Macro Letter – No 37 – 06-06-2015

Nigeria and South Africa – what are their prospects for growth and investment?

- The IMF forecast South Africa to grow by only 2% in 2015 and 2.1% in 2016

- Whilst Nigeria is forecast to grow by 4.8% in 2015 and 5% in 2016

- Both countries are succeeding in diversifying away from resources

- Corruption remains the greatest political challenge to their prosperity

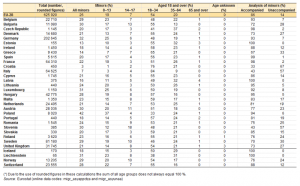

To begin my analysis of the two largest economies in Africa here is a table of statistics:-

| Indicator |

Nigeria |

South Africa |

| GDP |

523 USD Billion – Dec 13 |

351 USD Billion – Dec 13 |

| GDP y/y |

3.96 percent – Feb 15 |

2.1 percent – Feb 15 |

| GDP per capita |

1098 USD – Dec 13 |

5916 USD – Dec 13 |

| GDP per capita PPP |

5676 USD – Dec13 |

12106 USD – Dec 13 |

| Unemployment Rate |

23.9 percent – Dec 11 |

26.4 percent – Feb 15 |

| Population |

174 Million – Dec 13 |

54 Million – Dec 14 |

| Inflation Rate |

8.7 percent – Apr 15 |

4.5 percent – Apr 15 |

| Food Inflation |

9.48 percent – Apr 15 |

5 percent – Apr 15 |

| Interest Rate |

13 percent – May 15 |

5.75 percent – May 15 |

| Foreign Exchange Reserves |

4118713 NGN Million – May 15 |

470400 ZAR THO Million – Apr 15 |

| Balance of Trade |

1145749 NGN Millions – Dec 14 |

(2513) ZAR Million – Apr 15 |

| Current Account |

($158 USD Million) – Nov14 |

(198000) ZAR Million – Nov 14 |

| Gold Reserves |

21.37 Tonnes – Nov 14 |

125 Tonnes – Nov 14 |

| Crude Oil Production |

2520 BBL/D/1K – Jan 14 |

3 BBL/D/1K – Dec 14 |

| Foreign Direct Investment |

1030 USD Million – Nov14 |

1684 ZAR Billion – Nov 14 |

| Government Budget |

(1.8) percent of GDP – Dec 13 |

(3.8) percent of GDP – Dec 14 |

| Government Debt to GDP |

11 percent – Dec 13 |

46.1 percent – Dec 13 |

| Capacity Utilization |

60.3 percent – Nov 14 |

81.5 percent – Nov 14 |

| Corporate Tax Rate |

30 percent – Jan14 |

28 percent – Jan 14 |

| Personal Income Tax Rate |

24 percent -Jan14 |

41 percent – Apr 15 |

| Sales Tax Rate |

5 percent – Jan 14 |

14 percent – Jan 15 |

| Population below poverty line |

33.1% (2013 est.) |

26.2% (2011 est.) |

| Labour force |

48.57 million (2011 est.) |

17.89 million (2012 est.) |

| Labour force by occupation |

services: 32%; agriculture: 30%; manufacturing: 11% |

agriculture: 9%, industry: 26%, services: 65% (2007 est.) |

| Main industries |

crude oil, coal, tin, columbite, uranium; palm oil, peanuts, cotton, rubber, wood; hides and skins, textiles, cement and other construction materials, food products, footwear, chemicals, fertilizer, printing, ceramics, steel, small commercial ship construction and repair, entertainment, machinery, car assembly |

mining (world’s largest producer of platinum), gold, chromium, automobile assembly, metalworking, machinery, textiles, iron and steel, chemicals, fertiliser, foodstuffs, commercial ship repair |

| Ease-of-doing-business rank |

131st |

39th |

| Exports |

$97.46 billion (2012 est.) |

$101.2 billion (2012 est.) |

| Export goods |

petroleum and petroleum products 95%, cocoa, rubber, machinery, processed foods, entertainment |

gold, diamonds, platinum, other metals and minerals, machinery and equipment |

| Main Export Partners |

India 12.8% |

China 14.5% |

| |

United States 11.1% |

United States 7.9% |

| |

Brazil 10% |

Japan 5.7% |

| |

Spain 7.1% |

Germany 5.5% |

| |

Netherlands 7% |

India 4.5% |

| |

Germany 5.1% |

United Kingdom 4.1% (2012 est.) |

| |

France 4.7% |

|

| |

United Kingdom 4.5% |

|

| |

South Africa 4.2% (2013 est.) |

|

| Imports |

$70.58 billion (2012 est.) |

$106.8 billion (2012 est.) |

| Import goods |

machinery and equipment, chemicals, transport equipement, manufactured goods, foodstuffs |

machinery and equipment, chemicals, petroleum products, scientific instruments, foodstuffs |

