in terms of net inflow of quality researchers, Italy ranks quite poorly. Not only the country is a net contributor of scientists, it also trades high quality researchers for lower quality ones. Time for a reform of the university system?

The EU Commission is seeking to address the deficiencies of innovation policy within its borders. At a Bruegal event last January in a speech entitled – The New European Research Agenda – Commissioner Moedas – outlined plans to improve the environment for innovation:-

First, create the framework conditions for a more productive exchange of research results, fundamental science and innovation. Things like:

Screen the regulatory framework in key sectors in order to remove bottlenecks

Accelerate the implementation of standardisation

Promote the public procurement of innovation and innovation in the public sector

Promote a venture capital culture

Reduce bureaucracy in science and innovation systems

Second, is to consolidate fundamental research as the flagship for Europe. As the essential foundation for a knowledge-based society. Working towards a single, open market for knowledge though open science.

Third: implement Horizon 2020 and the new Investment Plan to leverage the Europe economy towards a higher plane as a research and innovation-based area. Working towards a single, open market for knowledge though open science. It is better to focus on our potential than to dwell on illusions. We will always be different from other parts of the world. But that difference has many benefits!

These are stirring words, but in the EU turning words into deeds takes time. In unfettered, free-markets, resources are allocated more efficiently. Nonetheless, hope remains.

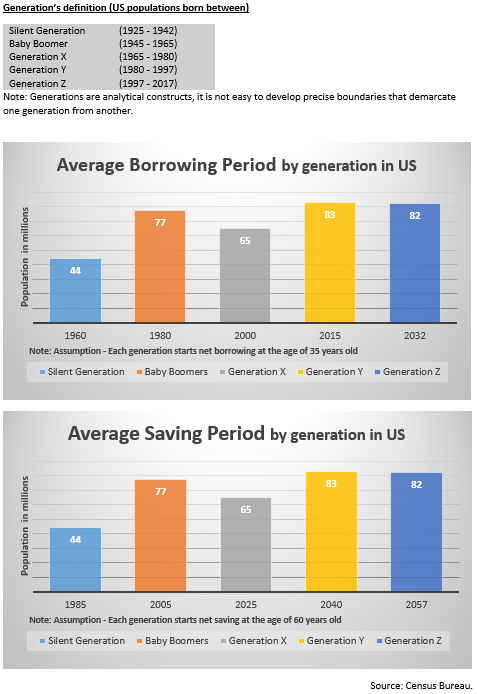

In terms of absolute valuation, US technology bulls point to the relatively undemanding PE ratio of the Nasdaq – around 24 times, vs 175 times during the zenith of the Dotcom frenzy. On the other hand, commentators such as Dent Research point to a flat-lining phase of the 45 year innovation cycle – this phase commenced around 2010 and will last until around 2032:-

It shows how clusters of powerful technologies increase productivity and move mainstream for about 22.5 years, like what we saw from 1988 into 2010.

Now we’re in the doldrums of this cycle and won’t move into the next upward swing again until after 2032. In short, the productivity revolution is over for the next two decades or so. That means less earnings and wage gains, regardless of demographic trends.

Interestingly, Dent then go on to wax lyrical about the potential for Bio-tech. In technology even the bears tend to be bullish about something.

We need to read Robert Gordon – Is US economic growth over? Faltering innovation confronts the six headwinds, to find a real bear. His CEPR paper was published in 2012 but these are ideas he has been developing for more than a decade. The premise is that the economic growth of the last 250 years is the exception rather than the rule:-

The ideas developed here are unorthodox yet worth pondering. They are applied only in the context of the US, because the worldwide frontier of productivity and the standard of living have been carved out by the US since the late 19th century. If growth of the US productivity frontier slows down, other nations may move ahead, or the slowing frontier could reduce the opportunities for future growth by all nations as the pace of productivity growth in the US fades out…

… The paper suggests that it is useful to think of the innovative process as a series of discrete inventions followed by incremental improvements which ultimately tap the full potential of the initial invention. For the first two industrial revolutions, the incremental follow-up process lasted at least 100 years. For the more recent IR3, the follow-up process was much faster. Taking the inventions and their follow up improvements together, many of these processes could happen only once. Notable examples are speed of travel, temperature of interior space, and urbanisation itself.

The benefits of ongoing innovation on the standard of living will not stop and will continue, albeit at a slower pace than in the past. But future growth will be held back from the potential fruits of innovation by six “headwinds” buffeting the US economy, some of which are shared in common with other countries and others are uniquely American. Future growth in real GDP per capita will be slower than in any extended period since the late 19th century, and growth in real consumption per capita for the bottom 99% of the income distribution will be even slower than that.

