Macro Letter – No 12 – 23-05-2014

Emerging Asia ex-China – prospects for growth – Currency – Stocks and Bonds

As Chinese growth slows will the rest of Emerging Asia falter?

Will Emerging Asia close the gap which has opened relative to developed markets?

Which Emerging Asian markets offer the best value?

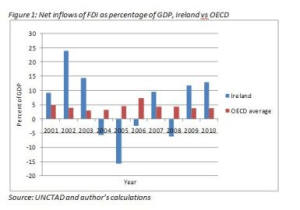

As the world economy continues its slow recovery from the great recession the developed economies have been taking over the reins of growth from the emerging markets. This has been clearly illustrated by the under-performance of the MSCI Emerging Market Equity Index compared to the S&P500; the PE differential between EEM index and the S&P is near to levels last seen in 1997. Emerging equity markets are currently trading at their largest discount to developed markets in more than a decade. Historically when the EM equity price to book ratio is below 1.5 – which is currently the case – the next year sees double digit returns.

Source: Yahoo Finance

This five year chart shows the initial “lock-step” recovery during the early phase of the recovery. After the Eurozone crisis the two markets diverged despite significant capital flows into emerging markets.

The emerging markets share of global GDP is forecast to rise to 40% by 2018 – it was just 10% in 2003. However, EM equities account for only 11% of global market capitalisation.

During 2013 the disappointing performance of emerging market equities spilled over onto the foreign exchange market with several Asian currencies declining precipitously.

The Indian Rupee led the charge followed by the Indonesian Rupiah this prompted aggressive tightening of monetary policy by the Reserve Bank of India and Bank Indonesia. Thailand, Malaysia and the Philippines all suffered by association as foreign capital was withdrawn. However, EM central banks learnt from the Asian crisis of 1997/98 – their foreign currency reserves have increased from 16% of GDP in 1997 to 37% in 2013. The BIS – Foreign exchange intervention and the banking system balance sheet in emerging market economies – March 2014 offers a fascinating insight into this development and its impact on EM economies. They conclude that EM CB FX intervention amounts to an “Impossible Trinity” weakening their control over domestic monetary policy and increasing risks to the financial system.

The charts below are inverted but show the relative performance of the Emerging Asian currencies during the past year. China, of course, is the odd man out due to their peg against the US$.

THB – Blue, PHP – Purple, MYR – Light Blue Source: Bloomberg

INR – Blue, IDR – Purple, CNY – Light Blue Source: Bloomberg

These currencies have now stabilised but at lower levels thanH1 2013, however, Emerging and Developed Asia is the region of strongest forecast economic growth according to most commentators. The IMF 2014 forecasts for the region have changed little in the past year: –

| Country |

Jul-13 |

Oct-13 |

Jan-14 |

Apr-14 |

|

| World |

3.8 |

3.6 |

3.7 |

3.6 |

|

| Dev Asia |

7 |

6.5 |

6.8 |

6.8 |

|

| China |

7.7 |

7.3 |

7.5 |

7.5 |

|

| India |

6.2 |

5.1 |

5.4 |

5.4 |

|

| Asean 5* |

5.7 |

5.4 |

5.1 |

4.9 |

|

| * Includes Indonesia, Thailand, Malaysia, Philippines and Vietnam |

Source: IMF

The latest IMF – World Economic Outlook – April 2014 is entitled “Recovery Strengthens, Remains Uneven”. Here is how they sum up the prospects for Emerging Markets:-

First, if growth in advanced economies strengthens as expected in the current WEO baseline forecasts, this, by itself, should entail net gains for emerging markets, despite the attendant higher global interest rates. Stronger growth in advanced economies will improve emerging market economies’ external demand both directly and by boosting their terms of trade. Conversely, if downside risks to growth prospects in some major advanced economies were to materialize, the adverse spillovers to emerging market growth would be large. The payoffs from higher growth in advanced economies will be relatively higher for economies that are more open to advanced economies in trade and lower for economies that are financially very open.

