During the last three months inflation has become a much debated topic. This article, which was published in March, may still add something to the increasingly heated debate: –

Inflationary Inflection Point or Temporary Blip?

Macro Letter – No 139 – 18-06-2021

Commodities, Supply-chains and Structural Changes in Demand

As the spectre of inflation begins to haunt economists, many market commentators have started to focus on commodity prices in an attempt to predict the likely direction of the general price level for goods and services. This indexing of the most heterogeneous asset class has always struck me as destined to disappoint. Commodity prices change in response to, often, small variation in supply or demand and the price of some commodities varies enormously from one geographic location to another. Occasionally the majority of commodities rise in tandem but more frequently they dance to their own peculiar tunes.

Commodity analysts tend to focus on Energy and Industrial Metals foremost; Agricultural Commodities, which are more diverse by nature are often left as a footnote. Occasionally, however, a demand-side event occurs which causes nearly all sectors to rise. The Covid-19 event was just such a shock, disrupting global supply-chains and consumer demand patterns simultaneously.

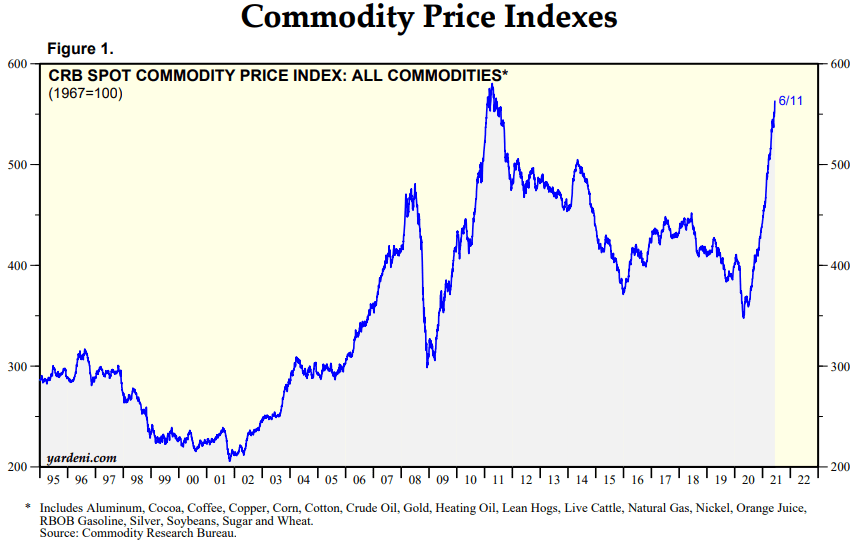

The chart below shows the CRB Index since 1995: –

Source: CRB, Yardeni

This chart looks very different to the energy heavy GSCI Index, which is weighted on the basis of liquidity and by the respective world production quantities of its underlying components: –

Source: S&P GSCI, Trading Economics

The small rebound on the chart above is not that insignificant, however, it equates to a 55% rise since the lows on 2020. The fact that prices collapsed, as the pandemic broke, and subsequently soared, as vaccines allowed economies to reopen, is hardly surprising. Economic cycles wield a powerful influence over commodity prices; short-term, inelastic, supply, confronted by an unexpected jump in demand, invariably precipitates sharp price increases.

The lockdown which followed the initial outbreak of the virus, led to an abrupt change in consumer demand; hotels and travel were out, remote working was in. Whilst house prices were already supported by a sharp lowering of interest rates and debt forbearance measures, the price of lumber, for home improvements and property extensions, exploded: –

Source: Trading Economics

Similar patterns were evident in Steel and Copper, but also due to shortages and bottlenecks in the semiconductor supply-chain, which led a slowing of automobile production, in turn prompting a rise in the price of both for new and used cars.

The recent resurgence in commodity prices has encouraged suggestions that a new commodity super-cycle is underway, however, these are relatively rare events. The most recent cycle is generally thought to have begun with the rise of Chinese demand in the late 1990’s and ended abruptly with the financial crisis in 2008/2009. Since the crisis Chinese growth has moderated, although the rise of India may see another wave of rapid industrialisation at some point. The chart below, however, portrays a different narrative, suggesting that the 2008 peak was merely a corrective wave from the 1980 peak. The new super-cycle has just begun, it will peak some-time around 2045: –

Source: Janus Henderson, Stifel Report June 2020. Note: Shown as 10yr rolling compound growth rate with polynomial trend at tops and bottoms. Blue dotted line illustrates a forecast estimation. Warren & Pearson Commodity Index (1795-1912), WPI Commodities (1913-1925), equal-weighted (1/3rd ea.) PPI Energy, PPI Farm Products and PPI Metals (Ferrous and Non-Ferrous) ex-precious metals (1926-1956), Refinitiv Equal Weight (CCI) Index (1956-1994), and Refinitiv Core Commodity CRB Index (1994 to present).

Another short-term factor, which has exacerbated the rise in the price of key commodities over the past year, is the ongoing trade tensions between the US and China. Tariff increases have increased costs for importers and wholesalers, meanwhile the effect of the Great Financial Crisis has been evident for the past decade in the shortening of global supply-chains. Covid accelerated this de-globalisation, forcing many firms to seek out new sources of supply. The long-run effect of these adjustments will be stronger, deeper supply-chains, but the short-run cost must be paid for by the importer, the producer or the consumer.

A part of the new commodity super-cycle argument is based on more structural factors. The reduction of carbon emissions will entail the use of vast amounts of metals. Electrification calls for copper; silver will be needed for photovoltaic panels; electric vehicles require aluminium, nickel, graphite, cobalt and lithium, together with numerous rare-earth metals – of which China is fast becoming the monopoly supplier.

The last great structural shift in energy was from coal to oil. Colonel Drake’s discovery in Pennsylvania in 1859 and the Spindletop find in Texas in 1901 set the stage for the new oil economy, yet it took until 1919 for gasoline sales to exceed those of kerosene.

Although coal-gas was used for most of the 19th century and the first US natural gas pipeline was built in 1891, prior to the 1920s, the vast majority of natural gas produced as a by-product of oil extraction was simply flared away. Superior welding techniques during the interwar years marked a boom in natural gas adoption, but major pipelines were still under construction as late as the 1960’s.

The time-line from Colonel Drake striking pay-dirt in 1859 to mass natural gas adoption took more than a century. Technology and innovation move at a much faster pace today, yet the infrastructural investment needed to transform from carbon to renewable energy will take decades rather than years.

Meanwhile, there remain shorter-term reasons to doubt the arrival of a new commodity super-cycle so precipitously upon the last. Chinese GDP growth has fallen sharply from the double-digit rates of the last decade. Its working age population is shrinking, added to which the People’s Bank of China seem reluctant to allow credit expansion on the scale of previous cycles. Rebalancing towards domestic consumption continues to be official policy.

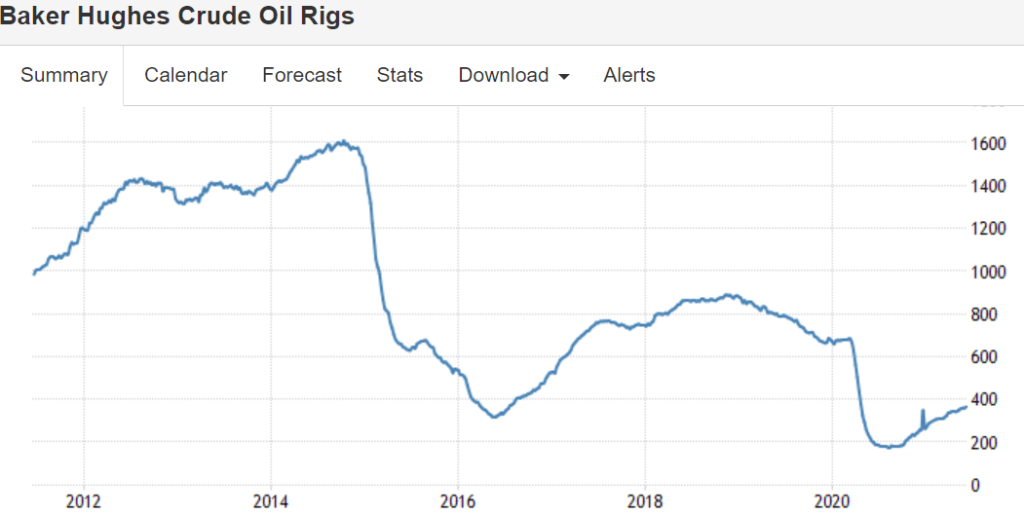

There is near-term evidence of energy supply constraints but over the longer-run oil and gas production, especially from the likes of the US frackers, can raise output rapidly in response to increases in the price of Crude. The chart below shows the fluctuations in the Baker Hughes US Oil Rig count over the past decade, no shortage of capacity is apparent here: –

Source: Baker Hughes, Trading Economics

Agricultural commodities tend to operate on even shorter supply cycles. If supply constraints send Wheat prices higher, farmers respond by switching away from Corn. Seasonal adjustments can be rapid.

The GSCI may have hit its lowest since the 1980’s last April and prices may have doubled since then, but it is still more than 75% below its June 2008 peak. Further upside may be seen as the global economy makes up for a year of lost economic growth, but as economic growth returns to normality demand for energy is likely to moderate just as fresh supply comes on stream.

The spending plans of the US administration may maintain demand in the US but China seems determined to nip its domestic credit bubble in the bud. In broad terms these factors counter-balance one another. According to the Federal Reserve, US GDP is forecast to range between 5% and 7.3% in 2021, falling to 2.5% to 4.4% in 2022 and 1.7% to 2.6% in 2023, meanwhile, according to the OECD, Chinese growth will moderate from 8.5% in 2021 to 5.8% in 2022.

Conclusion and Investment Opportunities

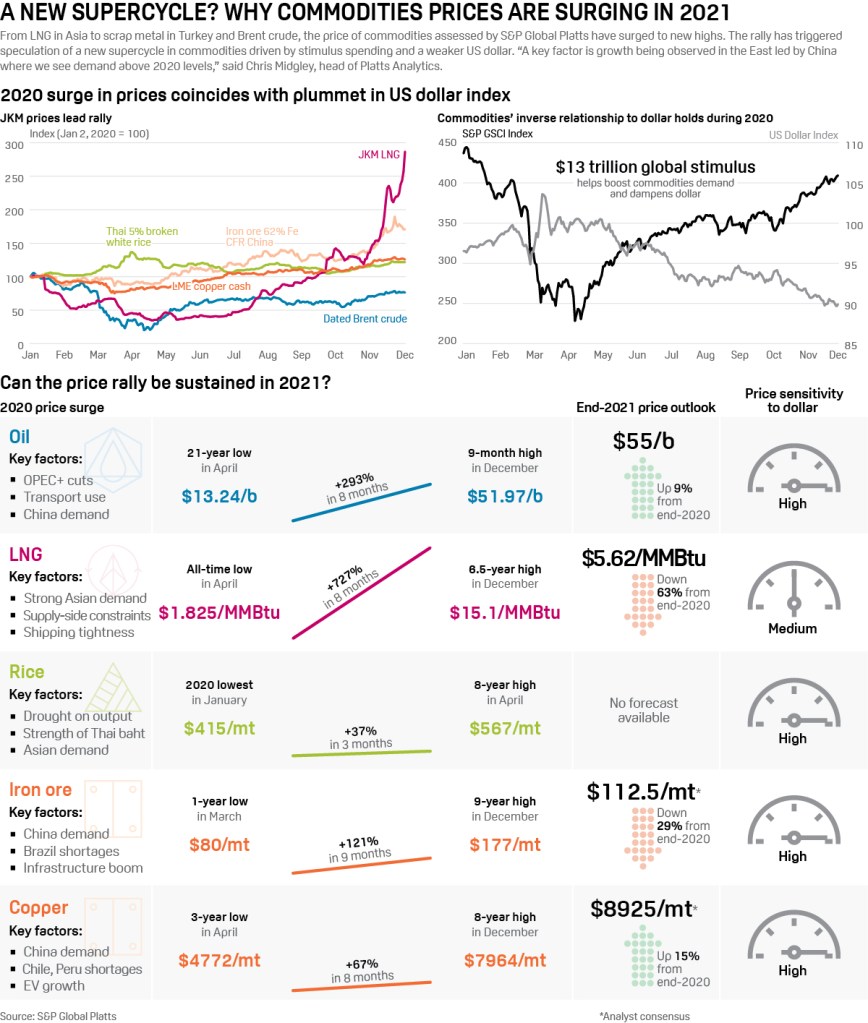

Back in January Goldman Sachs predicted a new commodity super-cycle. They see rising wages leading to faster, commodity price positive, home formation and more synchronised social policies, akin to those of 1960s ‘War on Poverty’ campaign. In other respects they believe this cycle has stronger parallels to the 1970s than the 2000s. Goldman expect industrial capex to run at 2000 levels whilst social rebuilding generates a 1970s style consumer boom.