Gordon goes on to identify six headwinds buffeting the US economy – slowing the pace of GDP growth:-

- The disappearance of the demographic dividend

- Educational attainment

- Rising income inequality

- Outsourcing (especially due to technological development)

- Environmental constraints on energy pollution

- Combined household and government debt

These are important impediments to growth but I believe not all of them are as clear cut as Gordon suggests.

Firstly, the demographic dividend may be in decline but technology has made it easier for people to work until much later in life. Added to which, a more flexible labour market encourages greater participation. I wonder whether the decline in labour force participation is to some extent due to the improvement in welfare provision and not just a deficit of permanent “quality” jobs?

Despite the concerns of Gordon and Bruegal, education is in the process of being revolutionised by new technologies. Mass Open Online Courses (MOOCs) are but one aspect of this sea-change. The cost of providing education – which has risen inexorably over the last 50 years – could be reversed. Of course Gordon has cause for concern about educational achievement. Whilst technology will allow “the horse to be led to water” it is another matter “making it drink”. The Economist – Wealth without workers, workers without wealth – from October 2014, discusses this issue in the broader context of new technologies disruption of labour markets globally:-

The modern digital revolution—with its hallmarks of computer power, connectivity and data ubiquity—has brought iPhones and the internet, not crowded tenements and cholera. But, as our special report explains, it is disrupting and dividing the world of work on a scale not seen for more than a century. Vast wealth is being created without many workers; and for all but an elite few, work no longer guarantees a rising income.

Income inequality is a popular economic theme and Gordon pays tribute to Emmanuel Saez – though not Thomas Piketty who has become its popular champion. From my interpretation of Piketty’s book, I believe that income inequality is a natural outcome of the long term benefits of peace. Reducing government intervention in the functioning of free markets is a better solution to this structural problem. Smaller government will not remove inequality but it will increase economic mobility, and, in the process, create faster economic prosperity – thereby more rapidly improving the standard of living for the greatest number of people. In freer markets, the technology entrepreneur, and creative risk takers in general, have a greater incentive to embrace opportunities.

Outsourcing is not new, David Riccardo observed its effects long ago. As rich countries adapt to concentrate on their comparative advantages – hopefully undistorted by government subsidy and protective tariff – the short-term headwind of lost domestic labour will be offset by the lower cost to the consumer of outsourced services. A greater proportion of a consumer’s income will then become available for investment. Once the investment has been allocated, the increased pool of available labour can then be retrained for employment in more productive enterprises. Frederic Bastiat – That Which is Seen and That Which is Not Seen makes this point much more eloquently than I could hope to do.

At the global level, man’s capacity to pollute his environment has not diminished but developing countries are less able to afford the luxury of conscience. Our best hope is technology. Yet technological discovery occurs by evolutionary leaps rather than steady increment. The lag between discovery and commercial application can also be long and variable. The collapse in the price of photovoltaic cells, making solar power dramatically more viable as an alternative to fossil fuel, is but one example. The tantalising potential of the development of tidal energy generation is another – especially given man’s predilection to inhabit the margins of the sea. Carbon sequestration technology – at present uneconomic – might be the next technological “leap”. I remain an optimist about man’s ingenuity. Since the Economist first published its Commodity Index in 1864 the price of commodities has been falling by roughly 1% per annum in inflation adjusted terms – punctuated by sharp price increases normally associated with war. Peace leads to investment and, as new technologies are adopted, prices begin to march lower once more.

This leaves Gordon’s concern about debt. Now, debt is a problem. It can be overcome, but the solution to excessive debt is not more debt. Deleveraging can be achieved by steady reduction or sudden default. Sadly, history favours the latter approach – I wonder whether Polonius’s advice to Laertes today would have been:-

Always a borrower never a lender be,

For loan oft loses both itself and bank,

And borrowing sure as hell beats husbandry.

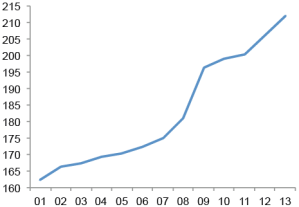

Last September – Deleveraging, What Deleveraging? The 16th Geneva Report on the World Economy – discussed this global issue in detail:-

Contrary to widely held beliefs, the world has not yet begun to delever. Global debt-to-GDP is still growing, breaking new highs. Figure 1 shows the evolution of total debt (excluding the financial sector) for our global sample (advanced economies plus major emerging market economies). While there was a pause during 2008-09, the rise of the global debt-GDP ratio recommenced in 2010-2011. Data in the report also show that debt-type external financing (leverage) continues to dominate equity-type financing (stock market capitalisation)

Source: CEPR

Perhaps surprisingly, the authors advise central banks to be cautious about interest rate increases in this environment:-

In such a context, and with still very high leverage, allowing the real rate to rise above its natural level would risk killing the recovery. Beyond pushing the economy into a prolonged period of stagnation, this would also put at risk the deleveraging process which is already very challenging.