| Main import partners |

China 20.8% |

China 14.9% |

| |

United States 11.2% |

Germany 10.1% |

| |

India 4.5% (2013 est.) |

United States 7.3% |

| |

|

Saudi Arabia 7.2% |

| |

|

India 4.6% |

| |

|

Japan 4.5% (2012 est.) |

| Gross external debt |

$10.1 billion (2012 est.) |

$47.66 billion (31 December 2011 est.) |

| Public debt |

18.8% of GDP (2012 est.) |

43.3% of GDP (2012 est.) |

| Credit Rating (S&P) |

B+ (Domestic) |

BBB+ (Domestic) |

| |

B+ (Foreign) |

BBB- (Foreign) |

| |

B+ (T&C Assessment) |

BBB+ (T&C Assessment) |

| |

Outlook: Stable |

Outlook: Stable |

| Foreign reserves |

$42.8 billion (2012 est.) |

$54.98 billion (31 December 2012 est.) |

Source: Trading Economics, CIA Factbook, IMF, World Bank, S&P

One additional factor to mention from the outset is the importance of China, and not just as an import partner, although South Africa also exports more to China than it does to any other country. Chinese companies have been aggressively bidding for infrastructure projects across the continent, partly in response to over-investment at home. These companies have also been acquisitive, especially in the resource sector, for several years. Across the continent China now accounts for 20% of infrastructure investment. This has grown from next to nothing in 2002. It has been concentrated in transportation – railways, roads and airports – and, to a lesser degree, in energy; although the decline in commodities prices since 2009/2010 has reduced China’ resource security concerns.

Looking ahead, Chinese investment in Africa has the potential to dramatically improve the prospects for large swathes of the continent. Brookings – Are Chinese Companies Retooling in Africa? elaborates.

Another major investment trend across Africa has been the growth of private participation in infrastructure (PPI) which now accounts for around 50% of the $30bln per annum – up from $5bln in 2003. This investment is concentrated in telecommunications – 64%, electricity – 18.6% and seaports – 9.8%. Nonetheless, the estimated infrastructure investment gap – $93bln – remains a significant impediment to productivity growth.

Nigeria

Nigeria has just emerged from a general election, the most credible since its return to constitutional government in 1999. The new president, Buhari and his APC party, secured a substantial victory on an anti-terrorist and anti-corruption mandate; it’s worth noting that Muhammadu Buhari is a devout Muslim, his campaign slogan was “new broom”.

The country has overcome some challenges but, as this article from Brookings – Nigeria’s Renewed Hope for Democratic Development – makes clear, there is much still to be done:-

…there is an extensive list of challenges awaiting Buhari and the APC government. They include: ending the Boko Haram insurgency; promoting the socio-economic advance of the largely Muslim and impoverished northern region; overhauling the criminalized petroleum sector; improving the core infrastructures of electricity, water supply, and public transport; drastically reducing corruption in state institutions; and rapidly increasing jobs in agriculture, agro-processing, and light industry.

Chatham House – Nigeria’s New President Pits Hope Against Harsh Realities, takes up the theme:-

This would-be economic powerhouse and Africa’s biggest crude oil producer is running low on fuel. While Nigeria exported around 2.08 million barrels of oil a day in the first quarter of 2015, its three refineries operate at 20 per cent capacity at most. So Nigeria imports its petrol to run cars and diesel to power private generators for homes and businesses. National grid power generation is negligible relative to demand.

The traders that import refined products are paid by government in cash or crude oil via the byzantine Nigerian National Petroleum Corporation (NNPC). Most foreign suppliers had long stopped supplying on credit as they are owed $1.5 billion in arrears dating back to 2011. Local traders and wholesalers claim to be owed N200 billion in subsidies and are withholding supplies pending some form of settlement.

…In a country that remains dependent on crude exports for fiscal revenue and product imports to function, the cabal-controlled opaque deals that keep the economy running are perhaps at the heart of the corruption that makes people’s lives unnecessarily harsh every day in Nigeria.

But given the parlous state of the economy after crude oil prices halved in six months in 2014, the depreciation of the national currency, the erosion of foreign reserves to under $30 billion, (perhaps four months of external payments), and the political and popular sensitivities around fuel importation and the fuel subsidy, the new government may not have chosen the fuel traders and how to reform the NNPC as the first challenge to tackle. But the traders have forced the issue.

…With ambitions including economic diversification, institutional reform and improving welfare to millions of Nigeria’s poorest, President Buhari and the APC will see their efforts stymied in 2015 by empty state coffers.

Yet it is not the availability of money but the management of it that may effect change in Nigeria. Years of high oil prices and strong GDP growth have not translated into the development, job creation and poverty reduction that they should have. Instead Nigeria is one of the fastest-growing markets for luxury aircraft and champagne, while it ranks 152 out of 187 countries in the Human Development Index.