S&P present some of these arguments in a useful infographic: –

Source: S&P Global

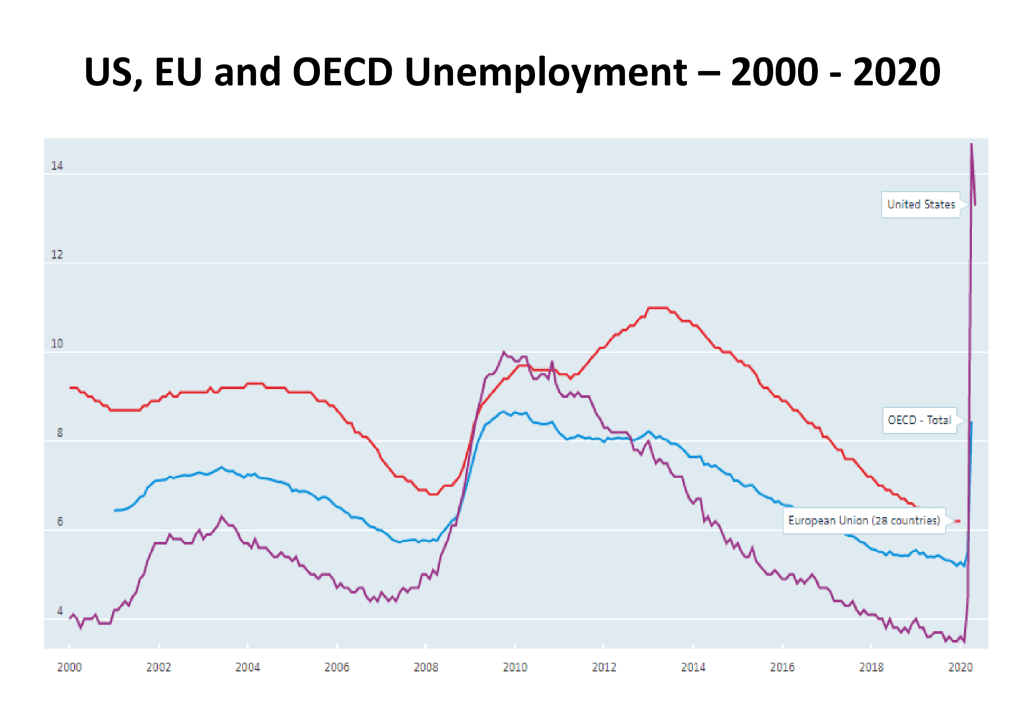

US unemployment has fallen from 11.1% to 5.8% during the last 12 months, even in the harder hit Euro Area it has declined from 8.7% to 8%, whilst Chinese data has followed a similar trajectory, falling from 6.1% to 5% since February 2020. Nonetheless, much of the global economy remains in some form of lockdown, with economic activity fuelled by fiscal spending. It remains difficult to envisage the conditions for a near-term sustainable economic boom. Remove global monetary and fiscal relief and commodity demand will evaporate.

As a general rule, in commodity and financial markets, what goes up price must eventually come back down. The price of US Stud Lumber (chart above) is well off its highs. Governments and their central bankers can attempt to remove the punch-bowl, but the markets are unlikely to take it well.

Macro Letter – No 138 – 21-05-2021

First In, First Out – China as a Leading Indicator

Whilst there are many aspects of the Chinese command economy which differ radically from that of the US, it is worth examining the performance of China’s economy, fiscal and monetary policy, and its financial markets. They may afford some insight into the future direction of other developed and developing markets as we gradually emerge from the Covid crisis: –

Source: Trading Economics

As can be seen from the chart above, whilst China was the first country to be struck by the Covid-19 pandemic it was also the first country to recover, however, a comparison of the Chinese and US bond markets provides a rather different picture: –

Source: Trading Economics

Chinese bond yields reached their lows at roughly the same time as those of the US, since when they have returned more rapidly to their pre-pandemic levels. If the US follows a similar trajectory the yield on US Treasuries is set to rise further.

It can be argued, however, that the plight of the Chinese bond market is a function of the monetary stance of the People’s Bank of China (PBoC). When the crisis first erupted the PBoC cut its interest rate corridor by 0.3% and also drove down Chinese interbank rates by around 1.2% through its open market operations. By May 2020 that policy had changed, accommodation was replaced by a steady drain of liquidity.

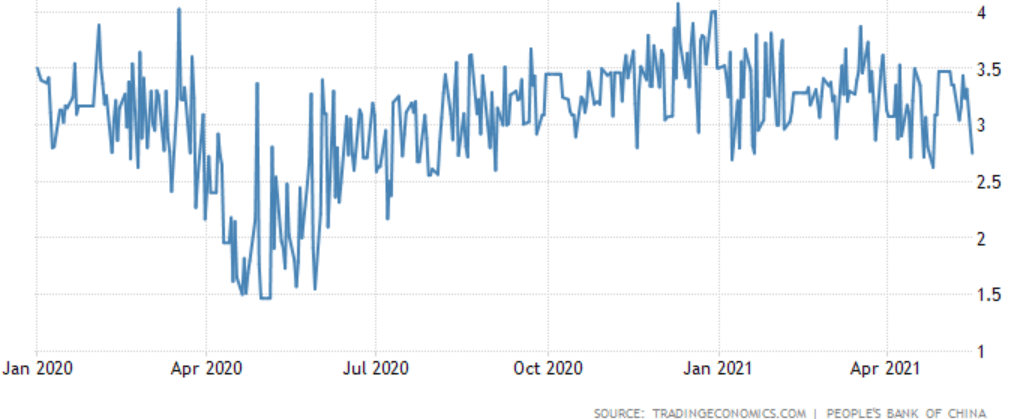

The chart below shows the, rather volatile, 3 month Shibor rate, this is in marked contrast to the ‘lower for longer’ approach taken after the 2008 crisis. The Covid accommodation has been remarkably short-lived: –

Source: Trading Economics, PBoC

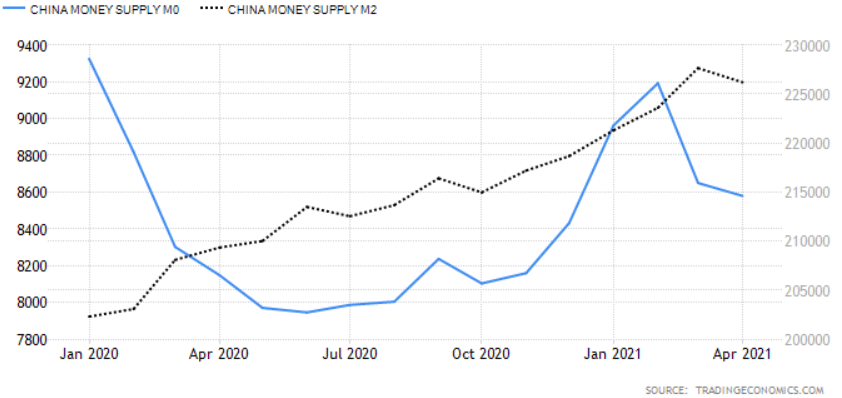

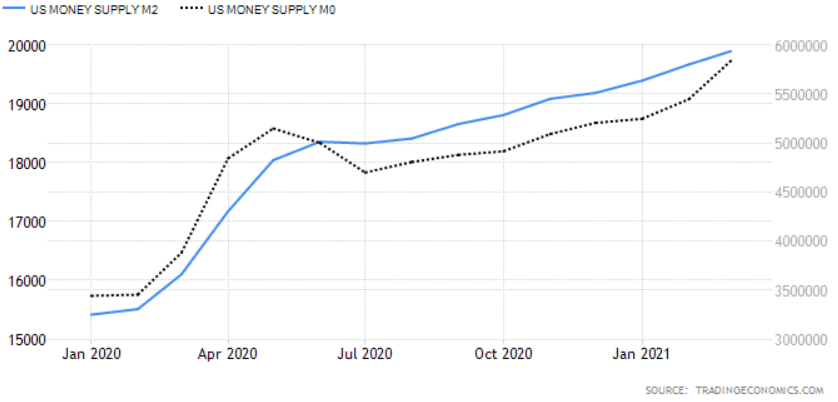

This PBoC tightening, which began in May 2020 and has been accompanied by official talk of the need for stability and the desire to avoid creating asset bubbles, is finally becoming evident in the money supply data: –

Source: Trading Economics

This contrasts with the continued expansion of US monetary aggregates: –

Source: Trading Economics

One of the challenges facing all central bankers is that interest rates are a blunt tool. Not all China’s asset markets have heeded the PBoC advice. The residential property market, for example, remains red hot despite the introduction of the three red lines policy – which aims to limit their liability-to-asset ratio (excluding advance receipts) to less than 70%, or their net gearing ratio to less than 100%, or their cash-to-short-term debt ratio to less than 1x, or a combination of all three. New home prices surged on regardless, gaining 4.8% in April, led by luxury real estate in Shenzhen, Shanghai and Guangzhou which is up 16% to 19% over the last year – a further tightening of regulation seems inevitable.

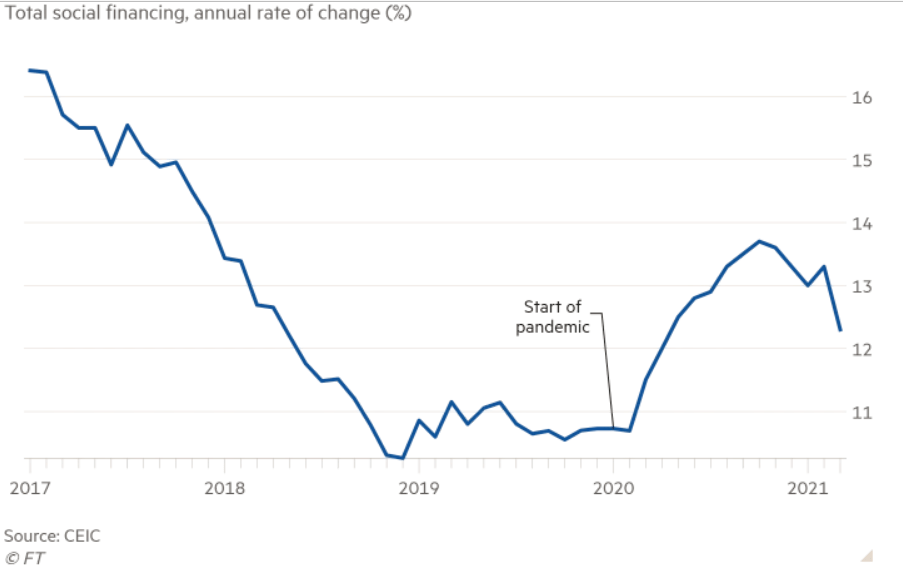

The PBoC has had greater influence elsewhere, Total Social Financing, their favoured measure of lending across the entire domestic financial system, rose by 12% in March, its slowest pace since April 2020:-

Source: Financial Times, CEIC

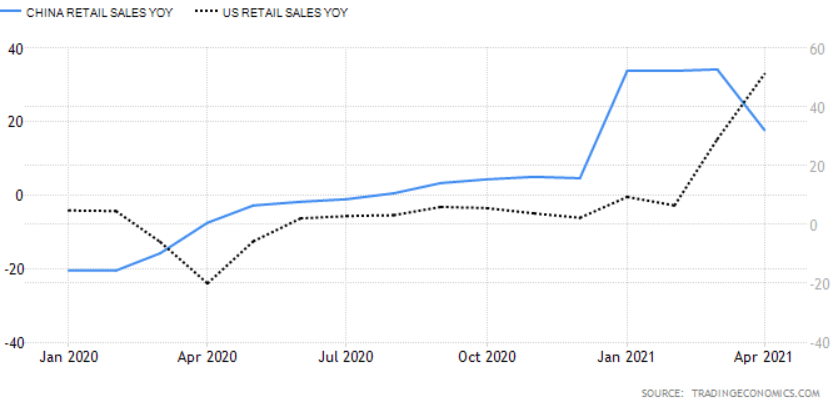

Another sign that official policy measures may be biting was seen in April’s retail sales which, whilst they rose by 17.7%, were down from a 34.2% in March, and came in well below the consensus forecast of 24.9%. Here again, China appears to be a leading indicator of the direction that the US economy might take: –

Source: Trading Economics

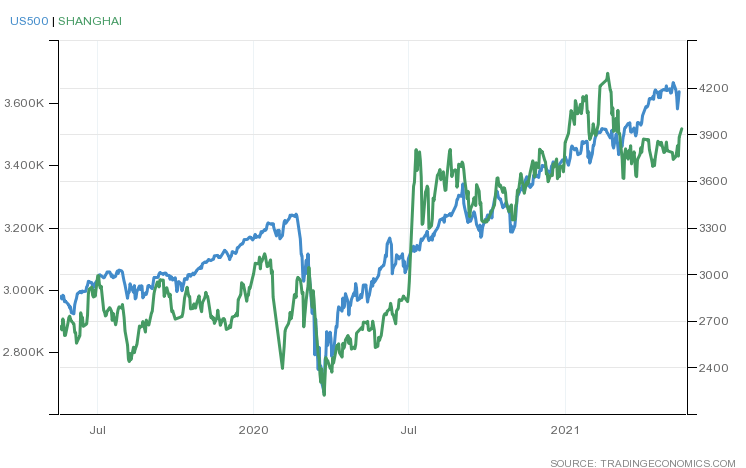

Interestingly, unlike 2015, the Chinese stock market has, thus far, reacted in a more measured way to the general tightening of monetary conditions. The next chart shows the relative performance of the Shanghai Composite versus the S&P 500 Index: –

Source: Trading Economics

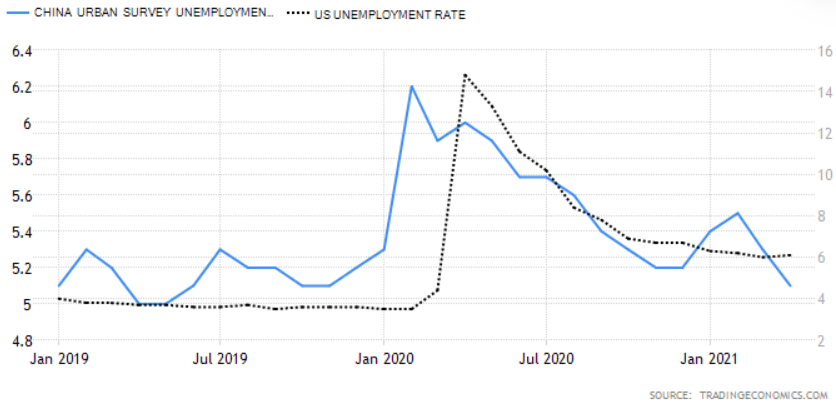

As mentioned above, money supply data points to a slowing of the Chinese economy but, like so many other countries, China saw a sharp rise in its, already high, household saving rate. The Paulson Institute estimates that Chinese households saved 3% more of their income than prior to Covid; Pantheon Macroeconomics equate this pool of savings to roughly 3% of GDP. While many commentators suggest that in China’s case this is a pool of precautionary saving, consumption will likely resume its long-term growth, now that employment prospects have begun to improve. The chart below shows the lagged trajectory of unemployment in US compared to China: –

Source: Trading Economics

US unemployment remains elevated relative to its pre-Covid rate but the economic recovery continues to gather momentum.