Second, if external financing conditions tighten by more than what advanced economy growth can account for, as seen in recent bouts of sharp increases in sovereign bond yields for some emerging market economies, their growth will decline. Mounting external financing pressure without any improvement in global economic growth will harm emerging markets’ growth as they attempt to stem capital outflows with higher domestic interest rates, although exchange rate flexibility will provide a buffer. Economies that are naturally prone to greater capital flow volatility and those with relatively limited policy space are likely to be affected most.

Third, China’s transition into a slower, if more sustainable, pace of growth will also reduce growth in many other emerging market economies, at least temporarily. The analysis also suggests that external shocks have relatively lasting effects on emerging market economies, implying that their trend growth can be affected by the ongoing external developments as well.

Finally, although external factors have typically played an important role in emerging markets’ growth, the extent to which growth has been affected has also depended on their domestic policy responses and internal factors. More recently, the influence of these internal factors in determining changes in growth has risen. However, these factors are currently more of a challenge than a boon for a number of economies. The persistence of the dampening effects of these internal factors suggests that trend growth is affected as well. Therefore, policymakers in these economies need to better understand why these factors are suppressing growth and whether growth can be strengthened without inducing imbalances. At the same time, the global economy will need to be prepared for the ripple effects from the medium-term growth transitions in these emerging markets.

As China reforms and rebalances its economy towards domestic consumption, how will the other countries of Emerging Asia perform and what will this mean for their financial markets?

The table below highlights some aspects of these markets. They are arranged in GDP size order: –

| Country |

GDP |

2014 f/c* |

2015 f/c |

Base Rate |

10yr Bond** |

Inflation |

Unemploy |

Gov Budget |

Debt/GDP |

C/A |

| India |

4.7 |

5.8 |

6.5 |

8 |

8.78 |

8.31 |

3.8 |

-4.9 |

68 |

-4.6 |

| Indonesia |

5.7 |

5.3 |

5.5 |

7.5 |

8.02 |

7.25 |

6.25 |

-2.2 |

26 |

-3.2 |

| Thailand |

0.6 |

4.5 |

5 |

2 |

3.39 |

2.45 |

0.62 |

-2.5 |

45 |

-0.4 |

| Malaysia |

5.1 |

4.8 |

4.9 |

3 |

4 |

3.5 |

3.2 |

-3.9 |

55 |

4.7 |

| Philippines |

6.5 |

6.5 |

7.1 |

3.5 |

4.31 |

3.9 |

7.5 |

-1.4 |

38 |

3.5 |

| * Forecasts World Bank – GEP – January 2014 |

| ** Source: Investing.com (15/5/2014) |

The World Bank GDP forecasts differ slightly from those of the IMF but not materially. All the countries are saddled with budget deficits but Malaysia and the Philippines are running current account surpluses. Indonesia’s Debt to GDP ratio is the lowest of the five nations but their debt is heavily US$ denominated whereas Thailand is principally a domestic borrower.

Below I’ve picked out some details from the IMF – World Economic Outlook:-

1. Deviation from Trend GDP

India is running around 3.5% below trend and Thailand 2% below, Malaysia is fairly neutral but Indonesia is already around 1.5% above trend and the Philippines nearly 2.5% above.

2. Responsiveness to US GDP shock

India is most sensitive at +/- 2%, followed by Malaysia 1.5%. The Philippines moves one for one and in the first year Thailand barely reacts, although in year two its sensitivity increases to +/- 0.6%.

3. Trade Openness (Exports plus Imports as a % of GDP)

Malaysia comes top at 175%, followed by Thailand at around 130%, then the Philippines at 80%, Indonesia at 60% and finally India at 45%

4.Trade exposure to advanced economies (Exports to US and EU as % of GDP)

Malaysia leads once again with 28%, followed by Thailand at 17%. The Philippines are hot on their heels at 15% whilst Indonesia and India languish at 8% and 5% respectively.

5. Foreign Capital flow volatility

Malaysia is most sensitive at 5%, followed by Thailand at 4.5%. Indonesian volatility is around 3% whilst the Philippines is only 2%. India has the least sensitivity at 1.8%.