Back in April 2014 the Nigerian Statistics Office rebased GDP for the first time in 20 years, the result was a near doubling of the size of their economy, as this article from the Atlanitic – How Nigeria Became Africa’s Largest Economy Overnight, expalins:-

In computing its GDP all these years, Nigeria, incredibly, wasn’t factoring in booming sectors like film and telecommunications. The Nigerian movie industry, Nollywood, generates nearly $600 million a year and employs more than a million people, making it the country’s second-largest employer after agriculture. As for the telecom industry, consider that there are now some 120 million mobile-phone subscribers in Nigeria, out of a population of 170 million. Nigeria and South Africa are the largest mobile markets in sub-Saharan Africa, and cell-phone use has been exploding in the country:

Nigerian Communications Commission (Datawrapper)

Incorporating the film and telecom industries into Nigeria’s GDP made a huge difference in the services sector, rendering the country’s economy not just bigger but more diversified:

National Bureau of Statistics (Datawrapper)

This is not the first time an African country’s GDP has risen after rebasing, Ghana saw a 60% increase in 2010. The World Bank and IMF estimates for growth in many frontier markets may prove self-fulfilling prophesies if other frontier economies rebase in a similar manner. Nonetheless, these countries are growing rapidly and present a plethora of investment opportunities in the process.

Between 2000 and 2008 African GDP growth averaged 4.9%, twice the pace of the previous decade. Last August, ahead of the US-Africa Summit, saw the publication of the Cato Institute – Sustaining the Economic Rise of Africa – they gave an excellent summation of the state of the region:-

…between 1990 and 2010, the share of Africans living at $1.25 per day or less fell from 56 percent to 48 percent, while the continent’s population almost doubled in size. If the current trends continue, Africa’s poverty rate will fall to 24 percent by 2030. Since 1990 the per-capita caloric intake in Africa increased from 2,150 kcal to 2,430 kcal in 2013. Between 1990 and 2012, the proportion of the population of African countries with access to clean drinking water increased from 48 percent to 64 percent. Many African countries have also seen dramatic falls in infant and child mortality. Since 2005, some African countries, such as Senegal, Rwanda, Uganda, Ghana, and Kenya, have seen child mortality decline by an annual rate exceeding 6 percent.

Nonetheless, the continent still lags significantly behind the rest of the world in its income levels and also in many indicators of human well-being. For example, Africa scored a mere 0.502 on the United Nation’s 2014 Human Development Index, measured on a scale from 0 to 1, with higher values denoting higher standards of living. By comparison, the United States scored 0.914, Latin America 0.74, and China 0.719.

…The extent of trade protectionism, for example, is large, especially when compared with other regions in the world. Average applied tariffs in Africa remain comparatively high, and the extent of trade liberalization on the continent has not matched that experienced in the rest of the world. While between 1988 and 2010, the average applied tariff in high-income countries in the Organization for Economic Cooperation and Development fell from 9.5 percent to 2.8 percent, Africa saw a reduction from 26.6 percent to 11 percent. That is not a negligible decrease but it still leaves the continent with unnecessarily high tariff protection, which hinders trade.

Cato went on to highlight what Africa needs:-

| Needs |

Examples |

| The Rule of law |

Land title, commercial contact enforcement |

| Improvement in governance |

Oversight of government contracts |

| Reduction of red tape |

Regulatory reforms |

| Infrastructure investment |

Electricity generation, transportation |

| Regional Economic integration |

Free-trade agreements |

Here are the IMF – Selected Issues papers – December 2014 – South Africa and April 2015 – Nigeria – which look in more detail at several of these issues.

Whilst Nigeria is not exactly a paragon of virtue when it comes to corruption – ranking 136th out of 175 countries on Transparency International’s Corruption Perceptions Index – this 2011 article from the Economist – Africa’s hopeful economies – points to real signs of progress, both in Nigeria and across the continent as a whole:-

Her $3 billion fortune makes Oprah Winfrey the wealthiest black person in America, a position she has held for years. But she is no longer the richest black person in the world. That honour now goes to Aliko Dangote, the Nigerian cement king. Critics grumble that he is too close to the country’s soiled political class. Nonetheless his $10 billion fortune is money earned, not expropriated. The Dangote Group started as a small trading outfit in 1977. It has become a pan-African conglomerate with interests in sugar and logistics, as well as construction, and it is a real business, not a kleptocratic sham.

…Severe income disparities persist through much of the continent; but a genuine middle class is emerging. According to Standard Bank, which operates throughout Africa, 60m African households have annual incomes greater than $3,000 at market exchange rates. By 2015, that number is expected to reach 100m—almost the same as in India now.

…Since The Economist regrettably labelled Africa “the hopeless continent” a decade ago, a profound change has taken hold. Labour productivity has been rising. It is now growing by, on average, 2.7% a year. Trade between Africa and the rest of the world has increased by 200% since 2000. Inflation dropped from 22% in the 1990s to 8% in the past decade. Foreign debts declined by a quarter, budget deficits by two-thirds.

…Africa’s population is set to double, from 1 billion to 2 billion, over the next 40 years. As Africa’s population grows in size, it will also alter in shape. The median age is now 20, compared with 30 in Asia and 40 in Europe. With fertility rates dropping, that median will rise as today’s mass of young people moves into its most productive years. The ratio of people of working age to those younger and older—the dependency ratio—will improve. This “demographic dividend” was crucial to the growth of East Asian economies a generation ago. It offers a huge opportunity to Africa today.