In China, as elsewhere, that portion of excess savings not consumed will either be left on deposit, used to reduce debt or invested. Even though interest rates have risen, the liquidity of Chinese capital markets should remain plentiful for the next six months to a year, sufficient to cushion any sudden downturns in the post-Covid recovery.

Conclusions and Investment Opportunities

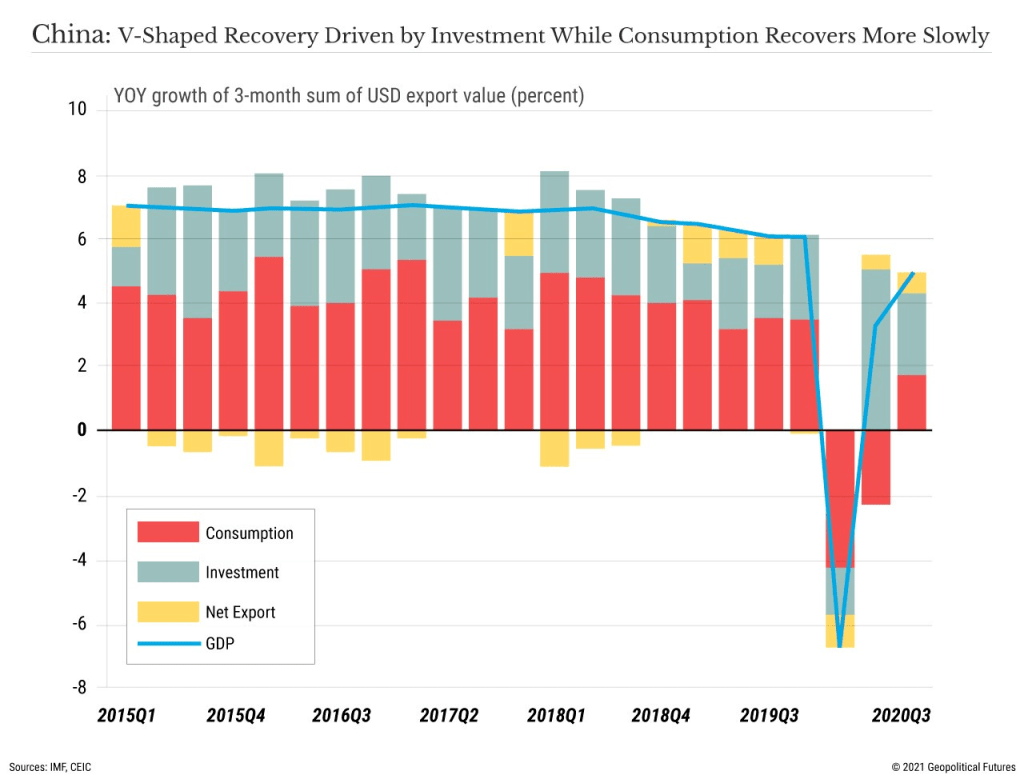

In the analysis above, I have produced a strew of charts suggesting that the US may follow the trajectory of China as the post-Covid recovery unfolds. This is almost certainly too simplistic. Above all else Beijing craves stability, it knows its pace of economic growth is slowing, this is structural. The investment-led growth model which has transformed the economy over the last four decades, requires the methadone of more credit to sustain even these lower rates of return. The policy of rebalancing towards domestic consumption offers longer-term hope, but China’s recovery from the Covid crisis was driven principally by investment and, to a much lesser extent, exports. The chart below, from George Friedman of Geopolitical Futures, shows the damage done to Chinese consumption by the pandemic and the subsequent rebound: –

Source: Geopolitical Futures, IMF, CEIC

The new(ish) US administration is also different from any we have seen for several decades. Markets believe in the arrival of a New New Deal fuelled by a gargantuan monetary and fiscal tonic which will heal-all. Asset prices continue to rise as The Everything Bubble inflates further.

We are still in the early stages of the economic recovery. Supply-chain constraints and labour shortages, even whilst under-employment remains elevated, have driven inflation expectations higher in the near-term, yet asset markets look beyond these shorter-term factors to the productivity gains, which have, in many cases, been a long overdue response to the crisis itself.

A few brave central bankers are seeking to temper the speculative frenzy. The majority, however, will place their emphasis on outcomes rather than the outlookas Federal Reserve Governor Lael Brainard recently stated. This politically expedient approach means fiat currencies will continue their race to the bottom, bond markets will remain neutered by the policy of QE; that leaves assets as the solitary safety-valve, somewhere between a store of wealth and thar she blows. They afford some protection against debasement and, with the advent of Decentralised Finance, there is a non-zero possibility that some of these assets might even become a means of exchange.

In the near-term we have seen the Norges Bank indicate that it may raise rates in H2 2021. The Bank of Canada has announced a tapering of government bond purchases, inking in a potential rate increase for late 2022, meanwhile the Bank of Japan, whilst it has made no bald statements, has moderated its ETF purchases and stands accused of taper by stealth because the scale of its bond-buying has actually slowed since it adopted yield curve control in 2016. These isolated actions are but clouds in a blue sky of endless liquidity but financial markets prefer to travel rather than to arrive. Choppier markets are likely over the next few months, there may be some excellent asset buying opportunities on sharp corrections.

I published this essay at the end of last year but as Cryptocurrencies and Digital Asset gain further prominence, I take the liberty of sharing once more. Central Bank Digital Currencies will be the next ‘innovation’ but we may see money, traditionally a store of value and a means of exchange, become either one or the other.

Digital Currencies and US Dollar Dominance

Macro Letter – No 137

A Review of Stock Market Valuations – Part 2

Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.

Charles Mackay – Extraordinary Popular Delusions and the Madness of Crowds (1841)

Money is a public good; as such, it lends itself to private exploitation.

Charles Kindleberger – Manias, Panics, and Crashes: A History of Financial Crises (1978)

Contributing to euphoria are two further factors little noted in our time or in past times. The first is the extreme brevity of the financial memory. In consequence, financial disaster is quickly forgotten. In further consequence, when the same or closely similar circumstances occur again, they are hailed by a new, often youthful, and always supremely self-confident generation as a brilliantly innovative discovery. There can be few fields of human endeavor in which history counts for so little as in the world of finance. Past experience, to the extent that it is part of memory at all is dismissed as the primitive refuge of those who do not have the insight to appreciate the incredible wonders of the present.

JK Galbraith – A short history of financial euphoria (1990)

This is the second of a two part letter reviewing the current valuation of stocks. The focus is US-centric and looks at both long-run valuation (Part 1) and shorter term factors which may be warning signs of irrational exuberance (Part 2).

During the last year we have seen stock markets around the world, decline rapidly and then rebound. Technically the longest bull-market in history ended in March of 2020, but the recovery was so swift that many commentators are calling it merely a sharp correction, simply an aberration. Since March the US stock market, fuelled by aggressive monetary and fiscal easing, has shot to new all-time highs. 2020 ended with the approval of the first Covid-19 vaccines, sending markets higher still.

Equity markets are forward-looking, the economic woes of today are discounted, expectations of recovery, backed by further fiscal support, make the prospects for future earnings appear relatively rosy. In this, the second part of my letter, I want to examine some shorter-term indicators which may or may not be cause for concern that current valuations are a triumph of hope of reality.

I once gave a speech entitled The Trouble with Alpha the gist of which contained my observation that Alpha – that portion of an investment managers returns which are not the result of the performance of the underlying assets was, was simply timing. To arrive at this conclusion I looked at 24 definitions of Alpha, finding that – once I had accounted for factors such as leverage, the ability to be long or short and (of particular importance) the choice of the index which was supposed to represent Beta – all that remained was timing.Suffice to say the speech was not received with acclaim by the audience – who were primarily investment managers. I mention this because, for the majority of investors, the investment time-horizon is finite. It is all very well for me to write about the Long Run and for Warren Buffet to describe his favourite investment horizon being forever, but for most investors, volatility, liquidity and mortality are key.

The economic historian Charles Kindleberger published Manias, Panics and Crashes: A History of Financial Crises in 1978, in which he observed patterns of fear and greed stretching back centuries, however, personally, I think Jesse Livermore sums-up the behaviour of financial markets best in the opening pages of Reminiscences of a Stock Operator, published in 1923: –

There is nothing new in Wall Street. There can’t be because speculation is as old as the hills. Whatever happens in the stock market today has happened before and will happen again.

In trading especially, but in investment too, timing is (almost) everything.

Show me the signs

There are times when making money from the stock market is hard, and times when it is easy, the latter periods are few and far between, but one of the tell-tale signs that a market has become excessively speculative is when retail investors pile in.

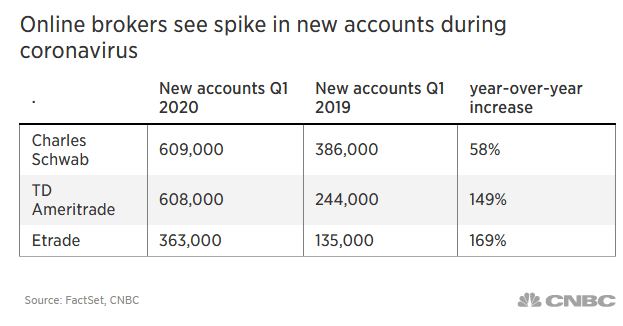

Stock market folk-lore tells of how Joseph Kennedy (although others attribute it to James Pierpont Morgan) decided to sell his stock portfolio ahead of the market crash of 1929. Kennedy figured that when he found himself in receipt of stock tips from his shoeshine boy, the market bubble was very well advanced. The table below shows the uptick in retail stock broker accounts between Q1 2019 and Q1 2020: –

Source: Factset, CNBC

Robinhood is not on the list above, but more on that topic later.

In a recent post – A Visit from the Doom Squad – 10th Man, Jared Dillian quotes research from South Korea on the behaviour of retail stock traders in the aftermath of a bursting stock bubble: –

The researchers observed the behavior of a few thousand of them. After six months, 90% of them had given up. After a year, the 1% who were left barely had enough money to cover their daily expenses.

Dillian believes the biggest risk is of the Federal Reserve becoming more hawkish as the pandemic is brought to heel by the process of mass-vaccination. He concludes: –

That is a real risk. In fact, it is really the only risk, because people correctly point out that the economy will recover strongly in the second half, once most of the vaccines have been distributed.

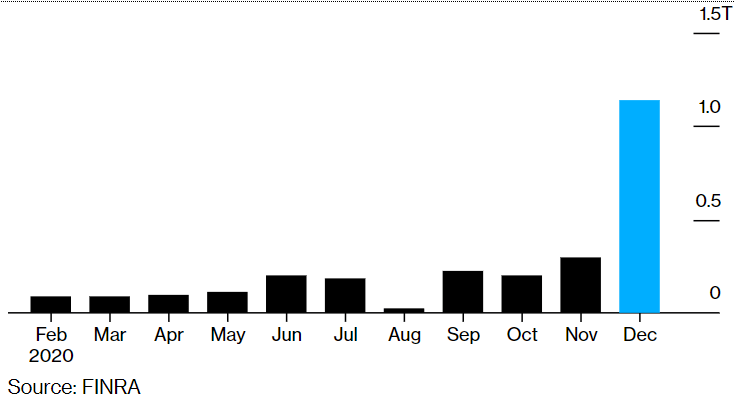

Aside from the proliferation of retail stock-trading accounts, there are several indicators of excessive speculative activity in the US stock market. Firstly, record OTC/Pink Sheet trading volume – these are stocks not listed on the main exchanges: –

Source: Finra, Bloomberg

Another bubble warning sign is the record high levels of equity margin trading. The chart below shows the evolution of margin balances and the direction of the S&P 500 index up to December 2020: –

Source: Advisor Perspectives

A further worrying sign of excess is the rise of the SPAC – Special Purpose Acquisition Company. This is a blank cheque shell corporation designed to take a company public without going through the traditional IPO process. SPACs allow retail investors to gain access to private equity type opportunities, particularly leveraged buyouts. A slightly tongue-in-cheek description of the difference between a SPAC and a traditional IPO is that, an IPO is a company in search of capital, whilst a SPAC is capital in search of an investment.

