Macro Letter – No 25 – 05-12-2014

Will the Nikkei breakout or fail and follow the Yen lower?

- The Japanese Yen has declined further against its main trading partners

- The Nikkei Index has trended higher on hopes of structural reform and QQE

- JGBs remain supported by BoJ buying

The Nikkei 225 index is making new highs for the year as the JPY trends lower following a further round of aggressive quantitative and qualitative easing (QQE) from the Bank of Japan (BoJ). The Japanese Effective Exchange Rate has fallen further which should help to improve Japan’s export competitiveness whilst import price inflation should help the BoJ achieve its inflation target.

Net Assets

For several decades Japan has been a major international investor, buying US Treasury bonds, German bunds, UK Gilts as well as a plethora of other securities around the globe. Japan has also been a source of substantial direct investment, especially throughout the Asian region. May 2014 saw the release of a research paper by the BoJ -Japan’s International Investment Position at Year-End 2013 – the authors observed:-

Direct investment (assets: 117.7 trillion yen; liabilities: 18.0 trillion yen)

Outward direct investment (assets) increased by 27.9 trillion yen or 31.1 percent. Inward direct investment (liabilities) remained more or less unchanged.

Portfolio investment (assets: 359.2 trillion yen; liabilities: 251.9 trillion yen)

Outward portfolio investment (assets) increased by 54.1 trillion yen or 17.7 percent. Inward portfolio investment (liabilities) increased by 71.4 trillion yen or 39.5 percent.

Financial derivatives (assets: 8.2 trillion yen; liabilities: 8.7 trillion yen)

Financial derivatives assets increased by 3.6 trillion yen or 77.5 percent. Financial derivatives liabilities increased by 3.3 trillion yen or 62.5 percent.

Other investment (assets: 178.4 trillion yen; liabilities: 193.6 trillion yen)

Other investment assets increased by 25.5 trillion yen or 16.7 percent. Other investment liabilities increased by 31.6 trillion yen or 19.5 percent.

Reserve assets (assets: 133.5 trillion yen)

Reserve assets increased by 24.1 trillion yen or 22.0 percent.

The chart below shows how Japan continues to accumulate foreign assets despite their balance of payments moving from surplus to deficit:-

Source:BoJ

From the mid 1980’s until the aftermath of the bursting of the 1990’s technology bubble, international investment was one of the principle methods by which Japanese firms attempted to remain competitive in the international market whilst the JPY appreciated against its main trading partners.

The Japanese Effective Exchange Rate chart below shows how the JPY has weakened since the initial flight to safety after the bursting of the “Tech Bubble” and again after the flight to quality during the “Great Recession”. This currency weakness was accelerated by the introduction of Prime Minister Abe’s “Three Arrows” economic policy:-

Source: BIS

We are now back to levels last seen before the Plaza Accord of 1985 – after which the JPYUSD rate rose from 250 to 130.

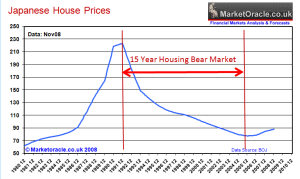

Whilst Japan’s foreign investments returns should remain positive – especially due to the falling value of the JPY – Japanese saving rates continue to decline, just as negative demographic forces are pushing at the door. The stock-market bubble, which burst in 1990, was most excessive in the Real-Estate and Finance sectors. With housing demand expected to decline, for demographic reasons, and financial firms now representing less than 4% of the Nikkei 225 these sectors of the domestic economy are likely to remain moribund. The chart below shows the evolution of Japanese house prices from 1980 to 2008:-

Source: Market Oracle

After the slight up-tick between 2005 and 2008 house prices have resumed their downward course despite increasingly lower interest rates.

What Third Arrow?