Dangote Group may not be a “kleptocratic sham” but it is protected from foreign competition by import tariffs which enable it to make a 62% margin on domestic sales. The Economist article goes on to apply a string of caveats – after all, every silver-lining must have its dark cloud, especially for those trained in the “dismal science”- the authors conclude:-

Africa is not the next China. It provides only a tiny fraction of world output—2.5% at purchasing-power parity. It is as yet not even a good bet for retail investors, given the dearth of stockmarkets. Mr Dangote’s $10 billion undeniably makes him a big fish, but the Dangote Group accounts for a quarter of Nigeria’s stockmarket by value: it is a small and rather illiquid pond.

For corporations wishing to succeed in Africa, Nigeria remains a key market. With roughly 20% of Sub-Saharan Africa’s 930 mln people and population growth of 2-3% per annum, this is a market one can’t ignore. The Economist – Business in Nigeria – takes up the story:-

In 2001 MTN, a fledgling telecoms company from South Africa, paid $285m for one of four mobile licences sold at auction by the government of Nigeria. Observers thought its board was bonkers. Nigeria had spent most of the previous four decades under military rule. The country was rich in oil reserves but otherwise desperately poor. Its infrastructure was crumbling. The state phone company had taken a century to amass a few hundred thousand customers from a population of 120m. The business climate was scarcely stable.

MTN took a punt anyway. The firm’s boss called up colleagues from his old days in pay-television and found they had 10m Nigerian customers. He reasoned that if they could afford pay-TV they could stump up for a mobile phone. Within five years MTN had 32m customers. The company now operates across Africa and the Middle East. But Nigeria was its making and remains its biggest single source of profits.

In the 1980’s, after an oil price collapse threatened to under-mine government finances, I ended up doing business in Nigeria with a subsidiary of Unilever (ULVR). Outside of the Oil and Mining sector, it was one of a very few multi-nationals still operating in the country, however, there had been an, almost catastrophic, deterioration in the operations of the division with which I dealt. This decline had taken place over the two decades since Nigerian independence: it reflected the endemic problems of doing business in the country. Managers privately told me, the principal reason they had not closed down was because this was the only practical way to recoup losses sustained in lending the government money.

Finally Unilever, along with a handful of other firms, are reaping the benefit of their long term investment. According to UN forecasts the population of Nigeria will overtake the population of the US by 2045, as soon as 2020, according to research from Oxford Economics, the population will have topped 200mln making Nigeria the fifth largest country in the world, overtaking Pakistan and Brazil – they should have a very bright future.

Near-term growth has slowed as a result of weaker GDP – 3.96% in Q1 2015 vs Q4 2014 at 5.94%, Q3 2014, 6.23% and Q2 2014 of 6.54%. The marginal effect of a falling oil price is still substantial – especially for the export market 95% of which is in petroleum and petroleum products.

The construction sector has remained robust, growing at around 10% – lower than in 2013 but still impressive. Information and Communications has also shown stability, growing at 8% per annum.

South Africa

South Africa has triple Nigeria’s per capita GDP, it is also endowed with better developed institutions. This does not, however, guarantee prosperity. This article from last week’s South African Independent on Sunday – South Africa’s triple challenge – makes that clear:-

We are frequently reminded by the political establishment of South Africa’s triple challenge of poverty, inequality and unemployment. This weighs heavily on the social, political and economic fabric of the country.

This is why the unemployment and economic growth data just released points to South Africa sinking into crisis. Official unemployment, at 26.4 percent, rose to a 12-year high. Growth slumped to 1.3 percent for the first quarter this year, below expectation.

The official unemployment rate is one of the highest in the world. The measure masks a low economic participation rate and excludes discouraged work-seekers. In other words, people who want work but have stopped looking for work due to being discouraged are not counted among the unemployed. If a higher participation rate was factored in and discouraged work-seekers were included in the data, the unemployment rate would be nudging towards 50 percent.

…The economy is not big enough to absorb everyone into it. The solution is a bigger economy. For that, the economy needs growth. Not difficult. But growth has ground down to 1.3 percent and looks set to slow further. At the recent Monetary Policy Committee meeting, the SA Reserve Bank warned the inflation risks were to the downside but the risks to economic growth were on the downside.

The combination of weak economic prospects, along with higher inflation, means unemployment is set to rise even further.

… The underperformance of South Africa has been self-inflicted. It struggles under its triple triple.

First Triple: poverty, inequality and unemployment.

…if South Africa had full employment, then poverty and unemployment would be dramatically diminished as issues. However, by not emphasising this perspective, policy is focused on inequality and poverty but is not resolving unemployment.

The national budget is a case in point where the “rich” (success) are penalised through a very “progressive” tax take. Inequality is reduced by pulling down the top end of earners (in reality right down to the working class).