India

After China, India is the largest economy in Emerging Asia. With 1.2 bln people it is blessed with the most favourable demographics of the BRIC economies. It should overtake China to become the most populous country on earth between 2020 and 2025. In the nearer term Indian voters have just elected a new BJP government with a strong reform agenda. I’m not sure that “Toilets not Temples” is the greatest campaign slogan but it clearly resonated with the masses.

India suffered from capital flight in 2013 with the INR declining by 17% against the US$. After the initial Federal Reserve tapering announcement on 3rd September 2013 capital outflows totalled $13.4bln and RBI reserves were depleted to the tune of $17bln. The RBI responded by raising the Marginal Standing Facility by 2%. They then reduced it by 150bp as the short term effect of capital flight subsided. Rates were then increased by 75bp as inflation concerned increased.

The RBI – Macro and Monetary Developments April 2014 report shows how the Indian economy has recovered over the last few months. It goes on to identify risks and opportunities looking ahead: –

The Indian economy is set on a disinflationary path, but more efforts may be needed to secure recovery

I.6 While the global environment remains challenging, policy action in India has rebuilt buffers to cushion it against possible spillovers. These buffers effectively bulwarked the Indian economy against the two recent occasions of spillovers to EMDEs — the first, when the US Fed started the withdrawal of its large scale asset purchase programme and the second, which followed escalation of the Ukraine crisis. On both these occasions, Indian markets were less volatile than most of its emerging market peers. With the narrowing of the twin deficits – both current account and fiscal – as well as the replenishment of foreign exchange reserves, adjustment of the rupee exchange rate, and more importantly, setting in motion disinflationary impulses, the risks of near-term macro instability have diminished. However, this in itself constitutes only a necessary, but not a sufficient, condition for ensuring economic recovery. Much more efforts in terms of removing structural impediments, building business confidence and creating fiscal space to support investments will be needed to secure growth.

I.7 Annual average CPI inflation has touched double digits or stayed just below for the last six years. This has had a debilitating effect on macro-financial stability through several channels and has resulted in a rise in inflation expectations and contributed to financial disintermediation, lower financial and overall savings, a wider current account gap and a weaker currency. A weaker currency was an inevitable outcome given the large inflation differential with not just the AEs, but also EMDEs. High inflation also had adverse consequences for growth. With the benefit of hindsight, it appears that the monetary policy tightening cycle started somewhat late in March 2010 and was blunted by a series of supply-side disruptions that raised inflation expectations and resulted in its persistence. Also, the withdrawal of the fiscal stimulus following the global financial crisis was delayed considerably longer than necessary and may have contributed to structural increases in wage inflation through inadequately targeted subsidies and safety net programmes.

I.8 Since H2 of 2012-13, demand management through monetary and fiscal policies has been brought in better sync with each other with deficit targets being largely met. Monetary policy had effectively raised operational policy rates by 525 basis points (bps) during March 2010 to October 2011. Thereafter, pausing till April 2012, the Reserve Bank cut policy rates by 75 bps during April 2012 and May 2013 for supporting growth. Delayed fiscal adjustment materialised only in H2 of 2012-13, by which time the current account deficit (CAD) had widened considerably.

The easing course of monetary policy was disrupted by ‘tapering’ fears in May 2013 that caused capital outflows and exchange rate pressures amid unsustainable CAD, as also renewed inflationary pressures on the back of the rupee depreciation and a vegetable price shock. The Reserve Bank resorted to exceptional policy measures for further tightening the monetary policy. As a first line of defence, short-term interest rates were raised by increasing the marginal standing facility (MSF) rate by 200 bps and curtailing liquidity available under the liquidity adjustment facility (LAF) since July 2013. As orderly conditions were restored in the currency market by September 2013, the Reserve Bank quickly moved to normalise the exceptional liquidity and monetary measures by lowering the MSF rate by 150 bps in three steps. However, with a view to containing inflation that was once again rising, the policy repo rate was hiked by 75 bps in three steps.