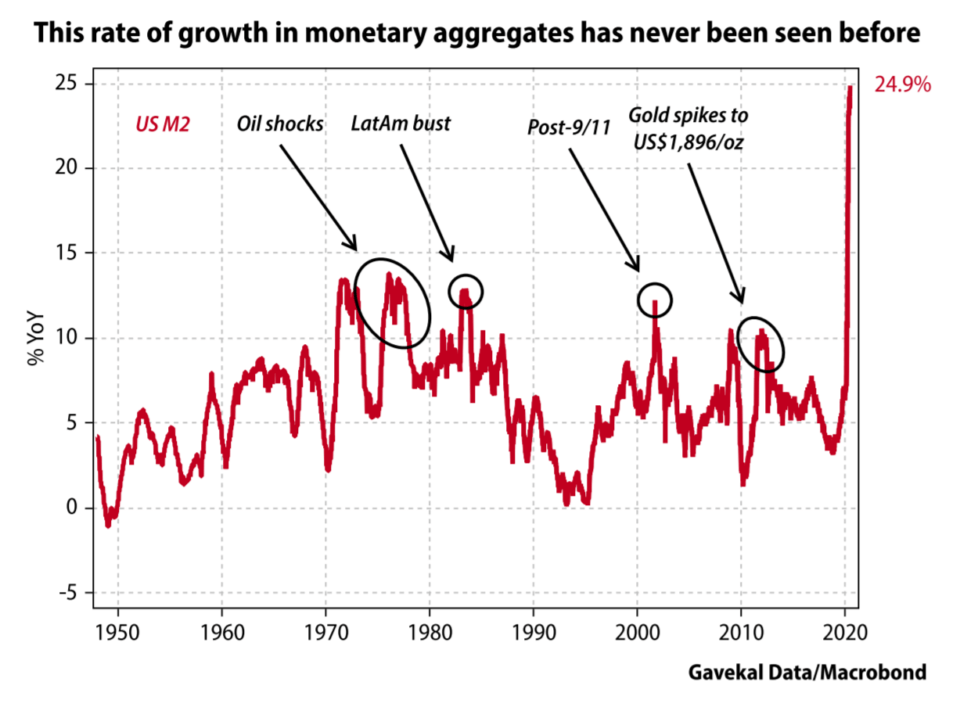

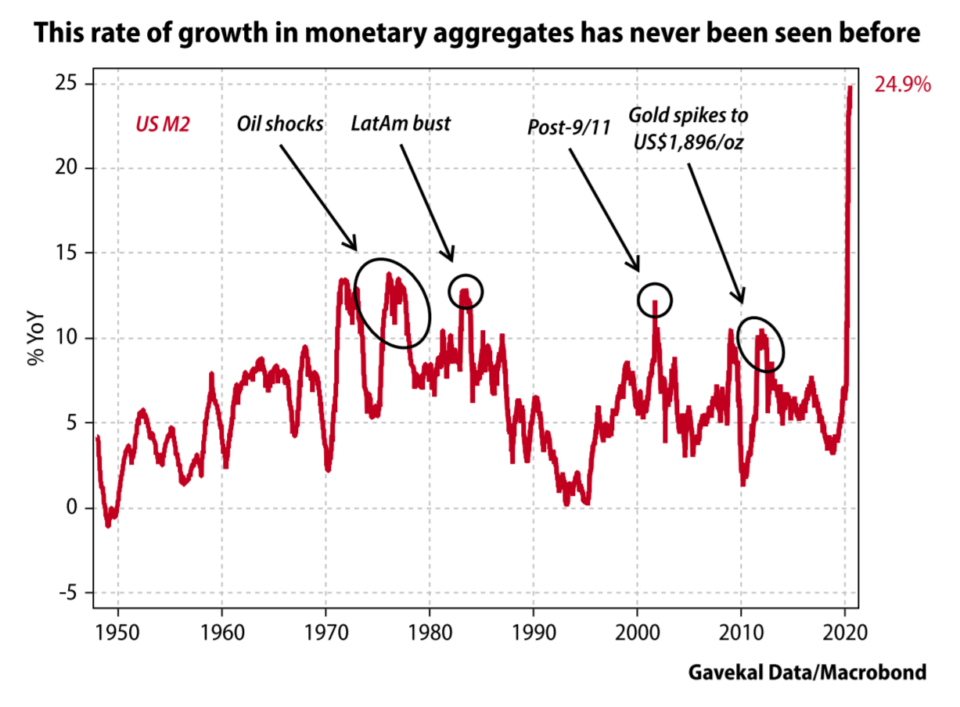

This chart of the ballooning of US money supply growth may help to explain the allure of the SPAC, along with many other signs of speculation: –

Source: Gavekal/Macrobond

In 2020, SPACs accounted for most of the growth in the US IPO market, raising $80bln from 237 listings. This surpassed the previous record of $13.6 billion raised from 59 IPOs in 2019. The trend has entered a new phase with $38bln raised from 128 listings in the first six weeks of 2021.

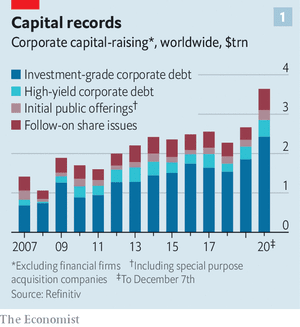

Another outcome of the rapid expansion in money supply can be observed in corporate capital raising. Last December The Economist – A year of raising furiously – noted that corporations globally raised more capital in 2020 than ever before: –

According to Refinitiv, a data provider, this year the world’s non-financial firms have raised an eye-popping $3.6trn in capital from public investors Issuance of both investment-grade and riskier junk bonds set records, of $2.4trn and $426bn, respectively. So did the $538bn in secondary stock sales by listed stalwarts, which leapt by 70% from last year, reversing a recent trend to buy back shares rather than issue new ones.

Here is a chart from the first part of this Macro Letter showing the composition of global corporate capital raising in 2020: –

Source: The Economist

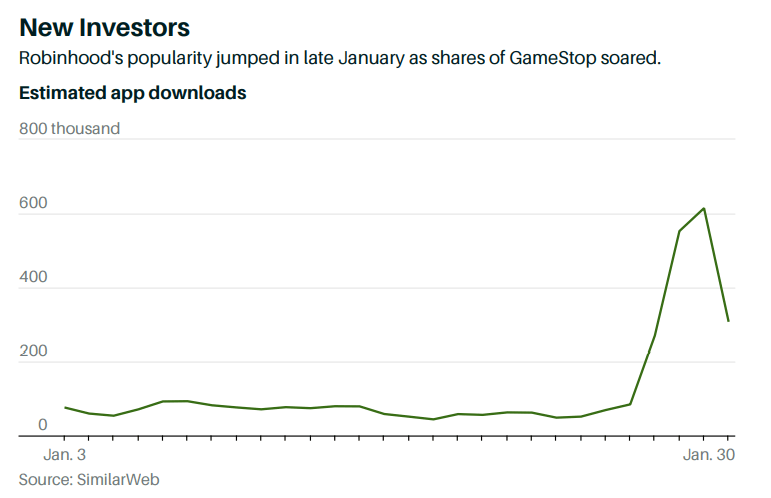

This brings us to the story of GameStop (GME) a video gaming retailer with dismal earnings expectations that was trading at less than $5/share in August of 2020 and peaked at $347/share during a frenzy of hedge fund short covering last month. An excellent description of the time-line and the players involved in the saga can be found in – How Main Street stormed the Financial Capital – the GameStop Story – Vijar Kohli. The GameStop effect spilt over into many small-cap names and pushed the Russell 2000 index to new highs.

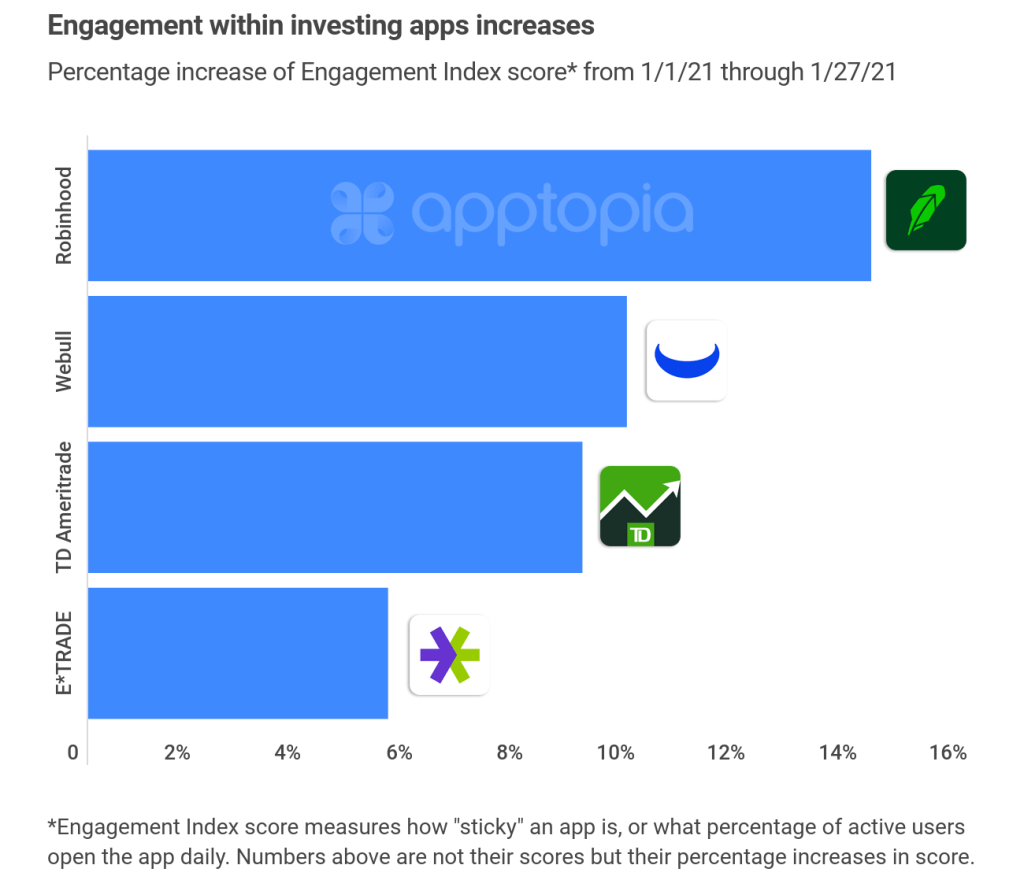

The GameStop tale is intertwined with the fortunes of a retail stockbroker with the beguiling name, Robinhood Financial , and an even more beguiling mobile app. This CNBC article from October 2020 – How Robinhood and Covid opened the floodgates for 13 million amateur stock traders– sheds light on this new phenomenon: –

Robinhood has been the fintech darling of Silicon Valley, founded by Vladimir Tenev and Baiju Bhatt in 2013. The app has amassed 13 million user accounts and led the way for zero-commission fee trading. In no time, it has created brand awareness and popularity unlike that of the legacy brokerages such as Charles Schwab and Fidelity, or its app-first competitors like Webull and Dough.

Despite Robinhood being forced to suspend customer purchases of GameStop, together with some other securities – precipitating an SEC investigation and string of Class Action law suits – the company has continued to take on new clients. According to Rainmaker Securities, the latest private bids for Robinhood shares puts the company’s valuation around $40bln. This February 2021 article from Yahoo Finance – Robinhood is still the app of choice for retail investors: new data– provides more colour. Here is a chart showing the downloads of the Robinhood App last month: –

Source: SimilarWeb, Gavekal

For a more robust economic analysis of the implications of the GameStop saga, Weimin Chen, The Austrian Economic Center – Gamestop Market Mayhem and the Sickness of the Economy is illuminating:. The author concludes: –

There will likely be future limitations placed by brokerage platforms, greater calls for government regulation of the markets, more instances of hysteric market actions, and a general scramble for the next Gamestop style speculation. Federal Reserve Chairman Jerome Powell was quick to deflect blame for this week’s market volatility, but this could be just the beginning of more upcoming economic turbulence.

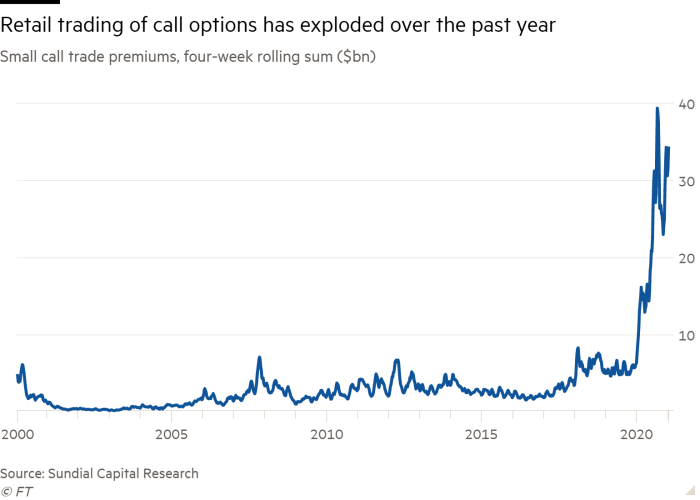

Another feature of the Robinhood Effect has been the dramatic increase in call option trading on single stocks: –

Source: FT, Sundial Capital Research

A common claim is that 90% of options expire worthless, but this is based on the fact that only 10% of option contracts are exercised. According to the CBOE, between 55% and 60% of options contracts are closed out prior to expiration. A more reasonable estimate is therefore that 30-35% of contracts that actually expire worthless. Nonetheless, retail investors have still paid option market-makers a vastly increased amount of option premium during the past year.

