Macro Letter – No 22 – 24-10-2014

The Celtic Tiger and the Eurozone periphery

- Ireland has the lowest yield of troubled nations of the Eurozone periphery

- The Irish stock market has performed well this year

- Irish Real-Estate has begun to rebound – is this more than a convergence game?

Last week, for the first time in almost a decade, I visited Dublin. Like so many capital cities, Dublin gives one a very different perspective on a country’s economy than the provinces. Seen from this vantage, the Celtic Tiger has re-emerged like a phoenix from the ashes of the Great Recession. At the IMF-World Bank annual meeting on 10th October, Central Bank of Ireland (BCOI) Governor Patrick Honohan, Alternate Governor for Ireland of the IMF gave an interesting up-date on the state of the Irish economy: –

The Irish economy is emerging from the crisis and there are clears signs that economic recovery is underway. GDP growth of 0.2 per cent was recorded last year and data for the first half of this year were very strong and were well ahead of consensus expectations. The increase in economic activity is broadly-based with both domestic sectors and exporting sectors performing strongly. Although below our domestic forecasts, we welcome the WEO’s projection of 3.6 per cent GDP growth in Ireland for 2014.

Labour market recovery is clearly underway. Employment has increased in each of the last seven quarters representing an increase of over 70,000 jobs since the low-point in mid-2012. This reflects recovery of almost a quarter of jobs lost since the crisis. In line with this, the unemployment rate stood at 11.1 per cent in September, down from a peak of 15.1 per cent in early 2012. While this is still unacceptably high, it is certainly moving in the right direction.

Domestic demand has stabilised and is showing encouraging signs of growth. Consumer spending is improving as confidence returns, while firms are investing in plant and machinery once again.

Due to its relatively small domestic market, Ireland’s growth model must be export oriented. Exports are expected to gain ground this year as demand in Ireland’s main export markets, particularly the UK, continues to hold up. In addition, on the basis of the latest trends, the impact of patent expiry in the pharmaceutical sector appears to have passed.

Mr Honohan then went on to discuss the state of Irish public finances:-

Targets to reduce the underlying General Government deficit have been over achieved to date. Reflecting the continued prudent budgetary stance, the General Government deficit for 2014 is now likely to be of the order of 3.5% of GDP down from 8 per cent of GDP in 2012. The size of the consolidation undertaken has been of the order of 18 per cent of GDP since 2008.

Ireland emerged successfully and on schedule from the EU/IMF programme at the end of 2013 and, in 2014, has returned to participating normally in the sovereign debt markets. Our successful exit was based on a number of factors – both domestic and international – including the Government’s steadfast delivery on its programme commitments, the extension of the maturities on the European portion of our programme loans, and the interventions by the ECB to calm the wider euro crisis.

Concerns still remain about the Irish Banking system and October sees the launch of the Strategic Banking Corporation of Ireland (SBCI) which will side-step the traditional and lend to SMEs. Unlike many countries where demand for business loans is anaemic, Ireland has seen a dramatic increase in new businesses this year – according to data from Vision.net 10,700 new enterprises were incorporated in Q1 2014, up 6% on 2013. During the same period insolvencies were down 23%. A slight concern is that new construction company start-ups were up 29%. According to CBOI data house prices nationally are up around 7.5% y/y in May 2014 and within the Dublin area by 15%.

The Central Bank of Ireland – Consultation Paper 87 – highlights measures being taken to avoid another housing bubble by the introduction of macro-prudential policies aimed at limiting excessive leverage in the mortgage market. The proposals are as follows:-

Restrict new lending for principal dwelling houses (PDH) above 80 per cent LTV to no more than 15 per cent of the value of all new PDH loans.

Restrict new lending for PDHs above 3.5 times LTI to no more than 20 per cent of the value of all new PDH loans.

Restrict new lending to buy-to-let above 70 per cent LTV to no more than 10 per cent of the value of all housing loans for investment purposes.

The rise in house prices is almost certainly due to a lack of supply coupled with strong population growth. The 2011 Census – published in June confirmed the significant increase in Irelands population since 2002. The Great Recession may have tempered the pace of growth (the five year inter-censal period showed growth of only 8.2%) but the trend is still positive:-

Source: CSO

Since 2002 the population in Ireland has grown by 17 per cent, two and a half times the rate of growth in Northern Ireland of 6.9 per cent.

…the median age of the population was 34, the lowest of any EU Member State.

These are attractive demographic trends and the rise in new construction companies is not surprising when viewed from this perspective.

In the Central Bank of Ireland – Macro-Financial Review – a semi-annual report last published in June – the bank acknowledges their concern about residential property and other potential headwinds, both internal and external, which may knock the Irish recovery off course:-

A number of headwinds will continue to restrain growth, however, including modest external demand growth, high household indebtedness, elevated unemployment numbers, weak prospects for disposable income growth, and the continuing need for fiscal adjustment.