Poverty is tackled through a very aggressive redistribution spending policy. Through this whole process, unemployment is neglected and perpetuated. Policy focus on poverty alleviation has the effect of transferring economic resources to consumption, which is in complete contrast to poverty reduction that transfers resources to investment.

…This shift of resources to consumption has resulted in the second triple, which has become a major constraint and stumbling block to resolving the first triple.

Second Triple: the triple deficit.

The budget deficit in recent years has led to a multiple downgrade of the credit rating. On the face of it, the government “needs” more taxes to balance its books. Yet households, the core of the tax base, are also in deficit. The cost pressures in recent years and availability of credit has led to households spending more than they have earned. The ability to meet a higher tax bill is simply not there. The tax base is both narrow and shallow.

The high unemployment rate also places pressure in a higher dependency ratio on each salary and wage earner. And the government has very ambitious spending plans and faces at least four expenditure threats where each one can take South Africa to a solvency crisis. These are: the public sector wage bill; National Health Insurance; State Owned Enterprises’ need for capital; and the nuclear deal. So far, indications are that the government is going to commit to all four.

The third deficit is the current account deficit. This has been widening to record levels, especially since 2008. Of particular concern is that the current account deficit has been widening while the economy has been slowing and the currency has been weakening. This is a major concern as it means the country is losing competitiveness at an alarming rate.

Part of the reason for the loss of competitiveness comes down to the third triple:

Third Triple: the triple mistake.

The first mistake is labour unrest. No one invests in labour unrest, and investment is essential to grow the economy. South Africa must find a way to resolve labour disputes without unrest. Labour relations is where South Africa languishes near the bottom of the World Economic Forum’s Global Competitiveness survey. The unemployment crisis needs attraction of investment into labour, not away from it.

The second major mistake is the regulatory tsunami that has hit the business sector. The economy is being attacked by policymakers not nurtured. Companies trying to contain costs in a low growth environment have resources diverted to compliance, leaving less to grow their businesses. The biggest problem is that the regulatory burden requires economies of scale in order to be compliant. This is manageable by big business but debilitating for the SME sector. And it is the SME sector that is the engine of job creation. South Africa should be seeking to make South Africa an easier place to invest and do business not more difficult.

…The third mistake South Africa is making is in taxes. Economic expansion cannot happen without investment. Investment cannot be sustained without savings. The investment rate is currently 19 percent of GDP. This will buy a long-term growth rate of 2 to 3 percent.

Excessive debt, both public and private, a low savings rate and a low investment to GDP ratio – it sounds remarkably like the problems of many developed economies. Before dismissing the above article as a little localised hyperbole it’s worth considering this leader from last week’s Economist – Africa’s second-largest economy is in a huge mess:-

There is little in the way of bright news about South Africa’s economy—and not just because power cuts are plunging neighbourhoods into darkness several times a week. According to figures released on May 26th, annual GDP grew by a mere 1.3% in the first three months of this year, a crawl compared with the 4.1% achieved in the fourth quarter of 2014. Unemployment is soaring. Even using a narrow definition, it stands at 26.4%, the highest since 2003.

“The numbers are saying ‘something has to be done, and done quickly’,” says Pali Lehohla, South Africa’s statistician-general. But where to begin? Power shortages under Eskom, the failing state utility, have dampened manufacturing, drought has hit agriculture and tourism, a rare boon, has been hampered by much-criticised new visa requirements. Rating agencies have warned that South Africa is dancing dangerously close to junk status, though no immediate downgrade is likely.

…Strikes are hurting mining. Talks between unions and gold-mine bosses are due to begin in early June. But with unions opening the bargaining by demanding that basic pay for unskilled mineworkers be doubled, prospects of an early settlement seem poor. Last year similar demands at platinum mines sparked five months of labour unrest. A strike by 1.3m public-sector employees has been averted, but only at the cost of a 7% wage increase, with the money coming from emergency funds.

The weak economy is stoking social unrest and public violence. Foreigners, seen as competition for scarce jobs, were targeted in a recent spate of xenophobic attacks that left at least seven people dead. The IRR, a think-tank in Johannesburg, says that protests have nearly doubled since 2010. Many relate to the provision of basic services such as water and electricity. Inequality remains high. A report by the Boston Consulting Group, a consultancy, placed South Africa 138th of 149 countries for its ability to turn the country’s wealth into well-being for its people.

So far the government of President Jacob Zuma has shown little sign of being able to improve matters. The African National Congress, the ruling party, is bogged down in internal political battles, not least over whether to pursue capitalist or socialist economics. The government’s much-touted National Development Plan, a market-friendly strategy to encourage investment and growth, is largely ignored. Even by the ANC’s own standards, it is failing: only 2% growth is expected in 2015 when the economy needs to expand by at least 5% a year to reduce unemployment.

The country doesn’t score that well on corruption either, ranking 67th out of 175 countries on the Corruption Preceptions Index.