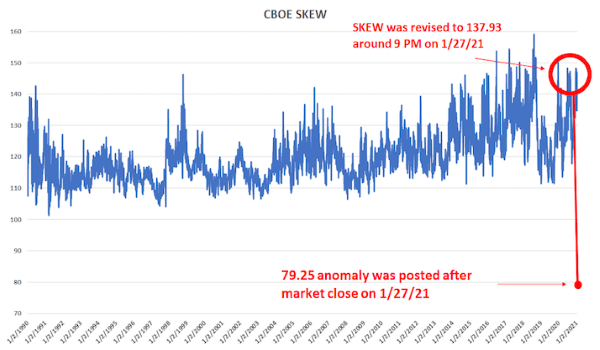

The traded options market is also an important indicator of risk. When the stock market falls, price volatility tends to rise, but option prices can anticipate changes in risk appetite. Without delving too deeply into the dark arts of option trading, in stable market conditions, call options tend to have lower prices (and therefore lower implied volatility) than put options, since investors tend to sell call options against their underlying portfolios but purchase put options to protect themselves from sudden market declines. There is a lot more to option pricing and trading than we can discuss here, suffice to say the Chicago Board Options Exchange (CBOE) calculate a SKEW Index – the difference between the relative price of different call and put options. SKEW values generally range between 100 and 150 – the higher the value, the higher the perceived tail risk. A reading of 100 should represent its lower bound (low tail-risk). For a further explanation I defer to David Kotok of Cumberland Advisors – GameStop And SKEW: –

Source: CBOE, Cumberland Advisors

When you examine the SKEW methodology closely, you realize that a 79.25 price is practically impossible. It would mean that the stock market is paying you to take a tail-risk. In other words, such a price means that a trade can be constructed in which the investor cannot lose significantly. This is never supposed to happen. But we see that there is evidence that such a trade may have occurred on the same day as the wild swings of short covering and GameStop trading. That price suggests a market distortion that was quickly multiplied by many times.

Markets are complex systems, the price action in GameStop – and other small cap securities – feeds through to the option market, which in turn impacts other markets. The hedge fund Melvin Capital survived the brutal GameStop short-squeeze to fight another day but the episode is reminiscent, in a more contained way, of the LTCM debacle of 1998 – here is the report of the President’s Working Group on Financial Markets from April 1999 – Hedge Funds, Leverage, and the Lessons of Long-Term Capital Management.

The Robinhood Effect – a lethal mixture of work from home, stay at home and getting a government relief cheque – has been mirrored among other online brokers: –

Source: Horizon Fintex

A similar rise in first-time retail customers is evident in the Cryptocurrency and Foreign Exchange markets.

Another sign of assets being in bubble territory is the performance of the housing market. Now, it goes without saying, all property is local, but looking at the US, where the fiscal and monetary response has been the largest, we find yet another asset market at an all-time high: –

Source: Federal Reserve

The rise in house prices has been fuelled by cheap money: –

Source: III Capital Management, Bloomberg, JP Morgan

Combined with a shortage of supply: –

Source: III Capital Management, Goldman Sachs, NAR

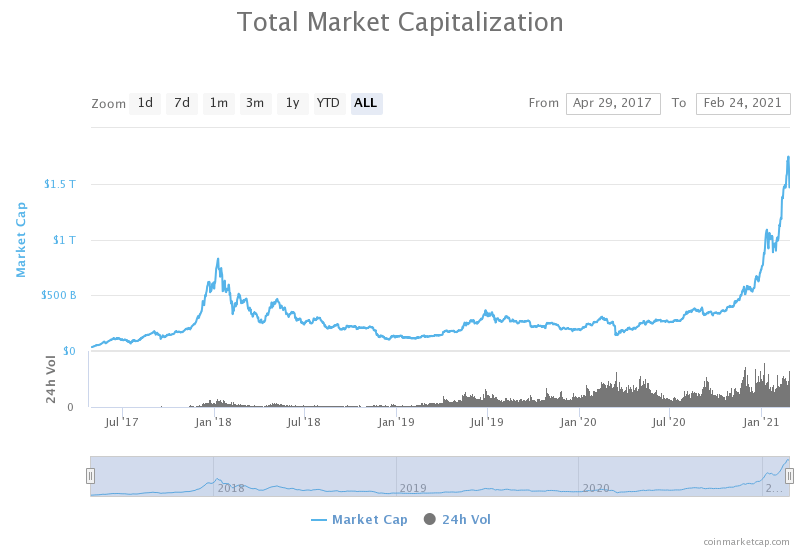

Finally, fiscal and monetary expansion is akin to fiat currencies have debasement, it is scant surprise, therefore, to see Cryptocurrencies resurgent. The chart below shows the combined market capitalisation of all the listed digital currencies: –

Source: Coinmarketcap.com

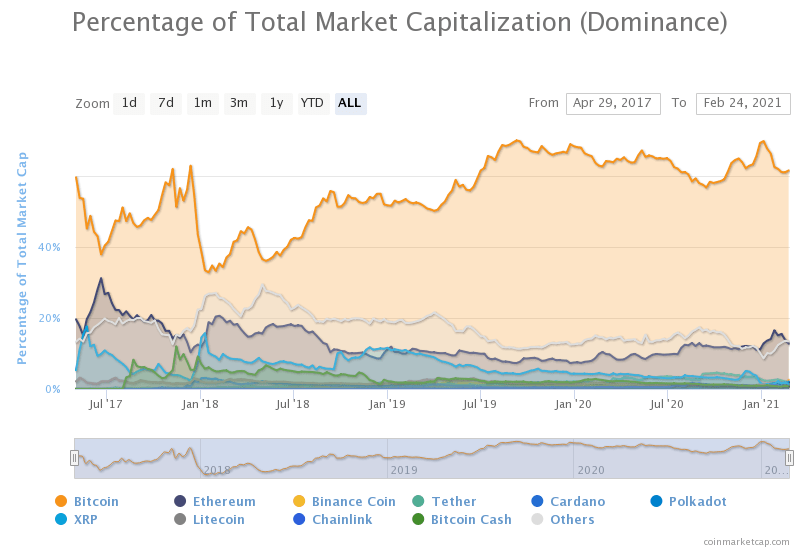

Of course the principal focus of the media has been on Bitcoin (BTC) access to which was made available to Paypal customers from October 2020. This month’s big stories include Telsa (TSLA) purchasing $1.5bln of BTC during January and Mastercard indicating that they intend to accept BTC as a form of payment later this year. The next chart shows the rising dominance of BTC (61%) compared to the previous peak in 2017: –

Source: Coinmarketcap.com

Ethereum (ETH) is second with a mere 12.7%. Putting digital assets in perspective, however, the market capitalisation of BTC, which just topped $1trln last week, is still less than 10% of the total market capitalisation of gold.

Whether or not one regards digital assets as an alternative store of value, soon to displace what Keynes dubbed the barbarous relic (gold), it is incontrovertible that the digital asset industry is in its infancy whilst the underlying technologies – DL, Blockchain and DeFi – have the potential to disrupt the entire financial system – who needs banks or other financial intermediaries in this brave new decentralised world? Coinbase, which has been described as the Robinhood of the Crypto world, is planning an IPO for later this year. The current indication is that it will achieve a capitalisation of $77bln.

What is of concern is that the Crypto charts above wreak of euphoria. Traders and investors with no prior experience, have jumped on the trend and now command cult-like status among the ingénue. Some of their followers will be lucky, but these price patterns are the tell-tale traits of a greater fool’s marketplace.

Even in the liquid, large-cap names, echoes of the DotCom bubble are apparent. Apple (AAPL) and Tesla (TSLA) stock rose more than 50% in the days after they announced stock splits. Apple created more value for shareholders by announcing a stock split in 2020 than through its new product launches, Tesla, which declared the first profit in its 18 year existence in 2020 ($721mln) has made more from its purchase of Bitcoin than it has made in its lifetime.

In a recent post, on what many have dubbed the everything bubble, – Is This The Biggest Financial Bubble Ever? Hell Yes It Is – John Rubino concludes: –

Meanwhile, the actions necessary to fix some of these bubbles are mutually exclusive. A stock market or housing bust requires much lower interest rates and bigger government deficits, while a currency crisis brought on by rising inflation requires higher interest rates and government spending cuts. Let everything blow up at once and there will be literally no fixing it. And the “everything bubble” will become the “everything bust.”

John’s website is called Dollar Collapse, of the two end-games he outlines above, letting the US$ slide is the least painful short-term solution, no wonder the US administration keep labelling other countries currency manipulators.

The Stock Market’s Nemesis

Having lain dormant for so long, its return to prominence may come as a shock to newer participants in the stock market: I am of course referring to the US Treasury Bond market. The chart below shows the 10yr yield over the last quarter century: –

Source: Trading Economics

10yr yields hit their all-time low at 32bp last March, today (24th February) they have risen to 1.39%. The table below shows a selection of forecasts for year-end yields: –

Source: III Capital Management

Central Bankers are holding short-term rates near to zero but the longer end of the yield-curve is being permitted to express concerns about the inflationary consequences of excessively accommodative fiscal and monetary policy. Meanwhile, central bank buying of corporate bonds has insured that credit spreads have shown a muted response to the recent increase in yields. At some point there will be an inflection point and credit will reprice violently. For those adventuring in the stock market, these words attributed to James Carville – a political adviser to President Clinton – remain worthy of careful reflection: –

I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.

Unless, as I expect, the world’s leading central banks intervene to fix the price of government bonds, the bond market, left to its own devices, will bring the stock market back to reality with a crash.

Conclusion and Investment Opportunities

Having written more than 6,000 words in this two part Macro Letter I still feel as if I have merely scratched the surface of the conflicting and contrasting factors which support the bull and bear case. Taking a step back, I encourage you to read Five Lessons From History By Morgan Housel, The Collaborative Funda short-ish article which presents five lessons which can be applied to investing and to life in general. In the interests of brevity: –

Lesson #1: People suffering from sudden, unexpected hardship are likely to adopt views they previously thought unthinkable.

Lesson #2: Reversion to the mean occurs because people persuasive enough to make something grow don’t have the kind of personalities that allow them to stop before pushing too far.

Lesson #3: Unsustainable things can last longer than you anticipate.

Lesson #4: Progress happens too slowly for people to notice; setbacks happen too fast for people to ignore.

Lesson #5: Wounds heal, scars last.

Reflecting on the current great viral crisis (GVC) and its aftermath, I see many signs of irrational exuberance but remain cognisant of the low likelihood of any sudden policy reversals by developed nation governments or their central banks, this is primarily due to the fragility of the current global economy. The scars of Covid will take many years to heal, unsustainable things may last longer than anticipated and, as JM Keynes famously observed: –

The markets can remain irrational longer than you can remain solvent.

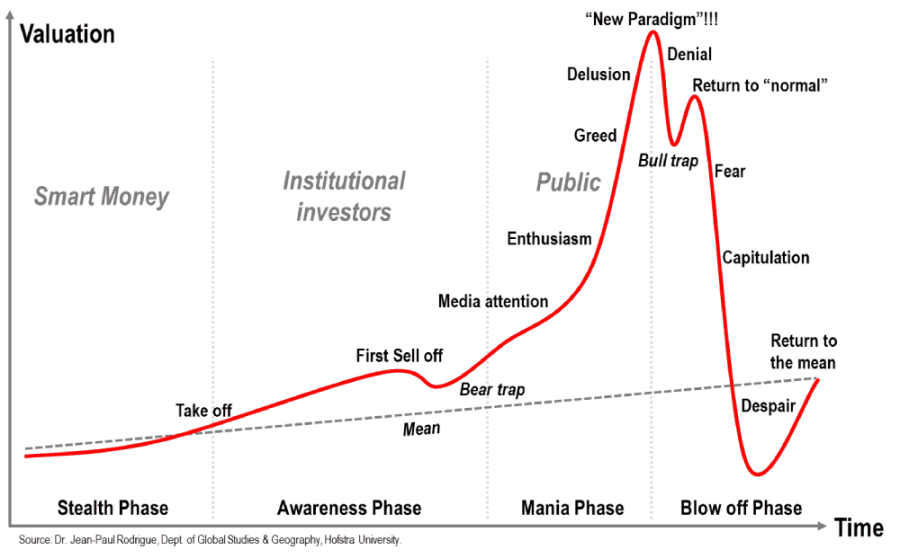

The cult of the personality, personified by the likes of Elon Musk, remains ascendant, so reversion to mean may be postponed a while. There is widespread evidence of what the French philosopher Rene Girard dubbed mimetic desire; the idea that, because people imitate one another’s desires, they tend to desire the same things; in the process this desire creates rivalry and increases the fear of missing out. In the classic evolution of a bubble mimetic desire leads from the momentum or awareness phase to the hallowed halls of mania and euphoria: –

Source: Dr Jean-Paul Rodrigue – Holstra University

Now is not the time to be rushing headlong into the stock market, but the upward trend remains firmly in tact. Alan Greenspan observed irrational exuberance in 1996, it took the market another four years to reach its high, mimetic desire makes it hard for investors to risk taking profit for fear of missing an exponential rise. There are several risk reduction strategies, but these statements, attributed to two of the most successful investors of all time are always worth keeping in mind: –

Be fearful when others are greedy. Be greedy when others are fearful.

Warren Buffett

The time of maximum pessimism is the best time to buy and the time of maximum optimism is the best time to sell.

Sir John Templeton

Macro Letter – No 136 – 19-02-2021

A Review of Stock Market Valuations – Part 1

This is the first of a two part letter reviewing the current valuation of stocks. The focus is US-centric and will investigate both long-run valuation (Part 1) and shorter term factors which may be warning signs of irrational exuberance (Part 2).