In order to get the Japanese economy back on track, fiscal stimulus has been the government solution since 1999, if not before. Shinzo Abe won a second term as Prime Minister with a set of economic policies known as “The Three Arrows” – a cocktail of QQE from the BoJ, JPY devaluation and structural reform. The Third Arrow of “Abenomics” is structural reform. This type of reform is always politically difficult. With this in mind Abe has called an election for the 14th December – perhaps prompted by the release of Q3 GDP data (-1.6%) confirming that, after two consecutive negative numbers, Japan is officially back in recession. He hopes to win a third term and fulfil his mandate to make the sweeping changes he believes are required to turn Japan around.

Energy reform is high on Abe’s agenda. Reopening nuclear reactors is a short term fix but he plans to make the industry more dynamic and spur innovation. In a recent interview with CFR – A Conversation With Shinzo Abe – the Prime Minister elaborated on his plan:-

…On the other hand, we wish to be the front-runner in the energy revolution, ahead of others in the world. I would like to implement the hydrogen-based society in Japan.

The development of fuel cells started something like 30 years ago as a national project. Last year, I have reformed the regulations that inhibited the commercialization of the fuel cell vehicle. And at last, a first ever in the world, we have implemented the commercialization of hydrogen station and fuel cell vehicles.

Early next year, in the store windows of automotive dealers, you’ll be able to see the line up of fuel cell cars.

In the power sector, we shall put an end to the local monopoly of power, which continued for 60 years after the war. We will be creating a dynamic and free energy market where innovation blossoms.

He then went on to discuss his ideas for reform of corporate governance:-

Companies will have to change as well. I will create an environment where you will find it easy to invest in Japanese companies. Corporate governance is the top agenda of my reform list. This summer, I have revised the company law on the question of establishment of outside directors. I have introduced the rule called “comply or explain.”

Amongst listed companies in the last one year, the number of companies which opted to have outside directors increased by 12 percent. Now, 74 percent.

Tax reform is another aspect of Abe’s package. In the past year, corporate tax rates have been cut by 2.4%. Another term in office might give Abe time to make a difference, but his ill-conceived decision to increase the sales tax earlier this year had a disastrous impact on GDP – Q2 GDP was -7.1%. A further increase from 5% to 8% was scheduled for October 2015 but has now been postponed until April 2017 – as a palliative to the “deficit hawks” the increase will be from 5% to 10%. Whilst this was a relief for the stock market it led to a further weakening of the JPY. Last week, Moody’s downgraded Japanese debt due to their concerns about the government’s ability to control the size of its deficit.

The Association of Japanese Institutes of Strategic Studies – Tax System Reform Compatible with Fiscal Soundness – makes some interesting suggestions in response to the looming problem of lower tax receipts: –

Given Japan’s challenging fiscal circumstances, broadening the tax base while lowering corporate tax rates seems a realistic compromise to head off a decline in corporate tax revenues. However, simply lowering corporate tax rates on the condition that corporate tax revenues be maintained is of limited effectiveness in stimulating the economy. If the emphasis is to be placed on the benefits of this approach for economic revitalization, then corporate tax rates will need to be drastically lowered and the rates for consumption tax and other taxes raised. Steps will also need to be taken to reform the tax system overall rather than just to secure revenues by increasing consumption taxes. Although the weight of the tax burden will inevitably shift toward consumption tax, the tax base must also be expanded through income tax reform to secure tax revenues. An obvious choice is reconsidering the spousal deduction that gives tax benefits to full-time housewives so that the tax system can be made neutral vis-a-vis the social advancement of women. A major premise in tax increases is ensuring efficiency and fairness in fiscal matters. If the public can be persuaded that tax money is being put to good use, high consumption tax rates such as those in Scandinavia will enjoy public support. A taxpayer number system should be promptly introduced and an efficient and fair tax collection environment put into place.

Japan’s government debt to GPD is currently the highest among developed nations at 227%, however, according to Forbes – Forget Debt As A Percent Of GDP, It’s Really Much Worse – as a percentage of tax revenue debt is running around 900%, far ahead of any other developed nation.