Likewise the Deliotte’s CFO Survey is less than encouraging. Many South African CFO’s expressed anxiety about the future. New investment is overwhelmingly directed towards expanding into other, higher-growth, parts of the continent. Of those companies with no presence elsewhere in Africa, 80% said they wanted to build such a presence within the next year – West and east Africa were their favoured destinations.

Capital Markets and Investment Opportunities

Africa is largely dependent on private capital flows as this May 2015 article explains – Brookings – Private Capital Flows, Official Development Assistance, and Remittances to Africa: Who Gets What?:-

The data also show that private capital flows to sub-Saharan Africa over the period of 2001-2012 have mostly benefited two countries—South Africa and Nigeria—which accounted for 45 percent and 13 percent of total private flows to sub-Saharan Africa, respectively. These two countries have attracted the most flows in part because they are the largest in sub-Saharan Africa, together making up more than half of the region’s GDP.

…Portfolio flows have also been increasing recently, though they remain concentrated in South Africa: That country received 96 percent of the portfolio flows to the region in 1990-2000. However, in 2001-2012, the issuance of sovereign bonds by a number of countries and increased interest by investors has led to a more diversified recipient base for portfolio flows. South Africa’s share of the total fell to 59 percent, whereas Nigeria’s increased to 24 percent, and other countries like Mauritius (14 percent) emerged on the scene.

…From 1990 to 2000, half of total FDI to sub-Saharan Africa went to South Africa (29 percent) and Nigeria (21 percent). This trend has not changed: Between 2001 and 2012, the top 10 recipient countries received 85 percent of the total FDI inflows to the region.

…In terms of volume, Nigeria was the largest recipient of remittances in the region from 1990 to 2012.

I want to turn my attention to more liquid opportunities.

Bonds – South Africa

The SARB – Quarterly Bulletin – March 2015 – sums up the recent price action in South African government bonds:-

South African bond yields moved generally lower from early 2014, in line with US bond yields. Local yields receded further in January 2015, supported by an improved inflation outlook and abundant international liquidity following the announcement of an expanded asset-purchase programme by the ECB and continued quantitative easing out of Japan. Bond yields edged higher in early March 2015 as a reversal in the oil price, the announcement of higher levies on fuel and rand depreciation impacted on inflation expectations. Most money-market interest rates have displayed little movement since the middle of 2014, remaining well-aligned with the repurchase rate of the South African Reserve Bank (the Bank) that had been held steady over this period.

The SARB has left base rates unchanged at 5.75% since July 2014 as a result of the stabilisation of the Rand and falling oil prices. Inflation expectations had been on the downside but as SARB Governor Lesetja Kganyago stated in the 21st May MPC statement:-

The challenges facing monetary policy have persisted, and, as expected, the downward trend in inflation which was mainly attributable to the impact of lower oil prices, has reversed. Headline inflation is expected to breach temporarily the upper end of the target range early next year, and thereafter remains uncomfortably close to the upper end of the target band for most of the forecast period. The upside risks have increased, mainly due to further possible electricity price increases. The exchange rate also continues to impart an upside risk to inflation as uncertainty regarding impending US monetary policy continues. Domestic demand, however, remains subdued while electricity constraints continue to weigh on output growth and general consumer and business confidence.

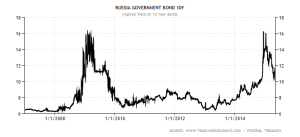

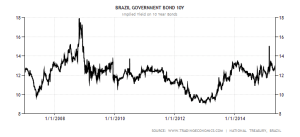

As the chart below suggests, 10yr Bond yields have risen from their January lows. The upward trend appears to be established, the current 10yr yield is 8.51% which is not far from the January 2014 high of 8.8%. I suspect this level will be breached but not to a substantial extent because the rising interest rate environment will undermine, already weak, growth expectations. If yields approach 9.25% I think this offers a buying opportunity. For the present, remain short. For most retail investors this means using South African bond index futures, but remember, only your P&L will be exposed to currency fluctuations.

Bonds – Nigeria

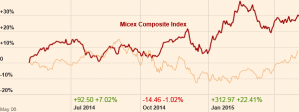

Nigerian 10yr Government bonds have behaved in a very different manner to South Africa over the last seven years, as the chart below reveals:-

Source: Trading Economics, Central Bank of Nigeria and South African Treasury

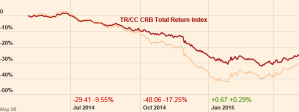

A portfolio of these two bonds would offer an attractive Sharpe ratio. Short South Africa and Long Nigeria 10yr might be another strategy to consider, you may get positive carry, but Nigerian inflation has been substantially higher over this period. Here is a chart:-

Source: Trading Economics, National Bureau of Statistics Nigeria and Statistics South Africa

The Central Bank of Nigeria – MPC May 2015 Communique 101 – provides a wealth of information, here are some highlights:-

The Committee expressed concern about the weakening economic momentum but recognized the relative similarity in the condition to the evolving economic environment in virtually all oil exporting economies, suggesting the need for acceleration of various ongoing initiatives to diversify the economic base of the country.