…The key systemic issue for the Irish economy remains the high level of impaired bank loans. Despite some recent reductions, mortgage arrears remain high, while the number of cases of very long-term arrears of over 720 days continues to increase. Loan-servicing arrears among small and medium enterprise (SME) borrowers are also a significant problem. Other challenges facing the SME sector include weak domestic demand conditions, difficulties accessing credit, and high indebtedness among a small proportion of firms. Resolving the loan arrears problem for both households and SMEs is essential for borrowers and lenders and in order to support growth and recovery in the broader economy.

Ireland’s largest export markets are the USA and UK. The relative strength of these economies helps to explain the export-led recovery in Ireland since 2008.

Source: OECD

The relative resilience of the export sector is a testament to the dynamic nature of the underlying economy. Added to this, US investment in Ireland is substantial, as is FDI in general. This March 2012 article from the World Bank – FDI in Ireland: A Reason for Optimism makes interesting reading:-

Over the past 10 years, inflows of FDI into Ireland tend to be substantially higher as a percentage of GDP than inflows into other OECD economies (see Figure 1). In 2009 and 2010, the two years immediately following the banking collapse, Ireland attracted three to four times more FDI proportionately than other OECD economies. These inflows were not just large in relative terms – they were equivalent to 11.7% of GDP in 2009 and 12.9% in 2010. The negative inflows in 2005 and 2008 do indicate that more money was disinvested out of Ireland than newly invested in the economy those years. However, such outflows are mostly loans or dividend payments from foreign-owned firms in Ireland to their affiliates abroad, at least some of which were likely caused by a 2004 change in the US tax rate on foreign profits.

Figure 1: Net inflows of FDI as percentage of GDP, Ireland vs OECD

Source: UNCTAD and OECD

Ireland has a small, well educated, open economy. Many large multi-national companies have their European operations headquartered in Ireland; especially in the Science, Technology, Pharmaceuticals and Agricultural sectors.

Ireland’s turn-around is in marked contrast to other countries of the Eurozone (EZ) periphery. The chart below shows Real GDP from 1996 to the end of 2010 for seven EZ countries:-

Source: Pordata

Since 2011 Ireland has outperformed further: –

Source: Tradingeconomics

Financial Market Performance

How has the Irish economic recovery been reflected in the performance of financial markets? I will look at Stocks, Bonds and Real-Estate.

Stocks

To begin, here is a ten year chart of the Portugese PSI20 vs Irish ISEQ Composite: –

Source: Bigcharts.com

Ireland’s difficulties started with the unravelling of the sub-prime mortgage market in the US. The initial down-turn in the ISEQ index was more severe partly due to the heavy weighting of CRH – an international building materials firm – followed by the Irish Banking sector in the index. However unlike Portugal the Irish market had already begun to recover prior to ECB Governor Draghi’s “Whatever it takes” speech in July 2012.

The next chart compares the ISEQ to the Athens Composite:-

Source: Yahoo Finance

This shows a similar pattern, however, the strong performance of the Athens Composite in the run up to 2008 was partly due to the heavy weighting of their highly leveraged Banking sector in the index – even today it has a 34% weighting.

A longer term perspective can be seen in the comparison with the Spanish IBEX35 going back to 1995:-

Source: Yahoo Finance

The broad-based strength of the Celtic Tiger meant that it avoided the worst effects of the bursting of the technology bubble in 2000, despite a significant technology sector. The lower interest rate regime across the EZ then hastened a dramatic housing bubble, which burst spectacularly in 2007. Both Spain and Ireland continue to struggle with high loan delinquency issues, but the accommodative policies of the ECB, as it seeks to soften the effects of a slow-down in economic growth in Germany and France, suggest both peripheral nations have time on their side.

Bonds

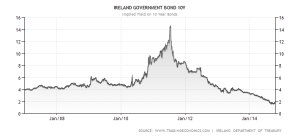

Irish 10 yr Gilts currently yield 1.82% down from July 2011 highs of 14.61% but they are off their recent lows of 1.62% seen last month.

Source: Tradingeconomics

Since early September uncertainty about EZ growth and the adequacy of ECB policy has precipitated an unwinding of yield convergence trades. The table below shows the evolution of 10 year Government bond yields since early September:-

| Country | Yld 06-9 | Sprd vs Bunds | Yld 23-10 | Sprd vs Bunds | Change |

| Ireland | 1.62 | 0.69 | 1.82 | 0.94 | 0.25 |

| Greece | 5.54 | 4.61 | 7.46 | 6.58 | 1.97 |

| Portugal | 2.93 | 2 | 3.32 | 2.44 | 0.44 |

| Spain | 2.02 | 1.09 | 2.21 | 1.33 | 0.24 |

| Germany | 0.93 | N/A | 0.88 | N/A |

Source: Investing.com

The flight to quality into German Bunds has been muted by the excessively low absolute interest rate offered by Bunds, however, the difference for Ireland today in comparison with 2011 is significant. At the beginning of July 2011 the 10 yr Irish Gilt spread over Bunds was 8.82% whilst the 10 yr Bonos spread was only 2.4%. It is important to point out that Spanish Bonos yields hit their high a year later than Ireland, in July 2012. At the beginning of July 2012 the spread between 10 yr Bonos and Bunds was 4.74%. By either measure the performance of Irish Gilts, since the depths of their depression, suggests the Irish economy is healing at a faster pace than Spain, Portugal or Greece.