Labour market reform is high on Abe’s wish list, in particular, the roll-out of incentives to encourage Japanese women to enter the labour market. This would go a long way towards offsetting the demographic impact of an ageing population. It has the added attraction of not relying on immigration; an perennial issue for Japan for cultural and linguistic reasons:-

Source: OECD Bruegal

Agricultural reform is also an agenda item. It could significantly improve Japan’s competitiveness and forms a substantial part of the Trans-Pacific Partnership (TPP) negotiations which have been taking place between Japan, USA and 11 other Asian countries during the past two years. Sadly the free-trade agreement has stalled, principally, due to Japanese reluctance to embrace agricultural reform. The Peterson Institute – Will Japan Bet the Farm on Agricultural Protectionism? – takes up the story: –

What is at stake? The gains for Japan from entry into the TPP are substantial, more than what nearly any other member of the agreement would reap. Peter A. Petri, visiting fellow at the Peterson Institute for International Economics, estimates that the agreement would add 2 percent to Japan’s GDP by 2025. More broadly, the TPP represents an opportunity for Japan to reinvigorate its unproductive domestic industries (agriculture included) by permitting greater foreign competition. It would also enable Japan to reassert itself as a leader and a model in the Asia Pacific. Facing an uncertain future with China gaining influence in the region, Japan needs to remain strong and dynamic at home, economically enabling it to leverage its technical and market-size advantages to secure its position in the region. These gains are now in jeopardy largely because of Japan’s agricultural protectionism.

How protectionist is Japan? To be fair, Japan has made progress on lowering support for agriculture since the 1980s. The United States—the primary objector to the protection afforded to Japan’s agricultural sector—also still provides support for its own agriculture sector. However, the magnitudes are starkly different. For every dollar of agriculture production, Japan provides 56 cents of subsidies to farmers. The United States and European Union provide just 7 cents and 20 cents for every dollar, respectively. Additionally, Japan spends nearly 1.25 percent of its GDP on agriculture subsidies (which includes support for producers, as well as consumers). The United States and European Union spend 1 percent and 0.7 percent, respectively. There are also many internal barriers, such as restrictions on the sale and use of farm land and preferential tax structures for farmers, which discourage older generations from leaving or corporate farms from entering the farming sector in many areas.

The political importance of the rural vote may have caused Abe to backtrack on his timetable for reform. This is another example of how important the forthcoming election will be both for the Japanese economy and its stock market.

Kuroda and GPIF to the rescue (again)

On October 31st the BoJ announced an increase in its stimulus package from JPY60trln per month to JPY80trln. On the same day the Government Pension Investment Fund (GPIF) which, with $1.2 trln in assets, is the world’s largest, announced that it planned to reduce its holding of government bonds to 35% from the current 60%, this money will be reallocated equally between domestic and international equity markets. That’s $150bln waiting to be allocated to Japanese equities. The BoJ also announced an increase in their ETF purchase programme, but this pales into insignificance beside the GPIF action.

Writing back in January 2013, Adam Posen of the Peterson Institute – Japan should rethink its stimulus – gave four main reasons why Japan has been able to continue with its expansionary fiscal policy: –

Japan was able to get away with such unremittingly high deficits without an overt crisis for four reasons. First, Japan’s banks were induced to buy huge amounts of government bonds on a recurrent basis. Second, Japan’s households accepted the persistently low returns on their savings caused by such bank purchases. Third, market pressures were limited by the combination of few foreign holders of JGBs (less than 8 percent of the total) and the threat that the Bank of Japan (BoJ) could purchase unwanted bonds. Fourth, the share of taxation and government spending in total Japanese income was low.