I.9 Recent tightening, especially the last round of hike in January 2014, was aimed at containing the second round effects of the food price pressures felt during June-November 2013. Since then, inflation expectations have somewhat moderated and the temporary relative price shock from higher vegetable prices has substantially corrected along with a seasonal fall in these prices, without further escalation in ex-food and fuel CPI inflation. While headline CPI inflation receded over the last three months from 11.2 per cent in November 2013 to 8.1 per cent in February 2014, the persistence of ex-food and fuel CPI inflation at around 8 per cent for the last 20 months poses difficult challenges to monetary policy.

I.10 Against this background there are three important considerations for the monetary policy ahead. First, the disinflationary process is already underway with the headline inflation trending down in line with the glide path envisaged by the Urjit Patel Committee, though inflation stays well above comfort levels.

Second, growth concerns remain significant with GDP growth staying sub-5 per cent for seven successive quarters and index of industrial production (IIP) growth stagnating for two successive years. Third, though a negative output gap has prevailed for long, there is clear evidence that potential growth has fallen considerably with high inflation and low growth. This means that monetary policy needs to be conscious of the impact of supply-side constraints on long-run growth, recognising that the negative output gap may be minimal at this stage.

What does this mean for the INR, Indian stocks and Indian Bonds?

The Sensex Index is already trading on a P/E of 17. This is expensive when compared to the EM average of 12. Therefore they do not offer exceptional value, however, Indian equities are making new highs, the uncertainty of the elections is behind them and world equity markets continue higher – stay long!

Indian Bonds are not easy for international investors to access and offer a real yield of only 0.47%. The Indian yield curve is positive to the tune of 0.78% but inflation expectations are falling. Whilst there are better real yields and steeper yield curves in Emerging Asia, Indian Bonds should perform well as the new government embarks on economic reform.

The USD/INR hit its low point in August 2013 at 69.25 but has since rallied to 58.38 this month; this is still in the lower end of its post 2009 range and well below 2005-2009 levels. I expect the INR to appreciate as the Modi government gets to work. This may dampen the rise of the Sensex.

The Sensex Index has rallied by more than 40% since its low in August 2013, taking out previous highs. The INR has also performed strongly but is still well below its 2010/2011 level of sub 50 vs USD. Indian 10yr bonds by contrast have seen yields increase from 7.2% in June 2013 to hit their highs at 9.17% in December last year. Since then they have increased slowly to their current yield of 8.78%. Technically they look uninteresting but fundamentally they should perform well – this is one of the highest yields in emerging markets.

Indonesia

Indonesia suffered from similar issues to India as the latest Bank Indonesia – Monetary Policy Review – April 2014 explains:-

At the Bank Indonesia Board of Governors’ Meeting held on 8th April 2014, it was decided to maintain the BI rate at 7.50%, with the Lending Facility rate and Deposit Facility rate held respectively at 7.50% and 5.75%. This policy is consistentwith ongoing efforts to steer inflation back towards its target corridor of 4.5±1% in 2014and 4.0±1% in 2015, as well as reduce the current account deficit to a more sustainablelevel. Bank Indonesia considers recent developments in the economy of Indonesia asfavourable and in line with previous projections, marked by lower inflation and a balance oftrade that has returned to record a surplus. Looking ahead, Bank Indonesia will continue toremain vigilant of a variety of risks, globally and domestically, as well as implement anticipatory measures to ensure economic stability is preserved and stimulate the economy in a more balanced direction, thereby buoying current account performance. To this end, Bank Indonesia will continue strengthening the monetary and macroprudential policy mix as well as enhancing coordination with the Government to control the rate of inflation and reduce the current account deficit, including policy to bolster the structure of the economy and manage external debt, in particular private external debt.

…Bank Indonesia expects the ongoing episode of domestic economic moderation to continue, leading to a more balanced and sound economic structure. Externaldemand is improving and substituting moderating domestic demand as a source ofeconomic growth. Several latest indicators and leading indicators demonstrate thathousehold consumption surged in the first quarter of 2014 in the run up to the 2014General Election, among others. Exports are also following a more favourable trend on theback of exports from the manufacturing sector in harmony with the economic recoveriesreported in advanced countries. Meanwhile, private investment growth during the firstquarter of 2014 remained limited and is not expected to pick up until the second semester.As a whole, economic growth in Indonesia for 2014 remains in the range projected previously by Bank Indonesia at around 5.5-5.9%.