During the last 12 months we have seen stock markets around the world, decline rapidly and then rebound. Technically the longest bull-market in history ended in March of 2020 but the recovery was so swift that many commentators are calling it merely a sharp correction, simply an aberration. Since March the US stock market, fuelled by aggressive monetary and fiscal easing, has shot to new all-time highs. Q4 of 2020 witnessed the approval of the first Covid-19 vaccines, sending markets higher still.

Equity markets are forward-looking, the economic woes of today are discounted, expectations of recovery, backed by further fiscal support, make the prospects for future earnings appear relatively rosy. In this, the first part of my, letter I want to examine the arguments for a continued rise in equity prices together with the counter-claim that a repeat of the performance of the past decade is simply inconceivable.

Every stock index is different but, for the purposes of this research, I will focus on the US rather than the rest of the world, since it is the US market which has tended, historically, to set the global tone. The chart below looks at the forward PE ratio of the US (in red) and the MSCI World – Ex-US (in blue): –

Source: Yardeni

Looking at the evolution of earnings per share and incorporating the recent forecasts for 2020 and 2021, we get a picture of a market which might just have got a little ahead of itself: –

Source: Crestmont Research

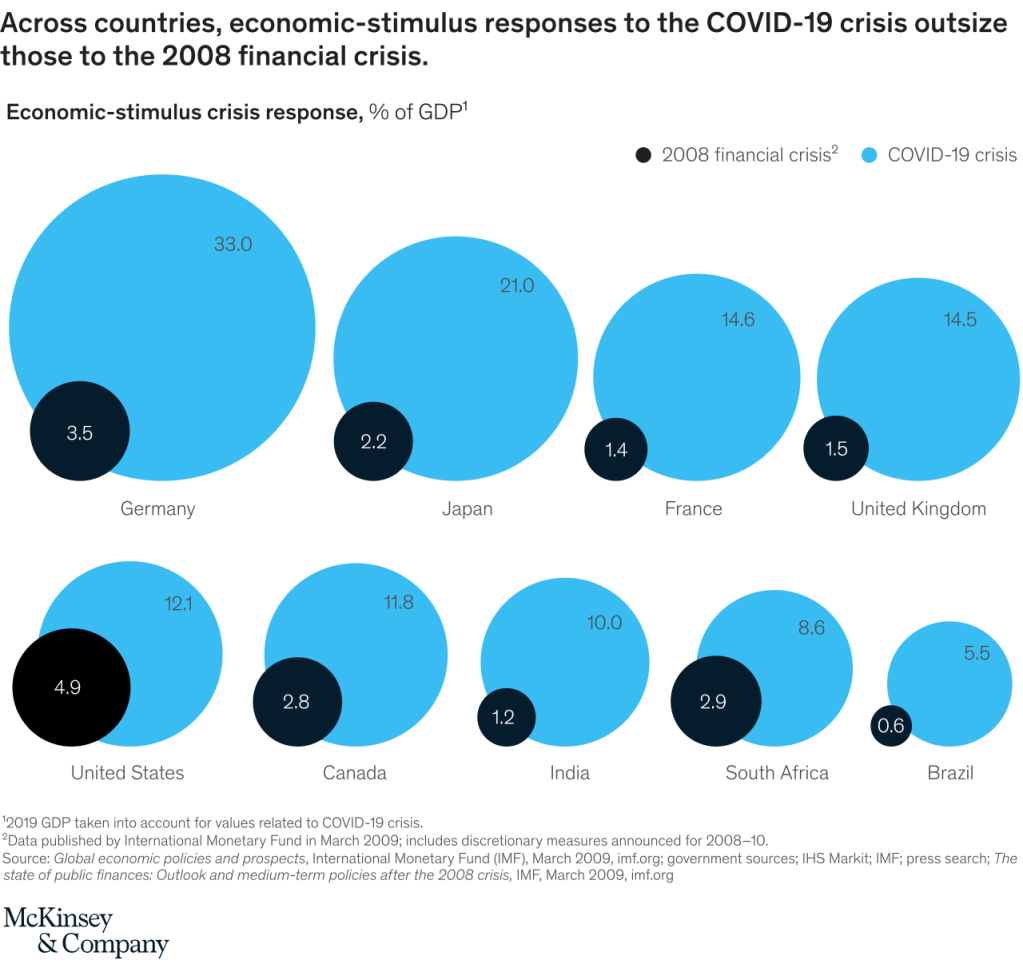

Part of the explanation for the substantial outperformance of the US has been the scale of the fiscal and monetary response of the US administration and its notionally independent central bank, yet, as the infographic below reveals, the US response whilst substantive is relatively less dramatic than that of some other countries: –

Source: McKinsey

Many commentators are concerned that the stock market (especially in the US) is over-valued, however a more nuanced view is provided by veteran equity market practitioner, Gregory van Kipnis. Writing at the beginning of last month in AIER, he makes a number of important observations in his article – Angst Over High Price-Earnings Levels Likely Misplaced. Stating from the outset that his purpose is not to provide valuation advice but a perspective on approaches to earnings valuation, the author looks at a variety of alternative valuation methodologies before reaching his conclusion: –

Market pundits who focus on PE, PE[-12], PE[+12] have come to the conclusion that the US stock market, as measured by the S&P 500, is overvalued and due for correction. Some believe we are in a bubble and there will be a sharp correction. Others opine that from current levels we are headed for a low rate of market performance for the next 10 years. These views may turn out to be correct.

However, a more formal analysis of classic valuation theory that relates the current price level to the present value of the future stream of expected income suggests otherwise; that is, the market is more fairly valued and in keeping with its historical norms. From a statistical point of view, there is uncertainty around such a conclusion. Market returns routinely fluctuate. Two thirds of the time total returns realized in the market fluctuate by plus or minus 4.4%. Nonetheless, there is analytical support for the conclusion that from both a market efficiency point of view and from the perspective of long-term valuation theory, the market is roughly aligned with long-term norms.

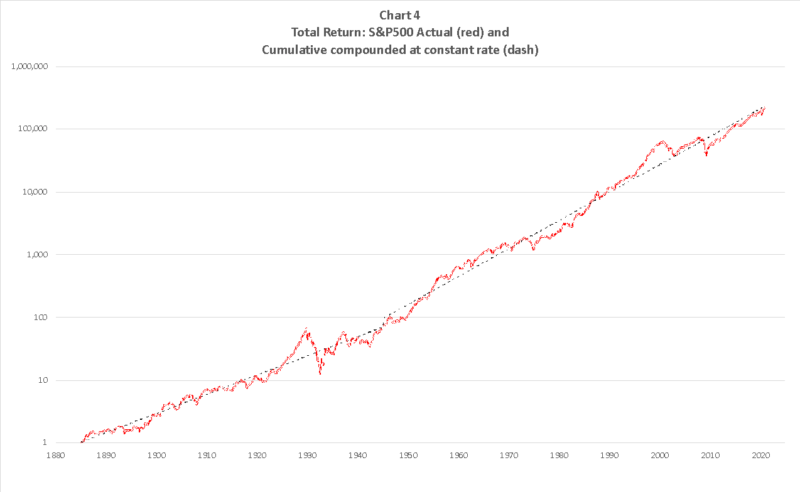

The chart below shows the S&P500 cumulative compounded total return at constant rate. The blue dotted line shows theoretical ‘fair-value’ derived from the author’s Total Return Model.

Source: AIER

Van Kipnis continues: –

At the risk of seeming repetitive, it should be stressed that the market trades within a range around its long-term fair value norms. For sure prices have trended for long periods below and above the historical norm. But it cannot be dismissed lightly that those historical norms are real and give every appearance of remaining intact for the foreseeable future.

Value amid the Growth

I have written on a number of occasions about the return of the Value investor, however, we are in a different environment from the 1980’s, where small cap stocks outperformed. The evolution is best explained by Robert Zuccaro, CIO of Target QR Strategies, who made the following observation in his January investor letter: –

Major differences are apparent between the economies of 1980 and 2020. Most companies in 1980 were industrial in nature and domestic in scope. In acknowledgement of the heavy influence of industrial companies in economic activity, the S&P 400 in this era was comprised solely by industrial stocks. Globalization has dramatically altered both the economy and the stock market. Whereas business activities were principally domestic in scope in the past, globalization offers an opportunity that is five times greater than the domestic market. Secondly, tech companies possess the capability to ramp up sales and profits faster than ever before. For example, it took Apple 31 years to reach a market cap of $100 billion. DoorDash which just came public did this in just 7 years. Forty years ago, some small companies starting from a small sales base were able to generate sales and profits growth up to 30-40% each year. Today, large cap tech companies with global reach can generate growth rates of 100%.

Vitaliy Katsenelson discusses the Growth versus Value debate in greater detail in – Value & Growth Demagogues – the author begins: –

I have a problem with both growth and value demagogues.

Growth demagogues will argue that valuation is irrelevant for high-growth companies because the price you pay for growth doesn’t matter. They usually say this after a very extended move in growth stocks, where these investors look like gods that walk on water. They call value investors “accountants.”

Katsenelson goes on to explain that he analyses corporate earnings looking four years ahead in order to capture the value in high growth stocks, nonetheless he believes many growth stocks as insanely overvalued.

On February 4th, Goldman Sachs, chief global equity strategist, Peter Oppenheimer expressed a more sanguine opinion on growth: –

We believe that we are still in the early stages of a new bull market, transitioning from the ‘hope’ phase (which typically starts during a recession, led by rising valuations) to a longer ‘growth’ phase as strong profit growth emerges.

The client note went on to discuss six areas which could benefit from capital inflows if investors start to price in higher inflation expectations: –

To date, roughly 70% of US companies have reported Q4 results, of these, around 85% have beaten expectations. Before you rush to buy remember the stock market is much happy travelling than arriving, the good earnings news is largely contained in the current price.

The Overvaluation Argument

Notwithstanding the analysis of van Kipnis and the forecasts of Goldman Sachs, the arguments for irrational exuberance are compelling. The catastrophic damage caused by the pandemic has yet to be fully revealed and a long-term secular stagnation remains a clear and present danger.

In his Forecast 2021: The Stock Market – John Mauldin takes a less rosy approach to current valuation: –

We all know the stock market was up significantly last year, and even more so around year-end, but you may not know how historically wild this is.

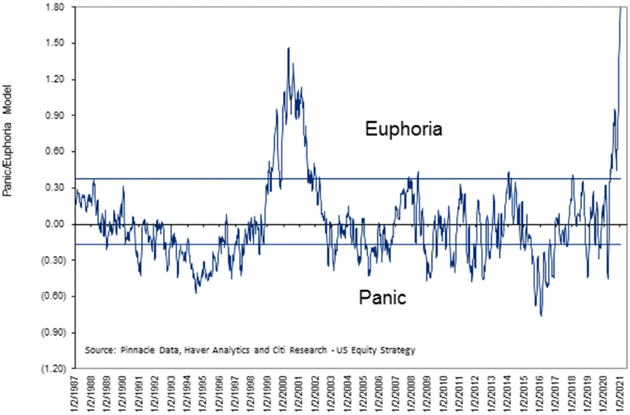

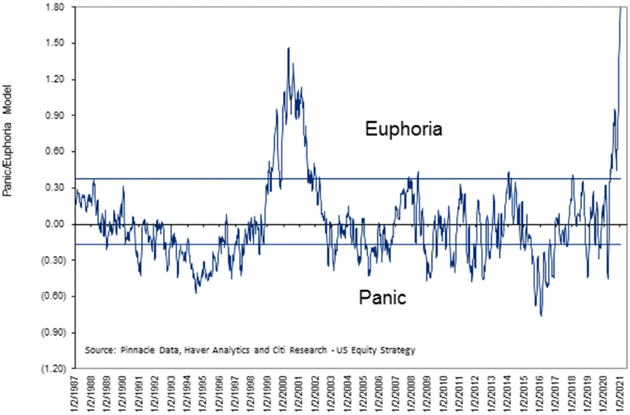

Citi Research has a “Euphoria/Panic” index that combines a bunch of market mood indicators. Since 1987, the market has typically topped out when this index approached the Euphoria line. The two exceptions were in the turn-of-the-century technology boom, when it spent about three years in the euphoric zone, and right now.

Source: Peter Boockvar, Pinnacle Data, Haver Analytics, Citi

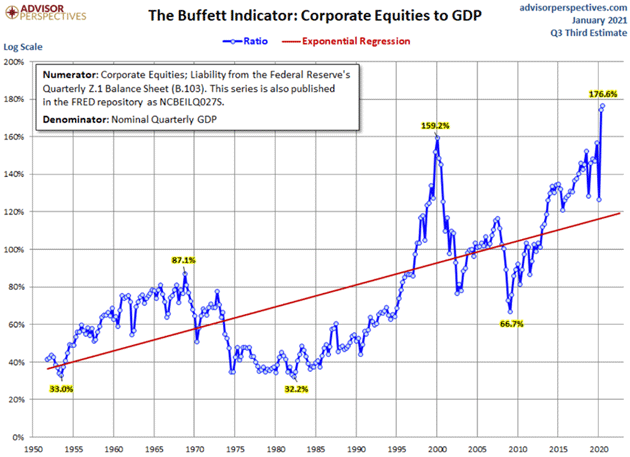

Another measure of overvaluation is the ratio of Equity Market Capitalisation to GDP, often referred to as the Buffett Ratio, since it is favoured by the Sage of Omaha: –

Source: Advisor Perspectives

I have a couple of issues with this ratio; firstly, as interest rates fall, so the attractiveness of debt relative to equity capital increases, and secondly, as a result of this fall in the cost of borrowing, less equity is issued and more equity is retired through mergers, de-listings and share buy-backs.