Last month saw the release of a working paper from Peterson – Sustainability of Public Debt in the United States and Japan – which contemplates where current policy in the US and Japan may lead, it concludes:-

The implication of these projections is that even for just a 10-year horizon, somewhat more effort will be required to keep the debt-to-GDP ratio from escalating in the United States, and much more will need to be done in Japan. Using the probability-weighted ratio of net debt to GDP (federal debt held by the public for the United States), holding the ratio flat at its 2013 level would require cutting the 2024 debt ratio by 8 percentage points of GDP for the United States and by 32 percentage points of GDP for Japan. In broad terms achieving this outcome would involve reducing the average primary deficit by about 0.75 percent of GDP from the baseline in the United States and by about 3 percent of GDP in Japan.

The Japanese economy is now entirely addicted to government fiscal stimulus, reducing the primary deficit by 3% and maintaining that discipline for a decade is unrealistic.

I’m indebted to Gavyn Davies of Fulcrum Asset Management for this chart which puts the BoJ current QQE policy in perspective: –

Source: Fulcrum

Whither the Nikkei 225?

With the JPY continuing to fall in response to QQE and the other government policy decisions of the last two months, the Nikkei has rallied strongly; here is a 10 year chart:-

Source: Nikkei

The long-term chart below, which ends just after the 2009 low, shows a rather different picture:-

Source: The Big Picture and The Chart Store

From a technical perspective, recent stock market strength has taken the Nikkei above long-term downtrend. Confirmation will be seen if the market can break above 18,300 – the level last reached in July 2007. A break above 22,750 – the June 1996 high – would suggest a new bull market was commencing. I am doubtful about the ability of the market to sustain this momentum without a recovery in the underlying economy – which I believe can only be achieved by way of government debt reduction. Without real reform this will be another false dawn.

The chart below shows the Real Effective Exchange Rate for a number of economies. The JPY on this basis still looks expensive however the impact of a falling JPY vs KRW or RMB will be felt in rising political tension and potentially a currency war:-

Source: BIS

Japan can play the “devaluation game” for a while longer, after all, a number of its Asian trading partners devalued last year, but the long-run implications of a weaker JPY will be seen in protectionist policies which undermine the principles of free trade.

Conclusions and investment opportunities

JPYUSD

The Japanese currency will continue to weaken versus the US$. This chart from the St Louis Fed, which only goes up to 2012, shows how far the JPY has appreciated since the breakdown of the Bretton Woods agreement:-

Source: Federal Reserve

I think, in the next two to three years, JPYUSD 160 is to be expected and maybe even a return to JPYUSD 240.

JGBs

The BoJ currently owns around 24% of outstanding JGBs but this is growing by the month. Assuming government spending remains at its current level the BoJ will hold an additional 7% of outstanding supply by the end of next year. By 2018 they could own more than 50% of the market. In order to encourage longer-term investment – or, perhaps, merely in search of better yields – the BoJ has extended the duration of their purchases out to 40 year maturities. The latest BoJ data is here.

Central bank buying will support the JGB market as the GPIF switch their holdings into domestic and international stocks. . International ownership remains extremely low so adverse currency movements will have little impact on this decidedly domestic market. With 10 year yields around 0.45%, I see little long-term value in holding these bonds when the BoJ inflation target is at 2% – they are strictly for trading.

Nikkei 225

The Nikkei is heavily weighted towards Technology stocks (43%) and on this basis the market still appears relatively cheap, it also looks cheap on the basis of the P/E ratio, the chart below shows the P/E over the past five years:-

Source: TSE and vectorgrader.com

Here for comparison is the Price to Book ratio, this time over 10 years:-

Source: TSE and vectorgrader.com

Neither metric indicates that the current valuation of the Nikkei is excessive, but, given the frail state of the economy, I suspect Japanese stocks are inherently vulnerable.

Over the next year the Nikkei will probably push higher, helped by buying from the GPIF and international investors, many of whom are still under-weight Japan. A break above 18,300 would suggest a move to test the April 2000 high at 20,833, but a break above the June 1996 high at 22,757 is required to confirm the beginning of a new bull market. In the current economic environment I think this will be difficult to achieve. There are trading opportunities but from a longer-term investment perspective I remain neutral.