… The Committee noted that the uptick in inflationary pressures, year-to-date, was largely traceable to transient factors such as high demand for transportation, food and energy, especially in the period around the general elections as well as the Easter festivities. It also noted the roles played by system liquidity and the pass-through effects of the recent depreciation of the naira exchange rate. When the transient causes are isolated, the Committee observed the decline in month-on-month inflation across all the measures in April as headline inflation moderated to 0.8% from 0.9% in March; core inflation moderated to 0.6% from 0.8% and food inflation moderated to 0.9% from 1.0%.

The Committee reiterated its commitment to price stability noting that given the already tight stance of monetary policy and the transient nature of the incubators of the current inflationary trend, which are outside the direct control of monetary policy, the space for maneuver remains constrained, necessitating the intervention of fiscal and structural policies to stimulate output growth.

…the Committee stressed the need for proactive measures to protect the reserve buffer to safeguard the value of the domestic currency and engender overall stability of the banking system. It was, however, noted that monetary policy is gradually approaching the limits of tightening and would, therefore, require complementary fiscal and structural policies.

…Consequently, the MPC voted to:

(i) Retain the MPR at 13 per cent with a corridor of +/- 200 basis points around the midpoint;

(ii) Retain the Liquidity Ratio at 30 per cent; and

(iii) Harmonize the CRR on public and private sector deposits at 31.0 per cent.

10yr Bond yields have fallen from more than 17% in mid-February to 13.7% today. I believe that the hawkish policy of the Central Bank of Nigeria will insure that inflation falls further. Now the election is over, bond yields will continue to decline as foreign capital flows into the country. As recently as July 2014 yields were at 12% – I think they will go lower even than this despite yield curve inversion. The one major risk to this otherwise promising scenario is a rating agency downgrade. S&P downgraded Niara bonds to +B as recently as March, the election result helps but the new government need to deliver on their promises of reform.

To access the Nigerian bond market you need to contact one of the primary dealers – here is the link to the Nigerian Debt Management Office. You will have to deal with the issues of exchange controls, an alternative would be to be a fixed rate receiver through a Niara interest rate swap. The list of dealers may be a place to start but I suspect this is a strictly institutional option.

Stocks – South Africa

The SARB – Quarterly Bulletin – March 2015 – describes recent developments in South African equities:-

Despite the subdued growth in the economy over the past year, domestic share price entered 2015 on a positive note, recovering from the losses incurred in the second half of 2014 to reach all-time-high levels in March 2015. The domestic share market benefited from sustained accommodative monetary policies in the advanced economies, while lower international oil prices and the depreciation of the rand also boosted some share prices. Corporate funding through the issuance of shares in the primary share market rose considerably in 2014, consistent with the high level of share prices and rising number of companies listed on the JSE Limited.

…The performance of equity funding on the JSE was strong in 2014. Equity capital raised in the domestic and international primary share markets by companies listed on the JSE amounted to R153 billion in 2014, which was 65 per cent higher than the amount raised in 2013. Equity capital raising activity was concentrated in companies listed in the financial and industrial sectors, which dominated equity funding in 2014 with shares of 35 and 41 per cent respectively. Dividing the industrial sector further, as shown in the accompanying graph, more than half of the industrial sector’s equity funding in 2014 was accounted for by companies in the consumer goods subsector. Proceeds were utilised mostly for acquisitions, both abroad and domestically.

Robust funding in the primary share market was consistent with the high level of share prices and rising number of companies listed on the JSE, as new listings exceeded delistings in 2014 for the first time since 2008. The number of company listings came to 329 on the main board at the end of February 2015, while 60 were listed on the Alternative Exchange (AltX) and 3 on the development and venture capital boards. The most prominent method of raising capital was the waiver of pre-emptive rights where shares were issued for cash to the general market or specific investors. Equity financing amounted to R43 billion in the first two months of 2015.

Secondary market trading has remained stable but the P/E ratio, at around 18 times, is above its long term average (1990-2015) of 14.4. The P/E ratio has only broken above 20 once, back in 2010, during the rebound from the global recession – though it came close to these levels in 1993.

The Johannesburg (JSE) and the Nigerian Stock Exchange (NSE) are currently working towards developing a partnership that would benefit both exchanges. In this collaboration, among other things, South African companies would be able to list on the NSE and Nigerian companies on the JSE.