In the aftermath of the pandemic a number of governments prohibited share buybacks by key institutions, in the September 2020 quarterly review from the BIS – Mind the buybacks, beware of the leverage the authors concluded: –

…share buybacks affect firms’ performance and financial resilience mostly through leverage… There is, however, clear evidence that companies make extensive use of share repurchases to meet leverage targets. The initial phase of the pandemic fallout in March 2020 put the spotlight on leverage: irrespective of past buyback activity, firms with high leverage saw considerably lower returns than their low-leverage peers. Thus, investors and policymakers should be mindful of buybacks as a leverage management tool, but they should particularly beware of leverage, as it ultimately matters for economic activity and financial stability.

The recent pick-up in the number and size of equity financings, despite historically low interest rates may be the beginning of a reversal of the 25 year decline of listed market breadth.

This chart shows how the number of listed US equities has waxed and waned since interest rates peaked in the early 1980’s: –

Source: FT, World Bank

This shrinking pool of listed securities is somewhat deceptive, the number of securities that trade on OTC Markets, colloquially referred to as the Pink Sheets (although it includes more than 4,000 names listed on Nasdaq’s OTCBB) currently stands at 11,943, more than double the total of 2010.

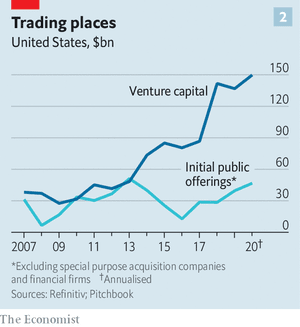

This is not simply to do with the onerous nature of listing requirements for the major exchanges, the preference for private over public also shows up in the value of IPOs versus Venture Funds: –

Source: The Economist

There is also a rising preference for debt financing, rather than equity issuance, a more direct effect of the financial repression of artificially low interest rates, which is evident, not just in the US but, at a global level: –

Source: The Economist, Refinitive

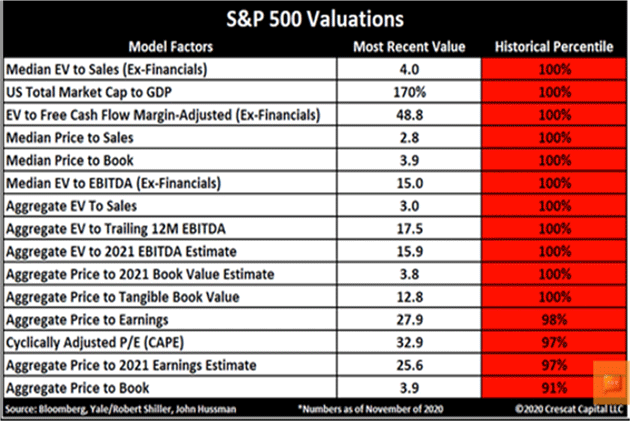

A number of other equity valuation metrics are in the top percentile of their historic ranges: –

Source: Crescat Capital, Doug Kass, Bloomberg, Yale, John Hussman

The Felder Report – What Were You Thinking? Goes further, observing the percentage of companies with a multiple of sales valuation exceeding 10: –

Source: The Felder Report

For the author, this is redolent of the Dotcom bubble of 1999. As for the title of his recent blog?

“What were you thinking?” That is the rhetorical question Scott McNealy, CEO of SunMicrosystems, asked of investors paying a “ridiculous” ten times revenues for his stock at the height of the Dotcom Mania. The incredulity in his voice is amplified by the benefit of hindsight as McNealy gave the interview this quote was taken from in the wake of the Dotcom Bust, after his stock price had lost over 90% of its value.

The Yield Dilemma

Another way to look at the valuation of stocks is to chart the earnings yield: –

Source: Meanwhile in the Markets, MLTPL

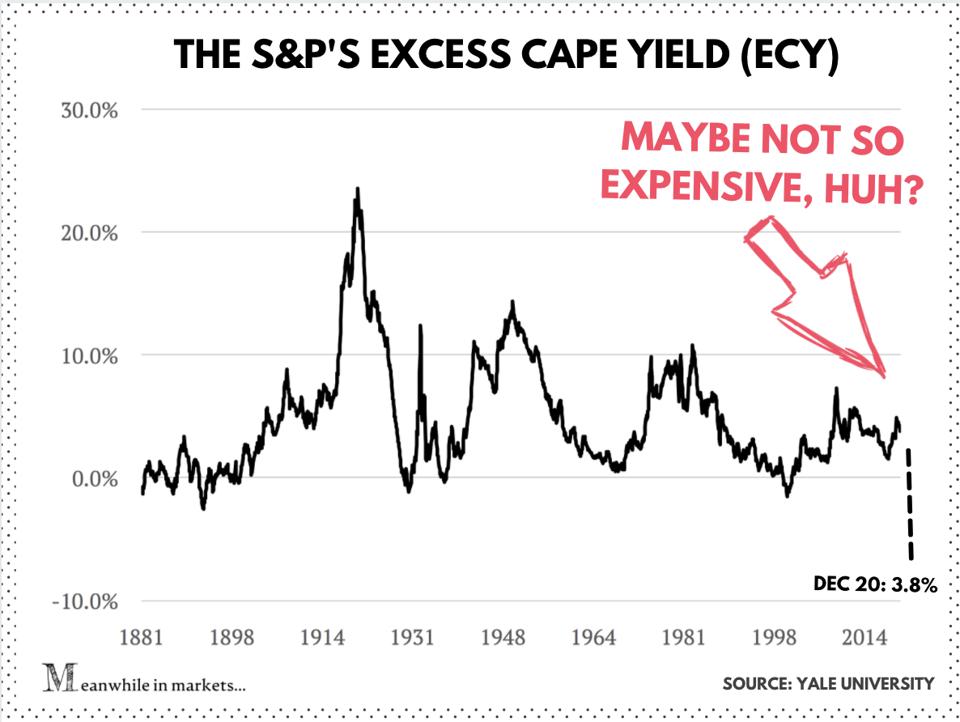

However, to get a more realistic picture you need to compare the earnings yield of stocks against the yield of US Treasuries, after all, investors need to put their money somewhere: –

Source: Meanwhile in the Markets, Yale

Writing in Forbes – Dan Runkevicius – The Stock Market Is The Most Attractive Since 1980, Nobel-Winning Economist Says – the author concludes: –

By this measure, the S&P is the most attractive against bonds since 2014. Nobel-prize winning economist Robert Shiller—who came up with the CAPE ratio—wrote in a recent paper:

“With rates so low, the excess CAPE yield across all regions is almost at all-time highs, indicating that relative to bonds, equities appear highly attractive.”

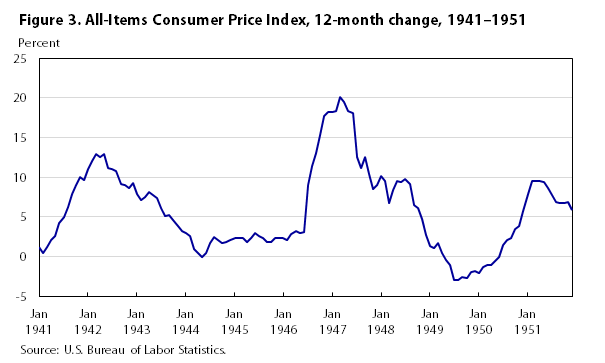

If the Federal Reserve are toying with the idea of introducing yield-curve control – a policy currently adopted by the Bank of Japan – then stocks become the onlyliquid game in town. If you think the idea of the Fed following the Japanese model is anathema, this Federal Reserve article – How the Fed Managed the Treasury Yield Curve in the 1940s – might give you pause for thought: –

By mid-1942 the Treasury yield curve was fixed for the duration of the war, anchored at the front end with a ⅜ percent bill rate and at the long end with a 2½ percent long-bond rate. Intermediate yields included ⅞ percent on 1-year issues, 2 percent on 10-year issues, and 2¼ percent on 16-year issues…

In late November 1950, facing the prospect of another major war, the Fed, for the first time, sought to free itself from its commitment to keep long-term Treasury yields below 2½ percent. At the same time, Secretary of the Treasury John Snyder and President Truman sought a reaffirmation of the Fed’s commitment to the 2½ percent ceiling.

The impasse continued until mid-February 1951, when Snyder went into the hospital and left Assistant Secretary William McChesney Martin to negotiate what has become known as the “Treasury-Federal Reserve Accord.” Alan Meltzer has observed that the Accord “ended ten years of inflexible [interest] rates” and was “a major achievement for the country.”

Given that the Covid-19 pandemic has had a war-like impact on the global economy, it is not unreasonable to anticipate a decade of near-zero US interest rates. Perhaps the Fed Hawks will prevail, but here is what US inflation did between 1941 and 1951: –

Source: BLS

After the inflationary experience of the 1970’s and 1980’s, the Federal Reserve may not have quite the tolerance for inflation that they had in the 1940’s, but when the least painful solution to the current debt crisis is inflation, the Fed may turn out to be far more tolerant of a rising price level than the markets are thinking at present.

A final factor when considering the performance of the US stock market is the amount of cash available for investment. When we look at the Mutual Fund market there is cause for concern, but the record low levels of cash available to mutual fund managers is itself a function of the poor return available on cash. This post from Lance Roberts – Why There Is Literally No “Cash On The Sidelines” – elaborates on the topic, but the chart below suggests that this trend is by no means new: –

Source: Real Investment Advice, Sentiment Trader

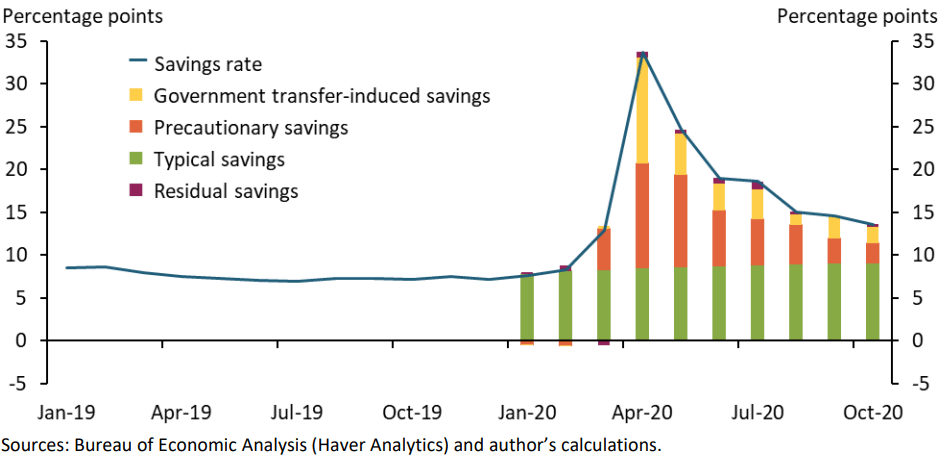

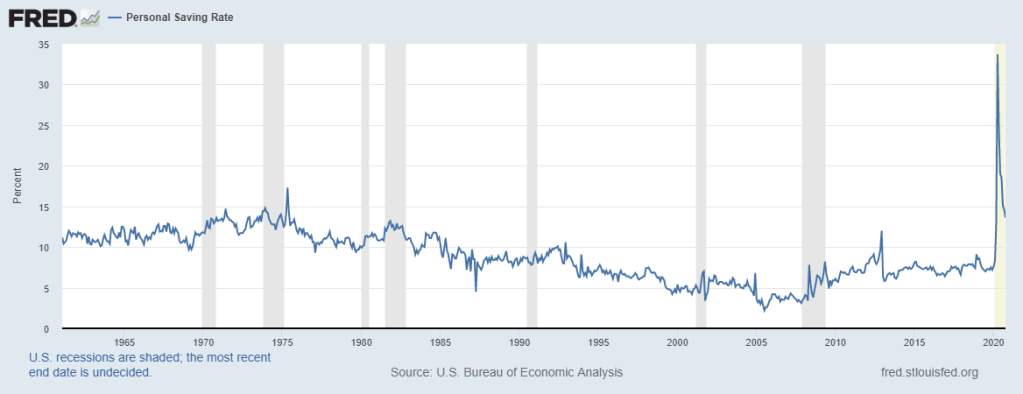

The other side of the cash debate concerns the rapid increase in the US personal savings rate which has accompanied the lockdown restrictions. This post fromthe Federal Reserve Bank of Kansas City – Why Are Americans Saving So Much of Their Income? – looks at the topic in more detail, however,the chart below supports my supposition that, as savings have risen, so too has the percentage of windfall payments which are invested rather than saved or consumed: –

Source: BEA, Haver Analytics, KC Fed

The author, A. Lee Smith is, of course, concerned with direction of consumption spending, concluding: –

As fiscal support lapses and forbearances expire, the strength of U.S. consumption is likely to be tested in the coming months. Recent increases in the personal savings rate have stirred hope that consumption will remain resilient. However, I find that such optimism may be misplaced, as past increases in the savings rate have failed to predict future consumption behavior.

An important caveat to this conclusion is that the unprecedented nature of this crisis could lead to departures from historical patterns. The sheer size and scope of recent government transfers, for example, could support spending once the pandemic recedes. However, the scarring nature of the crisis and previously unimaginable income risk could just as easily have given consumers a lasting desire to increase their liquidity buffers and guard against future income losses. After the Great Recession, for instance, Gallup surveys show a persistent increase in the share of consumers who prefer to save rather than spend (Saad 2019).