More balanced economic growth is further buttressed by improvements in the external sector from the standpoint of the trade balance and the financial account. The balance of trade of Indonesia in February 2014 rebounded to record a surplus of US$0.79 billion, bolstered by a burgeoning surplus in the non-oil/gas trade account. Thegrowing surplus in the non-oil/gas account stemmed from a contraction in non-oil/gas imports in line with moderating domestic demand along with a surge in non-oil/gasexports, primarily from the manufacturing sector as the economies of advanced countriescontinue to recover. The trade surplus also emanated from reductions in the oil and gastrade deficit as a result of rising oil and gas exports due to increased oil lifting as well as adecline in oil and gas imports in accordance with the mandatory use of biodiesel as fuel inthe transportation sector and the electricity sector. In terms of the financial account,foreign capital inflows continued unabated in March 2014, thus foreign portfolio inflows tofinancial markets in Indonesia reached US$ 5.8 billion accumulatively in the first quarter of2014. Against this auspicious backdrop, foreign exchange reserves held in Indonesia at theend of march 2014 topped US$ 102.6 billion, equivalent to 5.9 months of imports or 5.7months of imports and servicing external debt, which is well above international adequacystandards of around three months of imports. Looking forward, Bank Indonesia expectsimprovements in the external sector to continue, underpinned by a current account deficitin 2014 that can be brought down to below 3.0% of GDP and a deluge of foreign capitalinflows. To this end, Bank Indonesia will continue to monitor a plethora of risks, global anddomestic, which could undermine external sector resilience and its pertinent response,including the performance of external debt, in particular private eternal debt.

…The rate of inflation continued a downward trend in March 2014, which further supports the prospect of achieving the inflation target of 4.5±1% in 2014. The rateof headline inflation was low in March 2014 at 0.08% (mtm) or 7.32% (yoy), down on thatposted in February 2014 at 0.26% (mtm) or 7.75% (yoy). Furthermore, inflation in Marchwas also lower than the average rate over the past six years. Inflationary pressures eased as a result of lower core inflation, which dropped in line with exchange rate appreciation, moderating domestic demand and well-anchored inflation expectations. Furthermore, food prices also experienced deflation due to greater supply of several food commodities at the onset of the harvest season.

An overall moderation in growth and inflation but an increasing trade surplus due to improved export demand. This, together with inward capital flows has supported Indonesian stocks, bonds and the IDR.

Another major factor for Indonesia is the forthcoming presidential elections, scheduled for July. The lead candidate, Jokowi, appears to be a reformer but details of his policies are only beginning to take shape as this Lowy Institute article describes.

The IDX Index made its recent lows in August 2013 – a 27% fall from its May 2013 highs. Since then the market has recovered. This month it came within 2.7% of the May 2013 high. If long: stay long. If not, wait for a close above 5,231.

Indonesian Bonds have shown little significant strength. As recently as February 2014 they made new highs at 9.24%. This is a significant increase on their low point of 5.08% in January 2013. Technically they look neutral. Since the 2008 crisis when they briefly touched 21.10% they have risen substantially. After a brief decline to test 9.96% in January 2011 they have been driven by international capital flows. With a lower yield than India and a more volatile history during the 2008/2009 crisis I’m inclined to wait for confirmation – going long on a break below the October 2013 low of 6.92% or short, if you can secure the repo, above the February 2014 high of 9.24%.

During the 2008/2009 crisis the IDR declined from 9000 to 12500 vs US$. It then recovered to pre-crisis levels and only began the recent depreciation in 2012. The precipitous deterioration began in July 2013 when it broke through 10000. The low point occurred in January of this year at 12200. Since then the IDR has regained some ground but the recovery still appears tentative.