Although there is a lot of uncertainty about such predictions, our call is for caution on interest rate rises. The case for caution in pre-emptively raising interest rates is reinforced by the weakness of inflationary pressures.

…The policy requirements for successful exit from a leverage trap are much broader than the appropriate conduct of monetary policy. The report addresses the fiscal challenges, the scope for macro-prudential policies and the restructuring of private-sector (bank, household, corporate) debt and sovereign debt.

The report also argues that – given the risks and costs associated with excessive leverage – more needs to be done to improve the resilience of macro-financial frameworks to debt shocks and to discourage excessive debt accumulation. Finally, we advocate enhanced international policy cooperation in addressing excessive global leverage.

I keep hearing the immortal words of Stan Laurel:-

Well, here’s another nice mess you’ve gotten me into.

Signs of fatigue

With all markets, I begin my analysis with technical patterns. This is a form of self-preservation; to paraphrase Keynes, I may be right in my fundamental analysis but the market is never wrong. On this basis I see no compelling reason to exit the technology sector, although there is a case to be made for rotation out of the Nasdaq and into technology stocks in Europe. I make the caveat, however, that European stocks have inherently less liquidity than US stocks and are therefore likely to exhibit greater volatility, especially on the downside.

The second stage of my analysis is to look at the change in the makeup of tech indexes. The constituents of the Nasdaq are a case in point. The table below shows the top 10 stocks by market capitalisation in 2000 and 2015:-

| 2000 |

|

2015 |

|

| Microsoft |

MSFT |

Apple |

AAPL |

| Cisco |

CSCO |

Google |

GOOG |

| Intel |

INTC |

Microsoft |

MSFT |

| Oracle |

ORCL |

Facebook |

FB |

| Sun Microsystems |

JAVA |

Amazon.com |

AMZN |

| Dell Computer |

DELL |

Intel |

INTC |

| MCI WorldCom |

MCWEQ |

Gilead Sciences |

GILD |

| Chartered Semiconductor |

CHRT |

Cisco |

CSCO |

| Qualcomm |

QCOM |

Comcast |

CMCSA |

| Yahoo! |

YHOO |

Amgen |

AMGN |

Source: Nasdaq

Several of the names have changed, added to which, many of today’s valuations, as measured by P/E ratios, are far less demanding – although Amazon (AMZN) at more than 700 times earnings, remains a notable exception. Looked at from another perspective, the technology promise of 2000 has delivered – today’s top tech companies are delivering real earnings. To understand whether the undemanding multiples are a harbinger of a period of “ex-growth” to come or represent an undervalued opportunity, we need to examine each individual stock in detail. This is beyond the macroeconomic analysis of this report, but one “macro” factor worth considering is the question of debt versus equity finance.

Equity versus Debt

At the risk of making a sweeping generalisation, technology companies are more likely to finance their projects via equity than debt – although established, large cap, technology companies make ample use of the capital markets. Technology projects often require long-lead times to deliver positive cashflows and the value created is invariably intellectual rather than physical. An Oil company with proven reserves may have to wrestle with the volatility in the price of crude oil, but it can mortgage those “reserves” – they have a fairly predictable future demand. Technology companies must endure the vicissitudes of disruptive innovation. Todays “must have” products can rapidly become tomorrow’s museum “curiosities”. To this extent, technology firms are better placed to weather a cycle of increasing interest rates because they carry less debt.

Here lies a dilemma. In the absence of the interest rate on debt to signal the riskiness of an investment, the availability of equity finance becomes critical. As the IPO market has become more active, venture capitalists have been pouring money into earlier and earlier investment opportunities to avoid having to pay too high a price for private equity – I’ve heard the phase “pre,pre-seed” which smacks of a lack of discrimination. Access to equity investment should be a signal about the validity of a project – in the current “overinvestment” environment, the informational value of this “signal” is dramatically diminishing.

Conclusions and Investment Opportunities

The current technology boom is very different from the dotcom bubble of 2000. The top companies in the sector have real earnings and trade at less demanding PE multiples. There are still early stage companies which have no cashflows but these are the much less prevalent today. At the risk of stating the obvious, look for companies with low debt to equity ratios, since these will weather the storm of rising interest rates more comfortably. Look for companies with growing earnings and, where possible, growing dividends. Keep a close watch on the price trend of the stock and have a stop-loss level in mind at which you will exit to preserve capital, regardless of your own opinions. Set a price target if you wish but remember that markets are prone to irrationality – I tend to let the “trend be my friend”.