The uneven imprint of this crisis across the economy, which my aggregate analysis overlooks, could also lead to a departure from historical savings and consumption patterns. While many consumers may now have the desire to save more, only those that remain employed have the ability to actually save more. This distinction between desired and actual savings is important, as a pullback in consumption by employed households could amplify income losses for unemployed households in hard-hit sectors. This sectoral dynamic leaves little reason to be optimistic about future spending based on the elevated savings rate. In particular, if employed households are forgoing vacations and travel, forgone consumption today is unlikely to be made up in the future, creating a lasting income loss for many households.

If the author is correct, the likelihood of Federal Reserve tapering is very low indeed.

Conclusions

To arrive at a conclusion about current the value and near-term future prospects for equities, we also need to look at a range of shorter-term factors. This will be the focus of the second part of this letter.

Macro Letter – No 135 – 31-12-2020

US Stocks in 2020 and the prospects for 2021

The US stock market is making all-time highs (as at 29th December). It has been a torrid year. The 35% shakeout in the S&P 500, seen in March, turned out to be the best buying opportunity in several years. The market recovered, despite the human tragedy of the pandemic, fuelled by a cocktail of monetary and fiscal stimulus. When news of the rollout of a vaccine finally arrived in November, apart from a renewed rise in the broad market, there was an abrupt rotation from Growth to Value stocks. Value ETFs saw $8bln of inflows during November, there was also a weakening of the US$ and resurgence of European stocks. This was not necessarily the sea-change anticipated by many commentators, by the start of December technology stocks had resumed their upward march.

November marked some market records. It was the strongest month for the Dow since 1987 and the best November since 1928. European stocks rose 14%, their best monthly gain since April 2009 – that headline grabbing performance needs to be qualified, European indices remain lower than they began the year. For Japan’s Nikkei 255, the 15% rise marked its most positive monthly performance since January 1994, whilst for Global Equities, which returned 12.7%, it was the best month since January 1975.

Other financial and commodity markets also reacted to the vaccine news. OPEC agreed supply reductions helping oil prices higher, although Brent Crude remains around 22% lower than it started the year. The larger issue for stock markets is the logistical challenge of delivering the vaccination, this will test the healthcare systems of every country on the planet. The OPEC deal may fray at the edges, demand for oil could arrive later than anticipated. Nonetheless, risk assets have generally benefitted whilst both gold and silver have remained range-bound. After their strong rally in the summer, precious metals seem to have had their time in the sun. Interestingly, Bitcoin appears to be dancing to a different tune. Over the past two months it has risen more than 120%, breaking the previous highs of December 2017 to breach $28,000.

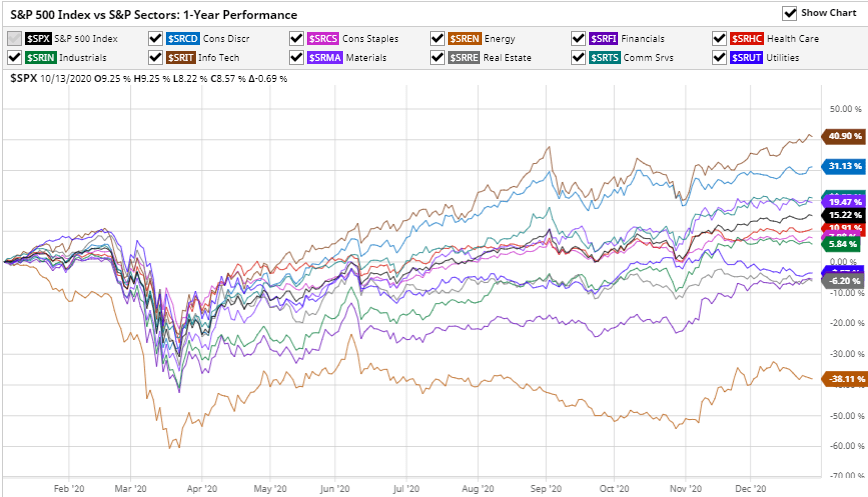

Looking ahead, Covid sensitive stocks should continue to recover, this chart shows the relative performance by industry sector over the last year (to 29th December): –

Source: Barchart.com, S&P

Energy, November’s top performing sector, remains more than 38% down over the last 12 months, whilst Information Technology is up almost 41% over the same period.

Prospects for 2021

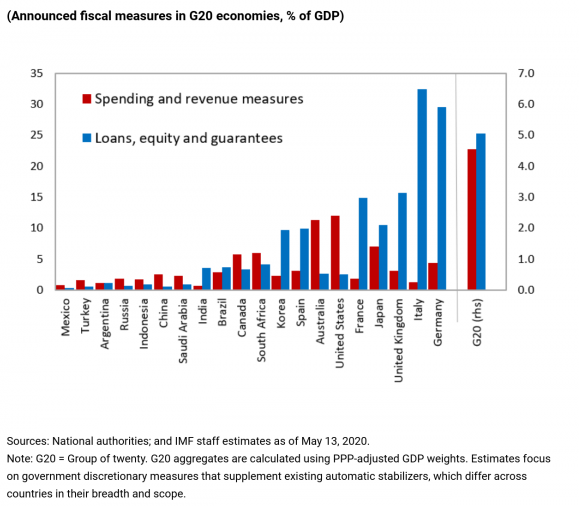

Central bank monetary policy and developed nation fiscal policy will be key to deciding the direction of stocks next year. This infographic from McKinsey shows the gargantuan scale of the fiscal response compared to the Great Financial Crisis of 2008: –

Source: McKinsey, IMF

The degree of largesse needs to be qualified, more than half of government support has been in the form of guarantees, designed to help companies avoid insolvency. Added to which, other stimulus measures have been announced, but that capital has yet to be been committed. The eventual bill for the pandemic might not be quite the strain on collective international government finances the McKinsey infographic portends. This chart from the IMF shows the composition of fiscal support as at mid-May: –

Source: IMF

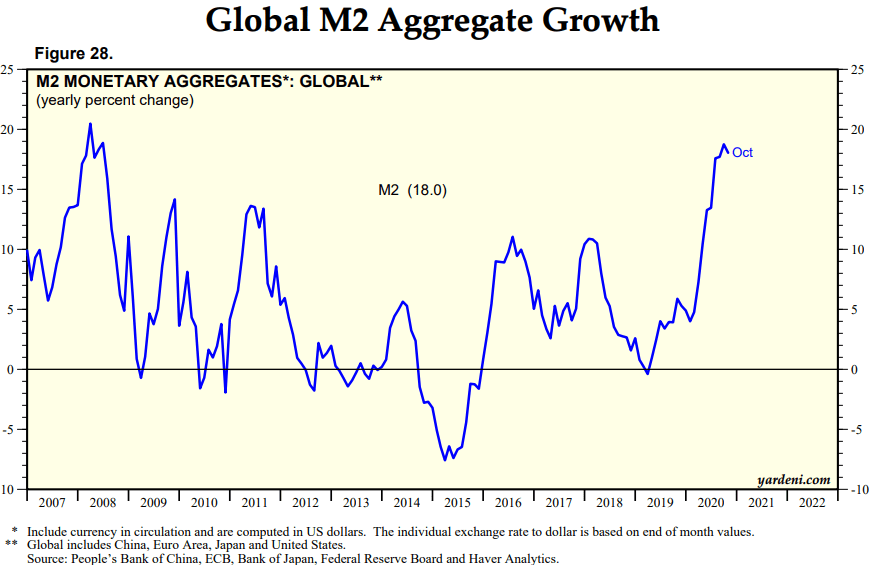

A more important factor for global stocks is the enormous injection of liquidity which has been pumped into the world economy: –

Source: Yardeni

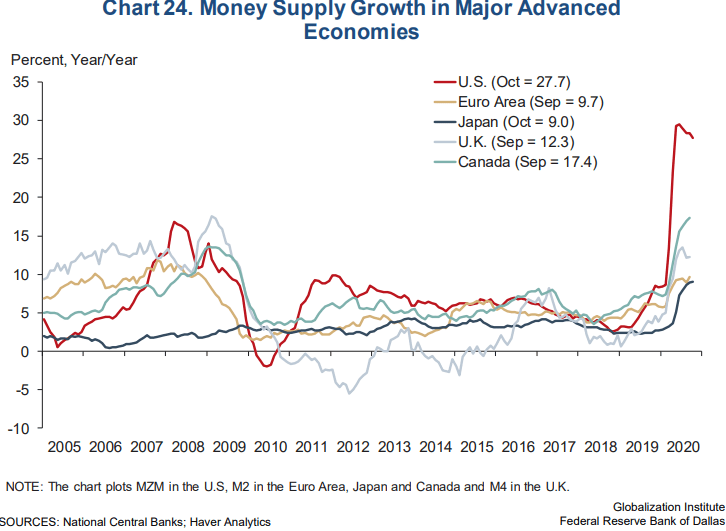

This global picture disguises the variance between countries: –

Source: Federal Reserve, National Central Banks, Haver Analytics, Globalization Institute

With the exception of the US, money supply growth has been relatively muted thus far, although it has been broadly comparable to the expansion undertaken in the aftermath of the sub-prime crisis of 2008. The vast expansion of the US monetary base is unprecedented by comparison with its developed nation peers, but even more so when seen in the context of US policy since WWII: –

Source: Gavekal/Macrobond

Money supply growth cannot be ignored when seeking a reason for the rise in US stocks. North American asset markets, such as stocks and real estate, will continue to benefit even if some of that liquidity seeps away to international investment opportunities. The Cantillon Effect, named after 18th century Irish economist, Richard Cantillon, remains very much alive and well. In Cantillon’s – Essai sur la Nature du Commerce en General – which was published posthumously in 1755 – he observed that those who were closest to the minting of money benefitted most.

Today, with unemployment sharply higher and lockdown restrictions curtailing consumption, the US savings rate has risen sharply. Even after hitting a peak in April it remains well above the levels seen since the 1970’s. The chart below does not account for the effect of the recent relief package which will release a further $900bln, including cheques to many individuals of $600 each: –

Source: Federal Reserve Bank of St Louis

Whilst the unemployment rate remains elevated, that excess liquidity will either be hoarded or flow into the stock market, in these uncertain times it is unlikely to fuel a consumption boom. This chart shows how unemployment rates have increased across the US, EU and OECD countries in aggregate: –

Source: OECD

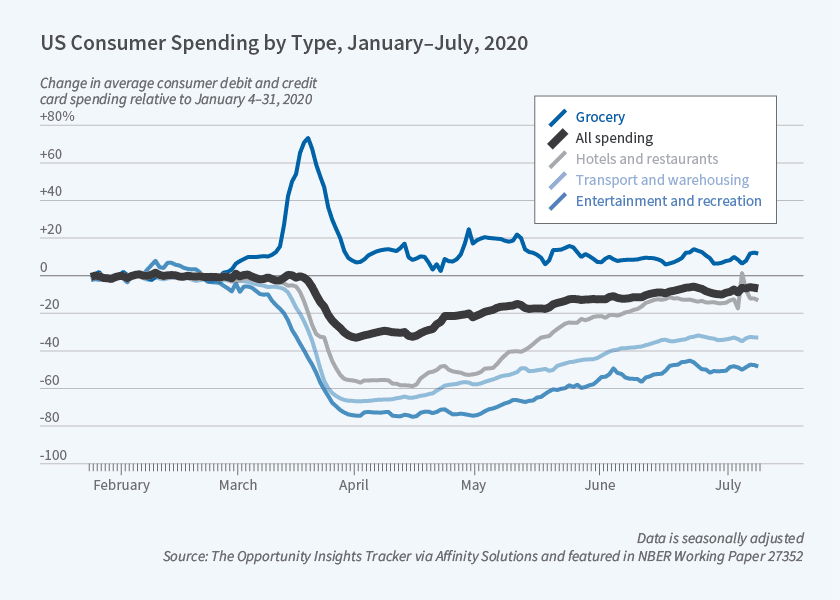

Aside from a short-lived boom in the grocery sector at the start of the crisis, US consumer spending remained muted running into the summer: –

Source: NEBR

The situation improved in Q3 as the inforgraphic below reveals: –

Source: Deloitte, BEA, Haver Analytics

Real personal consumer expenditure grew by 8.9% in Q3 compared to Q2. The nature of consumer spending has also changed as a result of the pandemic, with many consumers buying relatively more goods than services. Without reliable data it is difficult to assess the picture for Q4, but the second wave of Corona cases appears to be a worldwide phenomenon, a repeat of the April/May lockdown may yet defer the much anticipated recovery in consumption.

Investment Opportunities for 2021

Looking ahead, the first important test of US political sentiment will be the runoff Senate race in Georgia on January 5th. Nonetheless, for the coming year, with government bond yields still miserably low, excess liquidity will continue to flow into stocks. The recent weakening of the US$ may lend additional support to international markets, especially if Europe stops its squabbling and embraces fiscal expansion. Dollar bulls might just be rescued by the US bond market, 10yr yields reached 99bps at the beginning of December, the highest since the pandemic struck in March, yields have remained elevated with a fresh stimulus package to finance, but an economic recovery remains some way off, a real bond bear-market needs a significant inflation catalyst.

As Milton Friedman famously observed, ‘Inflation is always and everywhere a monetary phenomenon.’ Even allowing for a strong rebound in demand for goods and services in 2021, the consumer will remain cautious until mass-vaccination has proved to be effective. Meanwhile, that excess liquidity will have to go somewhere, all other things equal, asset markets will rise with liquid, listed equities in the vanguard.