The relative weakness of the IDR will aid Indonesia’s export competitiveness. Many investors choose to purchase US$ denominated Indonesian bonds so foreign capital is most likely to flow into the Indonesian stocks.

Thailand

Thailand has seen rapidly slowing growth, prompting the Bank of Thailand to cut interest rates again in March. The Bank of Thailand – Monetary Policy Report – March 2014 elaborates: –

The Thai economy appeared poised to slowdown in 2014 due to weaker domestic demand during the first half of the year. This was due to the political situation in Thailand which dented consumer and investor confidence. Meanwhile, exports gradually recovered in line with improved trading partners’ economies. Nevertheless, should the political situation subside by mid-2014, domestic demand was expected to pick up and would be the driver of economic growth together with exports. As a consequence, the Thai economy would resume growing close to its normal pace in 2015. Meanwhile, inflationary pressure edged up mainly from the pass-through of LPG cost to food prices, while demand pressure softened in line with economic conditions.

In the past three meetings, the MPC voted to reduce the policy rate by 0.25 percent in the first meeting, hold the policy rate at 2.25 percent per annum in the following meeting and then voted to reduce the policy rate by another 0.25 percent to stand at 2.00 percent per annum in the latest meeting. The MPC deemed that there was room for monetary policy to ease in order to lend more support to the economy during the recovery period, while inflationary pressure was not yet a concern.

The slowing of the Thai economy is also reflected in the weak performance of the USD/THB. From its recent high at 29.48 it sank to a low point of 33.15 in January this year – it has failed to stage much of a recovery since then.

Thai Bonds made a recent high in May 2013 at 3.29%. During the capital repatriation, yields backed up to 4.50% but have since fallen back to 3.39% – testament to the weakness of economic conditions.

The SET Index, by contrast has followed the global trend since making a low in January. It remains some distance below its May 2013 high. If the THB remains weak then the SET Index should benefit but the continued political unrest is likely to sap international enthusiasm for investment. This Bloomberg Business Week article may be useful by way of background.

Malaysia

Those who remember the Asian crisis of 1997 will recall that Malaysia took the decision to impose foreign exchange controls. At the time many market participants forecast the demise of the Malaysian economy. They were proved incorrect, however, the risk that an investment cannot be liquidated and the proceeds repatriated, still hangs over Malaysian financial markets. This is a double-edged sword; volatility in MYR remains significantly lower than for IDR or INR. According to the IMF Malaysia has the greatest sensitivity to Capital Flows of the Emerging Asia countries. The price action of the past few years suggests this may no longer be the case.

After the removal of exchange controls in 2005 the MYR quickly appreciated from USD/MYR 3.8 to around 3.20 by mid-2008. The crisis saw the currency fall briefly to 3.70. By mid-2011 it was touching 3.00. The 2013 “tapering-tantrum” took the rate back to 3.46 in January 2014 but this year it has followed the other Asian currencies, recovering its composure.

But what are the prospects for the Malaysian economy? This monthsBank Negara Malaysia – Monetary Policy Statement – May 2014 provides a good overview: –

Global growth moderated in the first quarter with several key economies affected by weather-related and policy-induced factors. Looking ahead, the global economy is expected to remain on a path of gradual recovery. In Asia, the better external environment provides further support to growth amid continued expansion in domestic demand. Conditions in the international financial markets have also improved following gradual and orderly policy adjustments in the major advanced economies while the impact from geopolitical developments remains contained.

For Malaysia, latest indicators suggest that the domestic economy continued to register favourable performance in the first quarter. Going forward, growth will remain anchored by domestic demand with additional support from the improved external environment. Exports will continue to benefit from the recovery in the advanced economies and regional demand. Private sector spending is expected to remain robust. Investment activity is supported by broad-based capital spending, particularly in the manufacturing and services sectors. Private consumption will be underpinned by stable income growth and favourable labour market conditions. The prospects are therefore for the growth momentum to be sustained.

Inflation has stabilised in recent months amid the more favourable weather conditions and as the impact of the price adjustments for utilities and energy moderate. Going forward, inflation is, however, expected to remain above its long-run average due to the higher domestic cost factors.