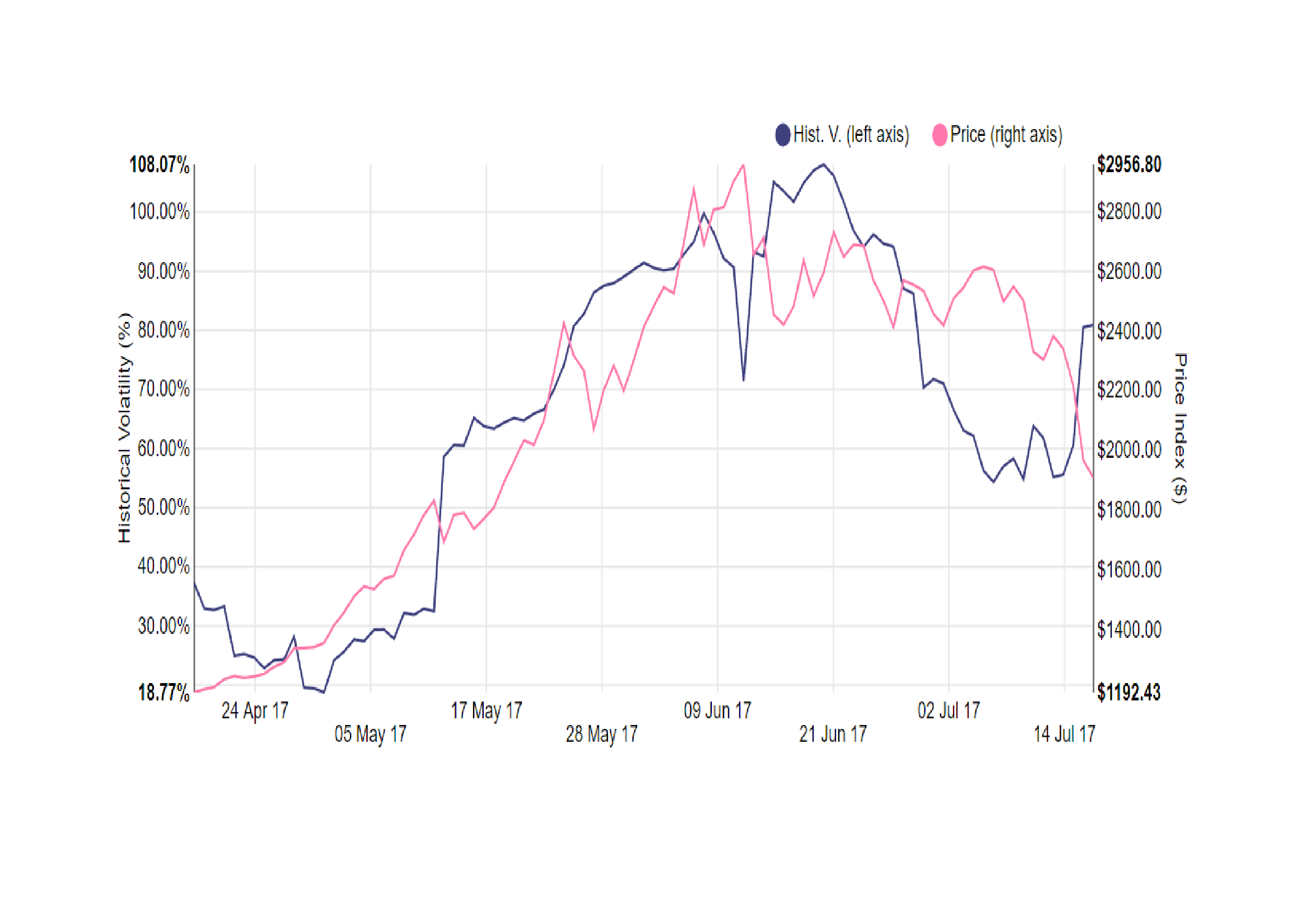

For the present, technology stocks look set to continue rising, but it is important to remember that the correlation between equity indices tend to be high – The Nasdaq and the S&P500 have a one month correlation of more than 90%. Interest Rates may stay low for a protracted period, but the risk is asymmetric – not far to fall, a long way to rise – and conventional wisdom, which advocates investment in stocks because they are negatively correlated to bonds, may be severely tested as central bank interest rates normalise globally. For more on this topic the November 2013 paper from Pimco – The Stock-Bond Correlation is well worth investigation.

A final caveat concerning technology stocks. Most of the constituents of tech indices are growth stocks and therefore tend to have higher betas than the underlying index. This is a simple measure of their volatility – replete with Gaussian assumptions of “normality”. When constructing your investment strategy, keep the absolute level of volatility in mind, albeit is a measure of variance rather than risk. If this is a technology bubble, make allowance for it and you will weather its tempests, underestimate it and you will be forced to capitulate; the bull market isn’t over yet and the broader market will determine the timing of its demise.