Real-Estate

Irish Real-Estate was at the heart of the economic crisis which slew the Celtic Tiger, it is, therefore, critical to examine to what extent this market has “cleared”:-

Source: CSO and Global Property Guide

This chart shows the evolution of prices up to the end of 2013. Since then prices have improved further with Dublin leading the recovery. According to the Central Statistics office, new Dublin area homes were up 16% in Q1 2014 whilst second hand properties were up 5%. CBOI data to May 2014 shows this trend gaining further momentum. A similar pattern is developing in Spain though the overall correction in prices was far less severe: –

Source: TINSA and Global Property Guide

By contrast Greek property prices are still under pressure. The prospects for a recovery were looking better as this Bank of Greece – Monetary Policy update from June explains:-

Prime commercial property prices are expected to stabilise in 2014, while prospects for high-end tourist properties are even more favourable, as a result of a projected substantial growth in tourism. Turning to non-prime commercial properties, prices are expected to drop further in the following quarters, while the real estate market as a whole is projected to start recovering gradually in 2015, provided that the present trend is not reversed by exogenous factors (political factors, international conjuncture, etc.).

The abrupt reversal of yield convergence this month may delay the recovery.

For Portugal the situation is similar to Greece, foreign demand has begun to re-emerge but the financial crisis surrounding Banco Espirito Santo during the summer has undermined confidence.

Ireland has domestic demographic growth on its side, although there is international demand for holiday homes in Ireland’s South West and West. The property market recovery is driven by domestic Dublin area demand connected to the broad-based resurgence in economic growth. The real estate market correction in Ireland has been larger than in Spain. I am also struck by the, almost mercantilist, export led recovery in Irish growth compared to the rising tide of imports into Spain.

Conclusion and investment opportunities

The Celtic Tiger suffered a severe mauling in the aftermath of the US sub-prime crisis. The Irish construction industry was forced to restructure or liquidate. Irish banking was devastated by the global forces of the Great Recession and the government embarked on an aggressive austerity programme to address these issues. The chart below, from the OECD, shows why the Irish government was forced to approach this situation in such a draconian manner: –

Source: Eurostat and OECD

Unemployment rose from 4.2% in 2007 to 15.1% by early 2012. Between April 2009 and April 2010 a net emigration of 34,500 occurred – the first outward migration since 1989. Since 2012 Employment has risen by 70,000 – approximately a quarter of the jobs lost in the Irish depression – this suggests an output gap still exists. Ireland is a net importer of Oil – its recent decline, despite geo-political tensions, will help to flatter inflation figures.

A turning point in the crisis came in the summer of 2011. To set the scene I will begin in 2010 when Ireland accepted a Eur85bln joint EU-IMF bailout to stabilise its banking system. This quickly bore fruit and by May 2011 the Irish Finance Minister, Michael Noonan, was ruling out the need for a second bailout. Market commentators and economists generally doubted the governments resolve and Irish Gilt yields continued to rise into the summer of 2011. At this point the National Treasury Management Agency (NTMA) clarified the terms of the original EU-IMF bail-out. The bond market suddenly realised that funds which had been earmarked for bank recapitalisation could also be used to fund the fiscal deficit. The Irish government would therefore require minimal new funding until 2013.

Once confidence in government finances had returned, the Irish economy could resume something approaching normality. This brings me finally to the “value question”. Have the financial markets priced in the return of The Celtic Tiger?

Stocks

The Irish stock market has performed strongly this year relative to other peripheral markets but seems to be lagging its own GDP growth. The economy relies heavily on the USA, UK and Europe since these are its principal export markets. On a relative value basis I would remain long of Irish stocks versus other EZ peripheral markets – but not Spain since I am also optimistic about its fortunes. On an outright basis it still offers better value than the rest of the EZ but is likely to experience higher volatility and lower liquidity, especially during times of stress.

Bonds

Irish Gilts (1.82%) by contrast, have been re-priced to reflect a default risk better than Spain (2.21%) and not much worst than France (1.30%). There is, however, a downside risk should the leveraged carry trade be unwound further. Whilst this is true for Spanish Bonos it is less true of French OATs; added to which, the Irish Gilt market has less depth of liquidity than Spanish or French bond markets.

Real-Estate

After its substantial correction, Irish Real-Estate looks like the best value asset class. The macro-prudential policies of the Central bank of Ireland should insure leverage does not become excessive. This will dampen volatility and extend the duration of the appreciation, but I believe it will also favour Dublin over the provinces – cash will be king. My main concern with this prediction is the stubbornly high level of non-performing loans. Yet this also favours Dublin area Real-Estate since negative equity is swiftly being erased.