Amid the firm growth prospects and inflation remaining above its long-run average, there are signs of the continued build-up of financial imbalances. While the macro and micro prudential measures have had a moderating impact on the growth of household indebtedness, the current monetary and financial conditions could lead to a broader build up in economic and financial imbalances. Going forward, the degree of monetary accommodation may need to be adjusted to ensure that the risks arising from the accumulation of these imbalances would not undermine the growth prospects of the Malaysian economy.

Moderate growth, stable, but above target, inflation and risks of further inflationary pressure ahead; not the most compelling grounds for investment. This doesn’t appear to have dampened enthusiasm for Malaysian stocks. The KLCI Index has barely looked back since the 2008/2009 crisis. It witnessed a small correction in the fall of 2011 and an even smaller one during the summer of 2013. This month it took out the December 2013 highs. From a technical perspective one should remain long and be adding to that exposure. The Bank Negara report, however, prompts some caution.

Malaysian Bonds also reflect the central bank’s cautious tone. Having made post crisis lows at 3.06% in May 2013 the bond market fell during the second half of 2013 to peak at 4.31% in January. Since then the yield has fallen moderately. At the current yield (4%) even with a 1% positive yield curve I don’t perceive much attraction at this level.

Philippines

The Philippines suffered an appalling natural disaster last year when Typhoon Haiyan unleashed its wrath. It caused an estimated $770mln of damage but I don’t believe this was enough to derail what looks to be a strong growth story. According to the IMF it is above its trend growth rate, but inflation seems under control and the political will to reform the underperforming aspects of the economy seem to be in place. The Bangko Sentral ng Pilipinas – Q1 2014 Inflation Report takes up the story:-

Headline inflation rises on higher food and non‐food inflation. y) headline inflation ‐s inflation target range of 1.0 ppt for 2014. The uptick in headline inflation could be attributed to higher food inflation as the prices of most food commodities increased owing to some tightness in the domestic supply conditions. Similarly, higher electricity rates and domestic petroleum prices contributed to food inflation. The official core inflation along with two out of three alternative measures of core inflation estimated by the BSP likewise rose in Q1 2014 relative to the rates registered in the previous quarter. The official core inflation was slightly higher at 3.0 percent during the review quarter from 2.9 percent in Q4 2013. The number of items with inflation rates greater than the threshold of 5.0 percent also increased and accounted for a higher proportion of the CPI basket.

Domestic demand conditions remain buoyant. The Philippine economy continued to expand at an year 2013 GDP growth to 7.0 percent for the year. Output growth was driven by robust household spending, exports, and capital formation (particularly durable equipment) on the expenditure side; and by solid gains in the services sector on the production side. At frequency demand indicators continued to show positive readings in the first quarter. Vehicle sales posted strong growth during the quarter, buoyed by brisk consumer demand and attractive financing options offered by industry players. Energy sales also continued to rise, albeit at a slower pace, on account of increased consumption by the industrial and commercial sectors, while capacity utilization in manufacturing is steady above 80 percent. The composite Philippine Purchasing expansion threshold at 58.2 in Q4 2013 levels. Similarly, the outlook of businesses and consumers for the following quarter turned more favorable, supporting the continued strength of aggregate demand in the coming months amid sustained credit growth and ample liquidity in the financial system.

…Local financial markets experience bouts of volatility but regain some stability. s tapering of its quantitative easing (QE) measures and potential abrupt adjustments in its policy stance as recovery in the US firms up. Indications of a further economic slowdown in China likewise quarter owing to positive domestic economic reports suggesting sustained resiliency of Philippine macroeconomic fundamentals along with expectations of continued strong corporate earnings. The US Fed pronouncement to scale back stimulus in measured steps further propelled optimism in the local s average, while the spread on Philippine credit default swaps (CDS) continued to trade lower relative to those of our neighbors in the region. The Philippine Stock Exchange index (PSEi) also began to recover gains lost in bill auctions during preference bills. However, the peso recorded moderate depreciation relative to previous quarter on lingering uncertainty on the external front.