South Africa has the most sophisticated financial markets in Africa, it also acts as a conduit for foreign investment to the rest of the continent. The main stock index – the FTSE/JSE 40 – has traded steadily higher since 2009:-

Source: Trading Economics and JSE

However, this does not take account of the currency risk of investing in the Rand. An alternative is the iShares MSCI South Africa ETF – EZA. Here are the top 10 components:-

| Company |

Symbol |

% Assets |

| Naspers Ltd Class N |

NAPRF.JO |

19.44 |

| Mtn Group Ltd |

MTNOF.JO |

9.83 |

| Sasol Ltd |

SASOF.JO |

6.51 |

| Standard Bank Group Ltd |

SBGOF.JO |

5.27 |

| Firstrand Ltd |

FSR.JO |

4.81 |

| Steinhoff International Holdings Ltd |

SNHFF.JO |

4.41 |

| Sanlam Ltd |

SLMAF.JO |

3.46 |

| Aspen Pharmacare Holdings Ltd |

APNHF.JO |

3.43 |

| Remgro Ltd |

RMGOF.JO |

3.28 |

| Bidvest Group Ltd |

BDVSF.JO |

2.63 |

Source: Yahoo Finance

Source: Yahoo Finance

It is clear from the chart above that South Africa’s main stocks are struggling due to the difficult domestic economic situation, which has led to continuous bouts of currency weakness and bond rating agency downgrades.

For domestic or hedged investors the market trend remains positive, but for international investors the carry costs of hedging undermines the attraction of this market.

Stocks – Nigeria

Nigerian stocks have recovered from weakness earlier this year. The Central Bank put most of the recent performance down to improvements in earnings, sentiment and the successful conclusion of the election.

Source: Trading Economics and NSE

Given the heavy weighting to Dangote in this index (25%) perhaps a more diversified investment would be the Global X MSCI Nigeria ETF (NGE) here are the top 10 constituents:-

| Nigerian Breweries PLC |

16.41 |

| Guaranty Trust Bank PLC |

11.54 |

| Zenith Bank PLC |

8.93 |

| Nestle Nigeria PLC |

7.06 |

| Ecobank Transnational Inc |

4.72 |

| Lafarge Africa PLC |

4.66 |

| First Bank Of Nigeria PLC |

4.64 |

| Dangote Cement PLC |

4.63 |

| Guinness Nigeria PLC |

4.48 |

| Stanbic IBTC Holdings PLC |

4.37 |

Source: Yahoo Finance and MSCI

The advantage of the ETF is that you don’t have to deal with the problem of Nigerian exchange controls, however you should keep a close eye on the currency which continues to depreciate against the US$. The technical picture is unclear, I have no direct exposure to Nigeria but it remains on my list of stock markets with significant long-term potential. The current P/E ratio is around 16 times, not cheap like China last year, but worth watching.

Source: Yahoo Finance

Currency

The South African Rand (ZAR) is a freely traded international currency. Daily turnover is roughly 1.1% of the global total – mostly traded in London. The Nigerian Niara (NGN) is subject to exchange controls. It is possible to trade non-deliverable forwards, but liquidity reflects the relative lack of tradability. The chart below compares the two currencies against the US$ since 2007:-

Source: Trading Economics

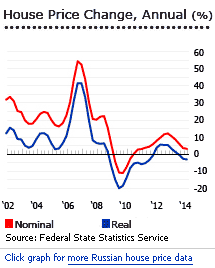

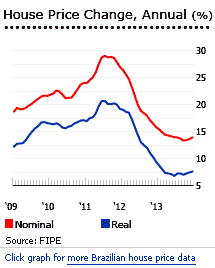

Since H2 2011 the ZAR/USD rate has been weakening. This trend looks set to continue. This is how its recent movements are described in the SARB – Quarterly Bulletin – March 2015 – they highlight the developments during 2014:-

The nominal effective exchange rate of the rand declined, on balance, by 2,8 per cent in 2014, compared with a decline of 18,6 per cent in 2013. The trade-weighted exchange rate of the rand increased, on balance, by 0,3 per cent in the fourth quarter of 2014 following a decline of 2 per cent in the third quarter. The rand did, however, regain some momentum, rebounding by 4,0 per cent in October 2014 supported by a positive Medium Term Budget Policy Statement and portfolio investment inflows. The domestic currency weakened by 0,3 per cent in November 2014 amid South Africa’s credit rating downgrade from Baa1 to Baa2 by Moody’s rating agency as electricity challenges became more acute. In December 2014, the trade-weighted exchange rate of the rand weakened further along with other emerging-market currencies and declined by 3,2 per cent. Sentiment towards emerging-market currencies, including the rand, was generally weighed down by the persistent weakness of the euro area, a slowing Chinese economy and an unexpected Japanese recession.

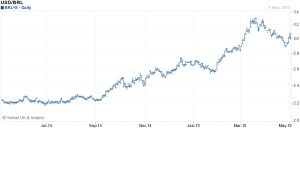

The USD/NGN has been declining by steps as the Central Bank of Nigeria, in a futile attempt to halt the depreciation, depletes its gross reserves. These have fallen to $28bln from more than $50bln in less than two years. Now that the elections are behind them the currency should be less vulnerable. During mid-April overnight rates hit 90% but have since returned to a more normal range – still a volatile series. It’s unlikely they will drop below 9% with the current hawkish MPC. This makes Long NGN Short ZAR an attractive trade – carry will be around 300bp. However, this should be viewed as a trading position. The Central Bank of Nigeria will probably have to defend the NGN again, when they fail the USD/NGN rate will rapidly head for 230.