Inflation expectations continue to support the within‐target inflation outlook. s target 2015. Analysts expect inflation to rise going forward due largely to factors such as pending electricity rate adjustments, weakening peso, and possible increases in food and oil prices. Results of the March 2014 Consensus Economics inflation forecast survey for the country also showed a higher mean inflation projection for 2014.

The BSP maintains key policy rates but adjusts the reserve requirement ratio. The BSP decided to keep its policy interest rates steady during its 3 February and 27 March 2014 monetary policy meetings on the assessment that the future inflation path was likely to stay within the target ranges of 1.0 ppt for 2015. At the same time, the MB decided to increase the reserve requirement by one ppt effective on 11 April 2014 to help guard against potential risks to financial stability that could arise from the recent rapid growth in domestic liquidity.

Prevailing monetary conditions and inflation dynamics suggest that the space to keep monetary policy settings unchanged is narrowing. Latest baseline projections continue to show average headlineinflation settling within the target ranges for 2014 and 2015. However, current assessment of the priceenvironment over the policy horizon indicates that the balance of risks to the inflation outlook remainstilted to the upside, with potential price pressures emanating from pending petitions for adjustments inutility rates and from possible increases in food and oil prices. At the same time, while inflation expectations are still within target, they have trended higher and are moving near the upper end of the target range for 2015. Firm growth dynamics arising from the broad buoyancy of domestic demand also suggest that the economy can accommodate measured adjustments in monetary conditions. trust account placements in the SDA facility in November with more loanable funds deployed to support domestic economic activity as evident by the robust growth in bank lending. The continued strong liquidity up of financial stability risks. On the whole, the BSP continues to have monetary policy space to address the challenges that could threaten the inflation objective and stability of the Philippine financial system.

Going forward, the BSP will remain guided by its primary objective of maintaining price stability along with safeguarding the resilience of the financial system, and stands ready to deploy appropriate measures as needed to ensure sustainable, non‐inflationary, and inclusive economic growth.

The USD/PHP exchange rate remains weak but the overall decline in the PHP was less dramatic than for some of its Emerging Asia neighbours. From a March 2013 high of 40.40 it weakened to just above 46 by March this year. It is currently around 43.60. This should benefit the Philippine equity market.

The PSEI Index, however, has some way to go before breaching its May 2013 high at 7403. The technical picture looks similar to Thailand and Malaysia but the economic fundamentals are more supportive. At 6900 the index still presents a buying opportunity.

The Philippine Bond market doesn’t present such an obvious opportunity. After making highs this time last year at 3.04% yields had risen to 4.63% by March of this year. Now at 4.31% they offer the lowest real yield of the group.

Conclusion

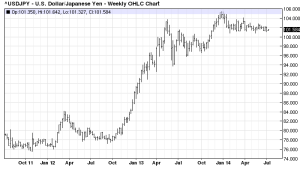

International capital is flowing back into emerging Asia. A World Bank study earlier this year found that 60% of the investment in emerging markets between 2009 and 2013 has been due to quantitative easing and related policies of developed country central banks. The Bank of Japan continue with the Three Arrows – I hear rumours of more radical policies to come. The Fed is still adding $55bln per month. The ECB may be ready to do there bit for European growth. The Basel III rules are being gradually diluted – which, through the multiplier effect, may eclipse any reduction of QE by the Fed. In this environment Emerging Asia should benefit from inward capital flows and growth in exports to the recovering economies of the US, UK and even some parts of Europe. China will continue to rebalance toward consumption but its neighbours should benefit longer-term; I would anticipate an increase in capital expenditure by Asian companies in expectation of greater consumer demand from China.

My favoured equity market is the Philippines followed by India. My favoured bond market is India on the grounds that it offers the highest nominal yield in this group of emerging markets. As for the top currency, again I choose India. The INR and IDR will both benefit from the carry trade, but India is a larger and more balanced economy. It is therefore more insulated from concerns about a commodity collapse as China’s economy slows.